Explaining Merge Mining, What are the Pros and Cons? Merge mining, also known as auxiliary proof-of-work (AuxPoW), is the practice of mining two dif

The benefits of merged mining include additional rewards at no extra cost, enhanced network security, low barrier to entry, and ecosystem synergy. However, it also has some drawbacks, such as algorithm constraints, pool reliance, and potential centralization risks.

Original Article Title: "In-Depth Analysis of Merge Mining: What are the Pros and Cons?"

Original Source: Dr. Chai's Crypto Talk

What is Merge Mining? The Secret of "One Hash, Double Reward"

Merge mining is a clever mining technique that allows miners to simultaneously mine two cryptocurrencies with the same hash power, without incurring additional electricity costs or hardware burdens. It is based on the concept of parent-child chains: the main chain (e.g., Litecoin) handles the primary computation, while the auxiliary chain (e.g., Dogecoin) "borrows" this work to validate its own blocks. Miners mining the main chain automatically receive rewards from the auxiliary chain.

Simple Analogy

It's like using the same lottery ticket to participate in two different lottery games. If you "win" (solve a block), you get the prize from both pools! The entire process is almost transparent to miners; they just need to connect to a mining pool that supports merge mining to achieve "one machine, dual mining." Unlike solo mining, merge mining leverages shared algorithms (such as Scrypt), enhancing overall efficiency.

According to recent data, merge mining has become the preferred strategy for many miners as of 2025, especially against the backdrop of a vibrant MEME coin market. It helps miners diversify risks and increase their income.

The Principle of Merge Mining: How is "One Machine, Dual Mining" Achieved?

The core of merge mining lies in algorithm compatibility and protocol coordination. Both chains must use the same mining algorithm (such as Scrypt). When the main chain generates a block, it embeds validation information from the auxiliary chain. The proof of work (PoW) submitted by miners is simultaneously valid for both, requiring no additional computation.

Workflow

- Miner Connects to Pool: The miner selects a mining pool that supports merge mining (e.g., F2Pool or ViaBTC).

- Hash Power Allocation: The mining machine calculates the hash value of the main chain (e.g., Litecoin).

- Auxiliary Chain Validation: The auxiliary chain (e.g., Dogecoin) automatically uses this hash to validate its transactions.

- Dual Reward: After successfully mining a block, the miner receives coin rewards from both the main chain and the auxiliary chain.

This technology is implemented at the pool level, requiring no complex setup from users. Merge mining significantly enhances the security of auxiliary chains without increasing miners' power consumption.

Which Coins Support Merge Mining?

In 2025, the most mature merge mining combination is still Litecoin (LTC) and Dogecoin (DOGE), both sharing the Scrypt algorithm, running smoothly, and widely supported by mining pools. Currently, Litecoin has a market capitalization of $8.89 billion, and Dogecoin has a market capitalization of $33.823 billion.

Emerging Combinations

- PepeChain and Bells: These meme coin projects have joined Scrypt merge mining, leveraging Litecoin's hashrate to enhance security.

- Other Subchains: Such as LKY, PEP, JKC, DINGO, SHIC, CRC, often supported by mining pools like F2Pool.

- Historical Cases: Bitcoin and Namecoin once engaged in merge mining but have gradually faded out.

With the meme coin craze, more projects like PepeChain are currently utilizing merge mining to leverage the ecosystems of Litecoin and Dogecoin. It is anticipated that more emerging chains will join in 2025.

Merge Mining Pros and Cons: Can You Really 'Earn While You Sleep'?

The greatest appeal of merge mining lies in the efficient use of resources, but it is not without flaws. The following is an analysis based on real-world cases in 2025.

Pros

- Additional Rewards at No Extra Cost: Mine two coins with the same hashrate, unchanged electricity cost but added rewards. For example, while mining Litecoin, automatically receive Dogecoin, enhancing overall income.

- Enhanced Network Security: Subchains borrow hashrate from the main chain, reducing the risk of a 51% attack. Dogecoin's hashrate has significantly increased through merging with Litecoin.

- Low Barrier to Entry: No need for new hardware, suitable for existing Scrypt miner users; pools handle the process automatically, making operation simple.

- Ecosystem Synergy: Such as the merge of Dogecoin and Litecoin, promoting multi-chain development, benefiting emerging projects in 2025.

Cons

- Algorithm Limitation: Limited to the same algorithm (e.g., Scrypt), does not support cross-algorithm mining.

- Pool Dependence: Not all pools support merge mining (e.g., some only distribute rewards from the main chain), requiring the selection of transparent pools; otherwise, subchain rewards may be lost.

- Potential Centralization Risk: Over-reliance on main chain hash power, which may affect the independence of sidechains.

- Overall, merged mining is suitable for miners seeking stable additional income, but they need to monitor coin prices and mining pool policies.

How Can Beginners Start Merged Mining?

Getting started with merged mining is not complicated. Here are practical steps:

1. Prepare Hardware

Choose Scrypt mining machines, such as ElphaPex DG 2 series, Ant L9 series.

2. Choose a Mining Pool

For example, F2Pool (supports LTC+DOGE+BELLS, etc.) or ViaBTC (transparently distributes multi-chain rewards).

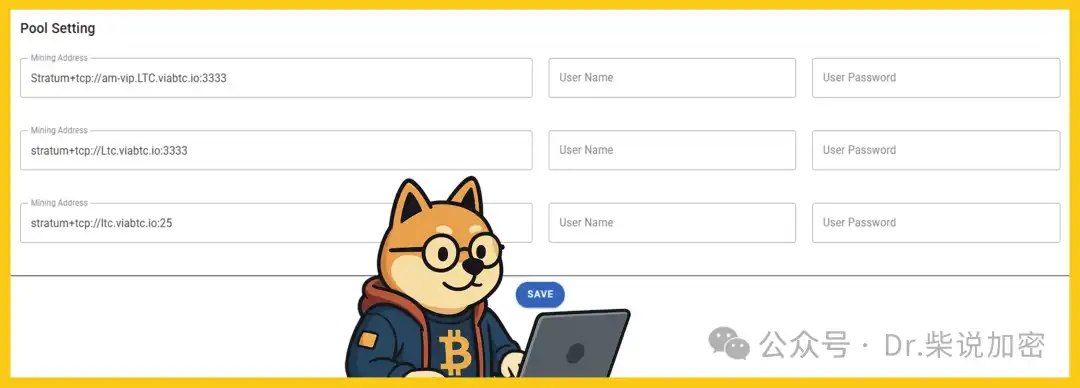

3. Set Up the Mining Pool

Access the web-based control panel of the mining machine, and in the management interface, set up basic information such as the URL, port number, miner name, password, etc.

4. Connect the Mining Machine

Configure the mining pool URL and port, then start mining. The mining pool will automatically record earnings from both coins.

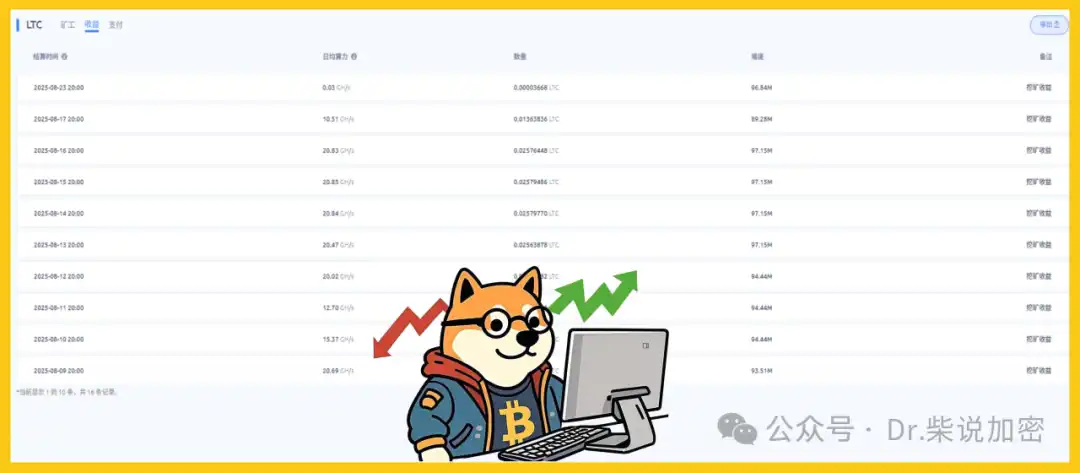

5. Monitor Earnings

Use the mining pool dashboard to view earnings. It is recommended to use inexpensive or clean energy to ensure profitability.

Note: This tutorial is only a rough guide, and the specific process should focus on the instructions provided with the specific mining machine.

06. Merged Mining vs Double Mining: Don't Confuse

Many people confuse merged mining and double mining, but the two are quite different:

Merged Mining

Same algorithm (e.g., Scrypt), low power consumption; hash power used for both chains simultaneously; suitable for ASIC miners, such as LTC+DOGE.

Double Mining

Different algorithms (e.g., Ethash+TON), high power consumption; GPU resources utilized separately; suitable for GPU mining, but configuration is complex and hardware burden is heavy.

The former is more efficient and energy-saving, while the latter is more flexible but costly. The choice depends on your hardware and goals.

Summary: Merged Mining, a New Efficient Way to "Prospect"

Merged mining is a smart "dual-mining" strategy, especially suitable for the classic combination of Litecoin (LTC) and Dogecoin (DOGE), which can significantly increase revenue and network security by 2025. This merger allows miners to automatically receive Dogecoin rewards while mining Litecoin, increasing overall revenue without additional electricity expenses.

However, it is limited by algorithm compatibility (such as having to share Scrypt) and coin price fluctuations. In the future, as more projects like Bells and PepeChain join the Scrypt ecosystem to enhance network security and efficiency through merged mining, the potential of this trend will be even greater. Some emerging chains like Pepecoin have already implemented multi-chain merged mining, further diversifying risks and attracting small miners.

Furthermore, under environmental pressure, merged mining can also optimize energy usage and drive sustainable "prospecting." Overall, this is a strategy worth paying attention to, helping miners steadily increase their income in a volatile market, but it requires a rational participation considering real-time coin prices and mining pool policies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto Presale Activity Spikes Ahead of FED Decision: Mono Protocol and Nexchain Lead the Watchlist

Hyperliquid (HYPE) Price Fluctuations and Key Drivers: Understanding Market Emotions and Liquidity Challenges in DeFi

- Hyperliquid (HYPE) faces liquidity risks amid $372M TVL and 0.89 Bitcoin price correlation, exposing it to systemic crypto downturns. - Institutional confidence grows as Nasdaq-listed Hyperliquid Strategy stakes $420M HYPE tokens, reducing short-term selling pressure. - Market analysis shows HYPE rebounding to $33.84 with 8.8% 24-hour gains, but $37 resistance remains critical for bullish momentum validation. - Speculative trading patterns reveal mixed signals: 40% restaked tokens indicate conviction, wh

The Cultural Dynamics of Technology: How Insights into Society Drive Innovation and Investment Achievements

- Cultural anthropology is reshaping tech innovation by integrating human behavior insights into AI design, education, and investment strategies. - STEM programs at institutions like Morehouse and Howard use culturally responsive curricula to boost Black student retention and drive inclusive innovation. - Mentorship initiatives like AUGMENT and Google's programs link cultural intelligence to 2-3x higher success rates in tech transformations, generating $4.50 ROI per dollar invested. - AI-first companies em

New Prospects in Higher Education Programs Fueled by STEM

- U.S. higher education is reorienting STEM programs to align with labor market demands, addressing a projected 1.4M worker shortfall by 2030 through workforce-ready curricula and industry partnerships. - Education ETFs, private equity, and university endowments are increasingly investing in STEM-focused institutions, driven by sector growth rates 3.5x higher than non-STEM fields and scalable digital learning platforms. - Systemic inequities in STEM are being tackled via mentorship programs and basic needs