Over the past three years, few topics have captured investor attention as much as the rapid progress in artificial intelligence (AI). The ability for software and machines to make instant decisions independently and improve their performance over time is seen as a transformative force across nearly every sector worldwide.

For the last thirty years, there has almost always been a new breakthrough technology or trend that has drawn the focus and investment of Wall Street. Before AI, major trends included the rise of the internet, breakthroughs in genome sequencing, nanotechnology, 3D printing, blockchain, and the metaverse, among others.

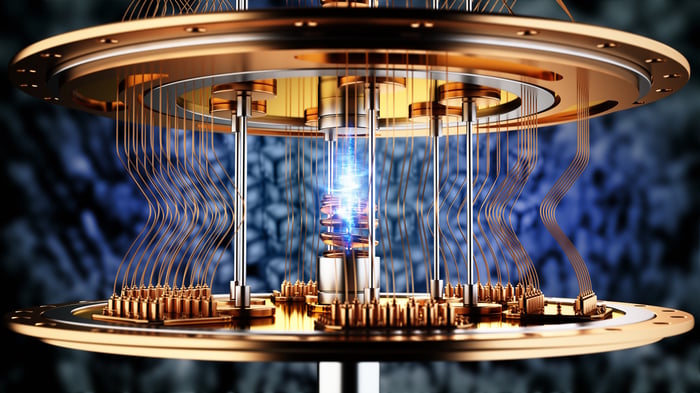

However, in rare periods of heightened enthusiasm, Wall Street sometimes sees two revolutionary trends emerge at once, as is currently happening with both AI and quantum computing.

Image source: Getty Images.

The four leading pure-play quantum computing companies — IonQ ( IONQ -3.64%), Rigetti Computing ( RGTI 3.86%), D-Wave Quantum ( QBTS -0.14%), and Quantum Computing ( QUBT -2.34%) — have each surged between 700% and 5,130% over the past year (as of Oct. 3). While the excitement is clear, it’s also evident that the moment to exercise caution when others are overly optimistic has arrived for these stocks.

What is quantum computing, and why is it generating so much investor enthusiasm?

Quantum computing leverages the principles of quantum mechanics to tackle problems that are beyond the reach of conventional computers. Its appeal lies in the vast range of practical applications it could unlock.

For instance, quantum computers can simulate molecular interactions, helping researchers predict how molecules behave. This capability can streamline the process of drug discovery and improve the chances of finding effective treatments for challenging diseases—essentially taking genome sequencing to a new level to boost the odds of success in developing new medicines.

Quantum technology also holds promise for revolutionizing cybersecurity. It could potentially break current encryption methods, but also pave the way for quantum-resistant security protocols that offer robust protection for cloud services and end users.

Perhaps most intriguing is quantum computing’s potential impact on the AI boom. Quantum machines could dramatically accelerate the training of AI models, enabling software and systems to learn and improve at a much faster pace. Large language models, for example, could be trained far more efficiently with quantum-powered solutions.

According to a bold projection from Boston Consulting Group, quantum computing could add between $450 billion and $850 billion to the global economy within the next 15 years. This optimistic outlook aligns with aggressive sales growth forecasts for the aforementioned quantum computing companies:

- IonQ: expected to grow sales by 87% in 2026

- Rigetti Computing: anticipated sales growth of 161% in 2026

- D-Wave Quantum: forecasted sales increase of 56% in 2026

- Quantum Computing: projected to achieve 412% sales growth in 2026

Despite the soaring optimism, Warren Buffett’s well-known advice stands out: "Be greedy when others are fearful, and be fearful when others are greedy."

Image source: Getty Images.

Why now may be the time for caution with quantum computing stocks

Berkshire Hathaway CEO Warren Buffett has outperformed the S&P 500 for six decades by following this principle. He takes advantage of market fear to buy undervalued assets and refrains from buying—or even sells—when prices seem unjustified by fundamentals. This is the essence of being cautious when the crowd is overly optimistic.

On paper, quantum computing presents a compelling long-term growth narrative. Its potential to enhance drug discovery, cybersecurity, supply chain management, financial modeling, and AI, among other fields, is certainly intriguing.

However, there are several reasons why investors holding IonQ, Rigetti Computing, D-Wave Quantum, or Quantum Computing might want to consider taking profits now.

First, history shows that disruptive technologies often experience a bubble phase during their initial growth period. Over the past three decades, every major trend has eventually faced a sharp correction. Investors and companies have repeatedly overestimated how quickly these technologies would be adopted or how useful they would be in the early stages, leading to disappointment down the line.

I’ve made similar points about AI, but they are even more relevant for quantum computing. While AI hardware is in high demand and leading companies are rapidly integrating AI, the practical use of quantum computing remains extremely limited. All the signs of a speculative bubble are present.

Second, all four of these pure-play companies are currently operating at significant losses and are far from proving their business models are sustainable. For example, in the first half of 2025, IonQ’s operating loss more than doubled to $236.3 million compared to the previous year, while Rigetti Computing’s operating loss increased by 27%.

IONQ PS Ratio data by YCharts .

To elaborate, all four companies are trading at price-to-sales (P/S) ratios that strongly suggest a bubble. Previous leaders in breakthrough technologies peaked at P/S ratios between 30 and 40, give or take. In contrast, the trailing 12-month P/S ratios for these quantum computing leaders are:

- IonQ: 319

- Rigetti Computing: 1,282.2

- D-Wave Quantum: 375.6

- Quantum Computing: 11,612.3

There is simply no justification for the multi-billion dollar valuations these companies have received, given their modest and inconsistent revenues. This is yet another indicator that a sharp correction could be on the horizon.

Lastly, investors should be wary because the so-called "Magnificent Seven" tech giants have far greater resources and a head start in building the infrastructure needed for a future quantum computing boom. While companies like IonQ have secured notable partnerships, the largest tech firms can invest heavily in quantum solutions, potentially reducing the demand for products and services from smaller players like IonQ, Rigetti, D-Wave, and Quantum Computing.