Institutional Wave Pushes Bitcoin ETFs Toward Record Quarter

A record wave of institutional inflows is propelling Bitcoin ETFs toward their strongest quarter ever. Bitwise CIO Matt Hougan says wirehouse access and hedging demand are fueling a structural shift in Wall Street’s crypto strategy.

Spot Bitcoin ETFs are drawing institutional cash at a record pace.

According to Bitwise CIO Matt Hougan, the products are heading for their strongest quarter yet as wirehouse approvals and inflation-hedge demand unlock new capital pools.

Distribution Unlocks Momentum For ETFs

By the end of Q3, Bitcoin ETFs had attracted $22.5 billion and are on track to reach $30 billion by year-end.

US spot Bitcoin fund trading rose to $7.5 billion in a single day this month—proof of liquidity deep enough for large institutional orders with minimal slippage.

As Bitcoin broke above $100,000 and hit $125,000, ETF activity climbed in lockstep. Bloomberg’s Eric Balchunas said $IBIT led weekly ETF flows with $3.5 billion—around 10% of all US inflows.

All 11 spot ETFs, including $GBTC, ended the week in the green, which he called “two steps forward mode.”

$IBIT is #1 in weekly flows among all ETFs w/ $3.5b which is 10% of all net flows into ETFs. Also notable is the rest of the 11 OG spot btc ETFs all took in cash in past week, even $GBTC somehow, that's how hungry the fish are. Two steps forward mode. Enjoy while it lasts. pic.twitter.com/iNrcgiRVHV

— Eric Balchunas (@EricBalchunas) October 8, 2025

Hougan outlined three key drivers behind the surge:

- Wirehouse distribution: Major brokerages such as Morgan Stanley and Wells Fargo now offer crypto ETFs directly to clients, giving thousands of advisors regulated Bitcoin access.

- The “debasement trade”: Investors are shifting to scarce assets like gold and Bitcoin to hedge against currency dilution and fiscal expansion.

- Reflexive momentum: Rising prices attract media coverage, which fuels more ETF buying and reinforces the rally.

Hougan pointed to Morgan Stanley’s new guidance allowing advisors to allocate up to 4% of portfolios to crypto. This policy could channel trillions into regulated products.

Wells Fargo and Merrill Lynch have followed, expanding institutional pipelines. He added that strong Bitcoin quarters often coincide with multi-billion inflows, reinforcing the link between price and capital.

BlackRock’s IBIT takes the lead in Bitcoin ETF dominance

BeInCrypto reported that IBIT is now BlackRock’s most profitable ETF, generating $244.5 million annually from a 0.25% fee with nearly $100 billion in AUM. It has overtaken the S&P 500 ETF (IVV) despite its larger scale.

Bloomberg data show IBIT approaching $100 billion in under 450 days—compared to over 2,000 for Vanguard’s VOO—making it the fastest-growing ETF ever.

This dominance narrows, spreads, and boosts liquidity, allowing institutional flows to recycle efficiently. US funds now hold about 90% of global Bitcoin ETF assets, underscoring Wall Street’s tightening grip on digital-asset liquidity.

Market structure shifts beyond cycles

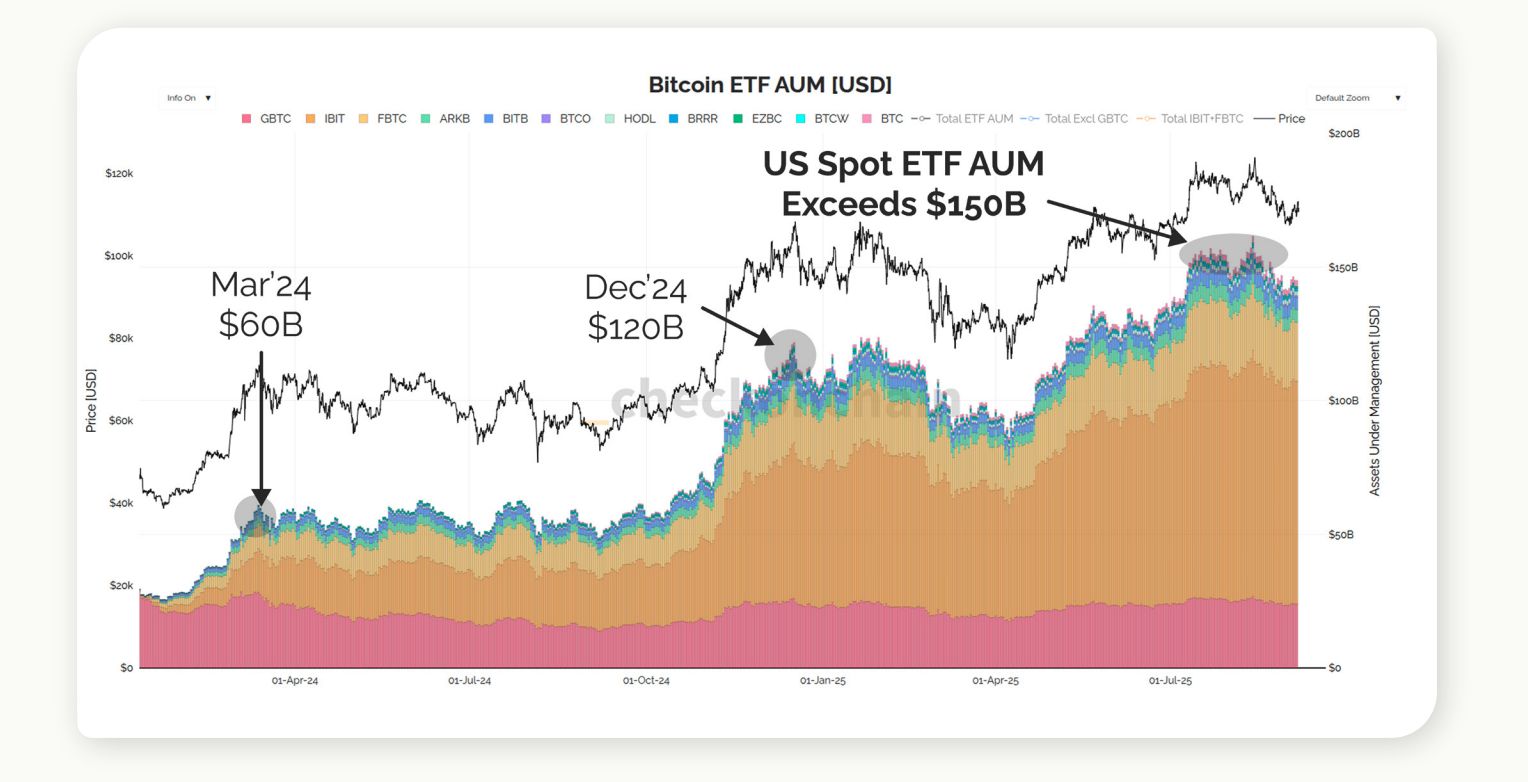

Analysts say this inflow wave is reshaping Bitcoin’s market structure. Checkonchain Analytics co-founder James told BeInCrypto that ETF inflows—roughly $60 billion so far—represent “tens of billions in fresh institutional capital,” not just on-chain holders moving into funds.

He added that long-term investors are realizing $30–100 billion in monthly profits, slowing price acceleration despite rising demand.

Source:

Checkonchain

Source:

Checkonchain

“Some holders are migrating from on-chain to ETFs—that’s happening. But they’re not the majority. The demand has been enormous—tens of billions in institutional capital—yet sell-side pressure remains. Since October 2024, IBIT has surged ahead of peers and remains the only fund with sustained inflows. The US now accounts for roughly 90% of global ETF holdings.”

K33 Research argues that institutional adoption and macro policy alignment have ended Bitcoin’s four-year halving rhythm. It has been replaced by a liquidity-driven regime.

James echoed this view, saying, “Bitcoin now responds to the world rather than the world responding to Bitcoin.”

ETF inflows, sovereign allocations, and derivatives growth have become the new anchors of price discovery. K33 data show open interest and momentum remain high but not extreme—suggesting brief corrections rather than a structural reversal.

Still, skeptics warn that rising leverage could trigger short pullbacks. The key question is whether billion-dollar trading days reflect fresh inflows or rotations from legacy funds like GBTC.

For now, record volumes, wider distribution, and deep liquidity all support Hougan’s thesis: expanded wirehouse access is Bitcoin’s strongest tailwind heading into year-end.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | Ethereum Fusaka upgrade officially activated; ETH surpasses $3,200

The Ethereum Fusaka upgrade has been activated, enhancing L2 transaction capabilities and reducing fees; BlackRock predicts accelerated institutional adoption of cryptocurrencies; cryptocurrency ETF inflows have reached a 7-week high; Trump nominates crypto-friendly regulatory officials; Malaysia cracks down on illegal Bitcoin mining. Summary generated by Mars AI. The accuracy and completeness of this summary are still undergoing iterative updates.

Do you think stop-losses can save you? Taleb exposes the biggest misconception: all risks are packed into a single blow-up point.

Nassim Nicholas Taleb's latest paper, "Trading With a Stop," challenges traditional views on stop-loss orders, arguing that stop-losses do not reduce risk but instead compress and concentrate risk into fragile breaking points, altering market behavior patterns. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively improved by the Mars AI model.

With capital outflows from crypto ETFs, can issuers like BlackRock still make good profits?

BlackRock's crypto ETF fee revenue has dropped by 38%, and its ETF business is struggling to escape the cyclical curse of the market.

Incubator MEETLabs today launched the large-scale 3D fishing blockchain game "DeFishing". As the first blockchain game on the GamingFi platform, it implements a dual-token P2E system with the IDOL token and the platform token GFT.

MEETLabs is an innovative lab focused on blockchain technology and the cryptocurrency sector, and also serves as the incubator for MEET48.