CAKE Soars 74% on Airdrop—Will X Account Hack and Profit-Taking Cap the Rally?

PancakeSwap’s 74% surge is under threat as a hacked account and profit-taking spark caution. Holding $4.00 support is key to sustaining momentum.

PancakeSwap (CAKE) price has emerged as one of the best performing tokens in the last few days. Owing to the recent airdrop the price surged. However, at the moment the altcoin is facing a major obstacle.

The Chinese X account of PancakeSwap was hacked today, with the hacker posting offensive tweets. The team is attempting to resolve this issue.

PancakeSwap Account Hacked

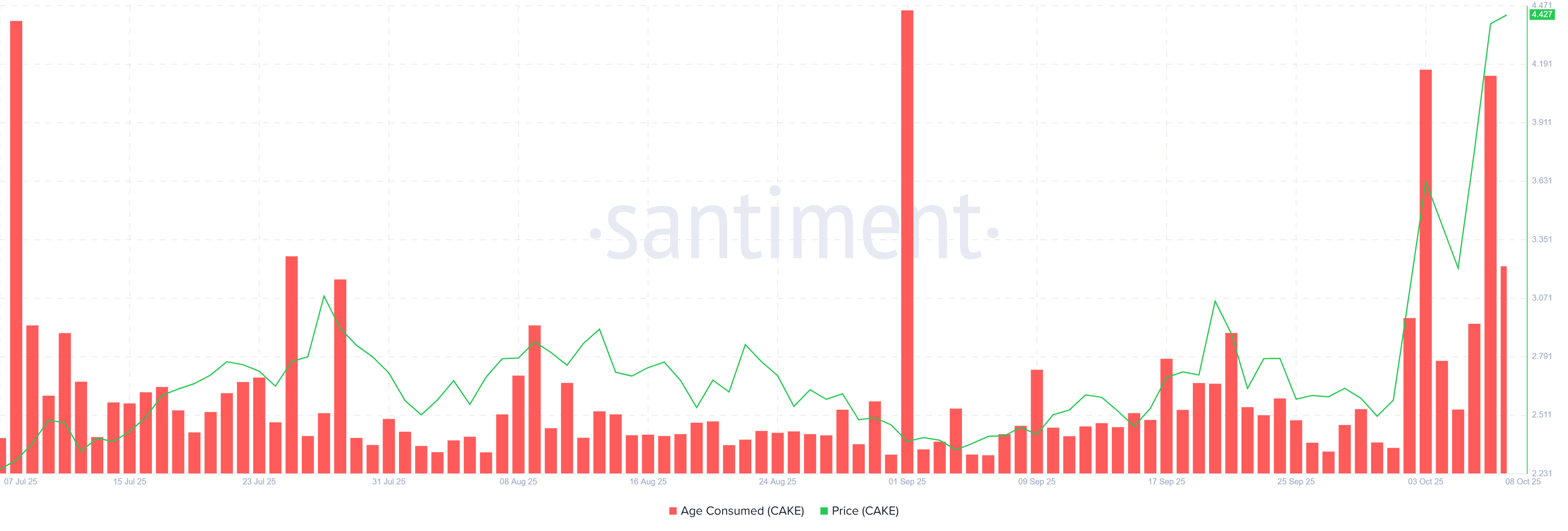

On-chain data reveals a significant spike in PancakeSwap’s age consumed metric — an indicator that tracks the movement of long-term holders (LTHs). A sharp rise in this metric signals liquidation activity, often driven by profit-taking or loss recovery. In CAKE’s case, the latest spike marks the highest level of LTH profit realization in over a month.

Long-term holders typically hold substantial market influence, and their selling behavior often precedes broader market corrections. The current wave of profit-taking suggests that these investors may be securing gains after CAKE’s strong rally.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

CAKE Age Consumed. Source:

Santiment

CAKE Age Consumed. Source:

Santiment

From a technical standpoint, PancakeSwap’s Chaikin Money Flow (CMF) indicator shows strong capital inflows over the past few days. While this normally signals bullish momentum, CAKE’s case presents a warning. Historically, when CMF breaches the 20.0 threshold, it often indicates market saturation — a stage where investors begin realizing profits before prices reverse.

This pattern appears to be repeating for CAKE. Despite steady inflows, the market may soon face a cooling-off period as traders lock in profits from the recent uptrend. The added concern of the X account hack could add to the selling pressure.

CAKE CMF. Source:

TradingView

CAKE CMF. Source:

TradingView

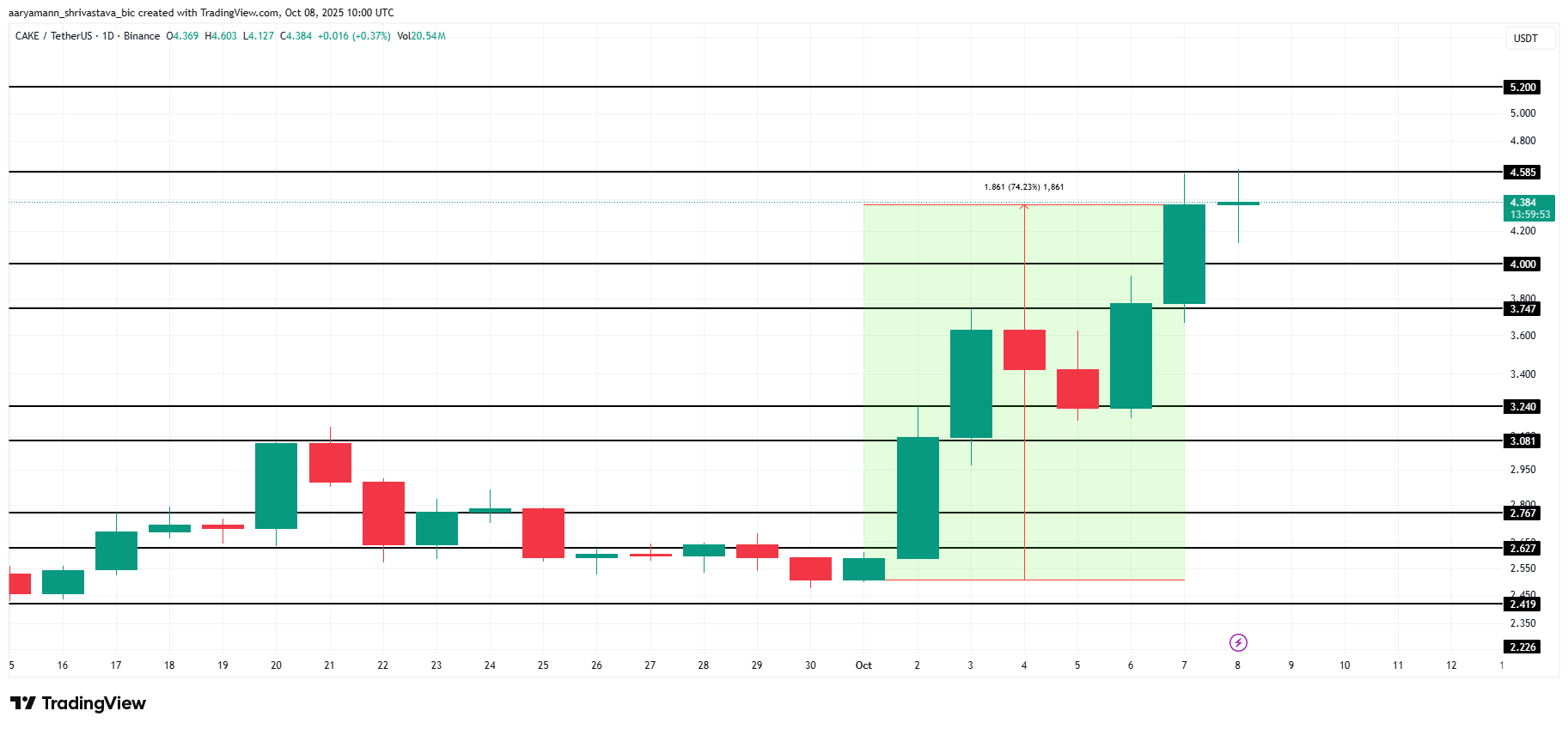

CAKE Price Could Continue Rally

CAKE is currently trading at $4.38, hovering just below the $4.58 resistance level. The token’s sharp 74% weekly gain highlights its strong short-term performance. However, sustaining this growth depends on investor conviction and external market stability.

If current trends persist, CAKE could face a reversal. A drop below the $4.00 and $3.74 support levels could push the token down to $3.24, erasing much of its recent progress.

CAKE Price Analysis. Source:

TradingView

CAKE Price Analysis. Source:

TradingView

However, if bullish momentum strengthens and overrides bearish cues, PancakeSwap’s price could reclaim its upward trajectory. A breakout above $4.58 could propel CAKE toward $5.20, invalidating the bearish thesis and signaling renewed confidence among investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Russia Plans to Ease Digital Asset Investment Thresholds, Expanding Legal Participation of Citizens in the Crypto Market

Russia plans to relax the investment threshold for digital assets, Texas allocates $5 million to Bitcoin ETF, an Ethereum whale sells 20,000 ETH, Arca's Chief Investment Officer says MSTR does not need to sell BTC, and the S&P 500 Index may rise by 12% next year. Summary generated by Mars AI. The accuracy and completeness of this summary produced by the Mars AI model are still being iteratively updated.

x402 The most crucial piece of the puzzle? Switchboard aims to rebuild the "oracle layer" from scratch

Switchboard is an oracle project within the Solana ecosystem and proposes to provide a data service layer for the x402 protocol. It adopts a TEE technology architecture, is compatible with x402 protocol standards, supports a pay-per-call billing model, and removes the API Key mechanism, aiming to build a trusted data service layer. Summary generated by Mars AI. The accuracy and completeness of this content, generated by the Mars AI model, is still in an iterative update phase.

Who would be the most crypto-friendly Federal Reserve Chair? Analysis of the candidate list and key timeline

Global markets are closely watching the change of Federal Reserve Chair: Hassett leading the race could trigger a crypto Christmas rally, while the appointment of hawkish Waller may become the biggest bearish factor.