OranjeBTC Lists in Brazil, Becomes LATAM’s Top Bitcoin Treasury

OranjeBTC’s debut on Brazil’s B3 exchange marks Latin America’s biggest Bitcoin treasury listing, backed by global investors and a transparency partnership with BitcoinTreasuries.net, reflecting the region’s rising curiosity and adoption of digital assets.

Brazilian firm OranjeBTC, which holds Bitcoin as its primary corporate asset, began trading on Brazil’s B3 stock exchange this week. Entering the market with 3,675 bitcoin—valued at roughly $444 million—OranjeBTC instantly became Latin America’s largest listed Bitcoin treasury.

The debut has drawn wide attention across Latin America’s financial markets, where investors closely monitor whether digital assets can deliver sustainable value within regulated exchanges.

Backed by Global Crypto Heavyweights

OranjeBTC went public through a reverse merger with education firm Intergraus, gaining faster access to trading under ticker OBTC3. The company officially listed on Tuesday, marking Brazil’s first public debut of a firm whose business model centers entirely on Bitcoin accumulation as a corporate strategy—similar to US pioneer MicroStrategy.

OBTC3 stock performance over the day / Source: Tradingview

OBTC3 stock performance over the day / Source: Tradingview

The stock of OranjeBTC opened at $4.35 (23.22 BRL) and saw an early surge, reaching an intraday high of $4.59 (24.50 BRL) as investors reacted to the historic listing. However, momentum faded through the afternoon, and shares closed near their session low at $4.33 (23.15 BRL), reflecting early profit-taking after the initial excitement.

The company’s investor lineup underscores its credibility. OranjeBTC secured $210 million in financing led by Itaú BBA, the investment arm of Brazil’s largest bank. It also counts among its backers Cameron and Tyler Winklevoss, founders of Gemini; Adam Back, CEO of Blockstream; Ricardo Salinas, Mexican billionaire and owner of Banco Azteca; FalconX, a major digital-asset brokerage; and ParaFi Capital, a US crypto-focused investment firm.

We’re officially public. 🇧🇷OranjeBTC is now listed on B3, Brazil’s stock exchange. Built in Brazil, made for the world — accelerating Bitcoin adoption across Latin America.A new era begins. 🍊#Bitcoin #OranjeBTC #B3 pic.twitter.com/Kwv9vdeICr

— OranjeBTC (@ORANJEBTC)

OranjeBTC also announced a strategic partnership with BitcoinTreasuries.net, the world’s leading data platform for corporate Bitcoin holdings and market intelligence. The collaboration aims to enhance transparency and expand OranjeBTC’s global investor reach.

“Our mission at Oranje is to accelerate the adoption of Bitcoin for corporate treasury and empower Latin American investors through education,” said Guilherme Gomes, CEO of Oranje.

According to BitcoinTreasuries.net, OranjeBTC ranks 26th globally among public companies by Bitcoin holdings (3,675 BTC), highlighting its growing international presence.

Regional Appetite for Crypto Innovation

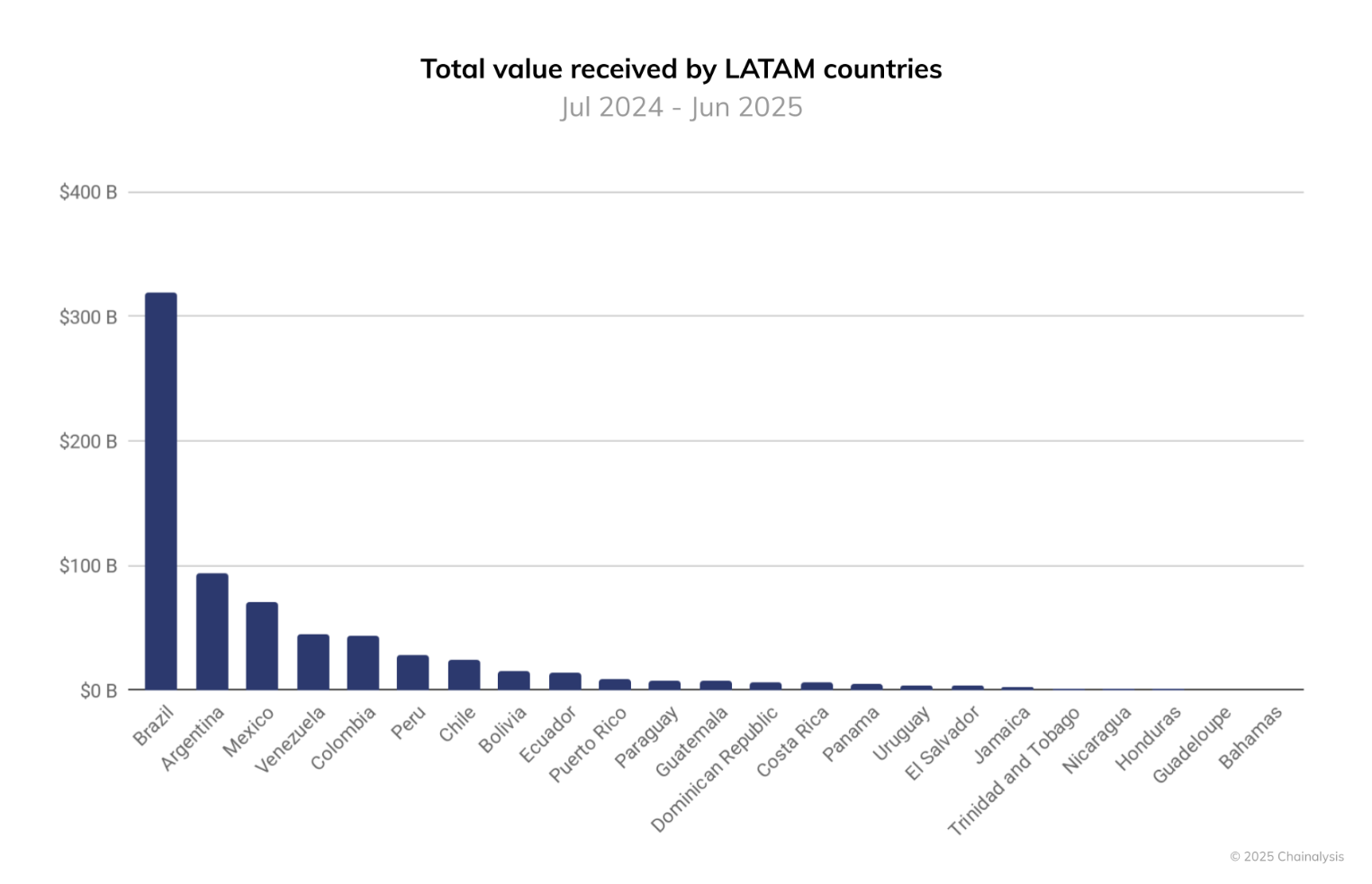

OranjeBTC’s listing comes as Latin America strengthens its position among the world’s fastest-growing crypto regions. According to the Chainalysis 2025 Geography of Cryptocurrency Report, adoption in the region climbed 63% over the past year, driven by major markets including Brazil, Argentina, and Mexico.

Total Cryptocurrencies value / Source:

Total Cryptocurrencies value / Source:

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Aevo Co-founder Criticizes the Industry: I Wasted 8 Years of My Life in Crypto

He believes the industry has lost its idealism and has turned into the largest and most participated super casino in human history, and he feels disgusted for having contributed to this casino.

Aevo Co-Founder's Epic Rant Slams the Industry: I Wasted 8 Years of My Life in Crypto

He believes the industry has lost its idealism, morphing into the largest and most widely participated super casino in human history, and feeling disgusted with having once contributed to this casino.

The rule designer who distrusts authority: Gavin Wood, from Lego enthusiast to Web3 world architect!