Deloitte survey: 99% of CFOs in the sample expect to use cryptocurrency in their business in the long term?

Tokenization is transforming traditional finance.

Tokenization is transforming traditional finance.

Written by: Juan Galt

Translated by: AididiaoJP, Foresight News

Tokenization in traditional finance has once again become a news focal point, as executives of publicly listed U.S. companies are discussing the benefits and risks of integrating cryptocurrencies into their businesses. The term "tokenization" refers to deploying traditional financial assets on the blockchain, digitizing financial assets (including currencies), thereby enabling the financial industry to benefit from the speed and transparency offered by blockchain. But is this just another cryptocurrency craze, or is this young industry truly solving a fundamental problem for the world of traditional finance?

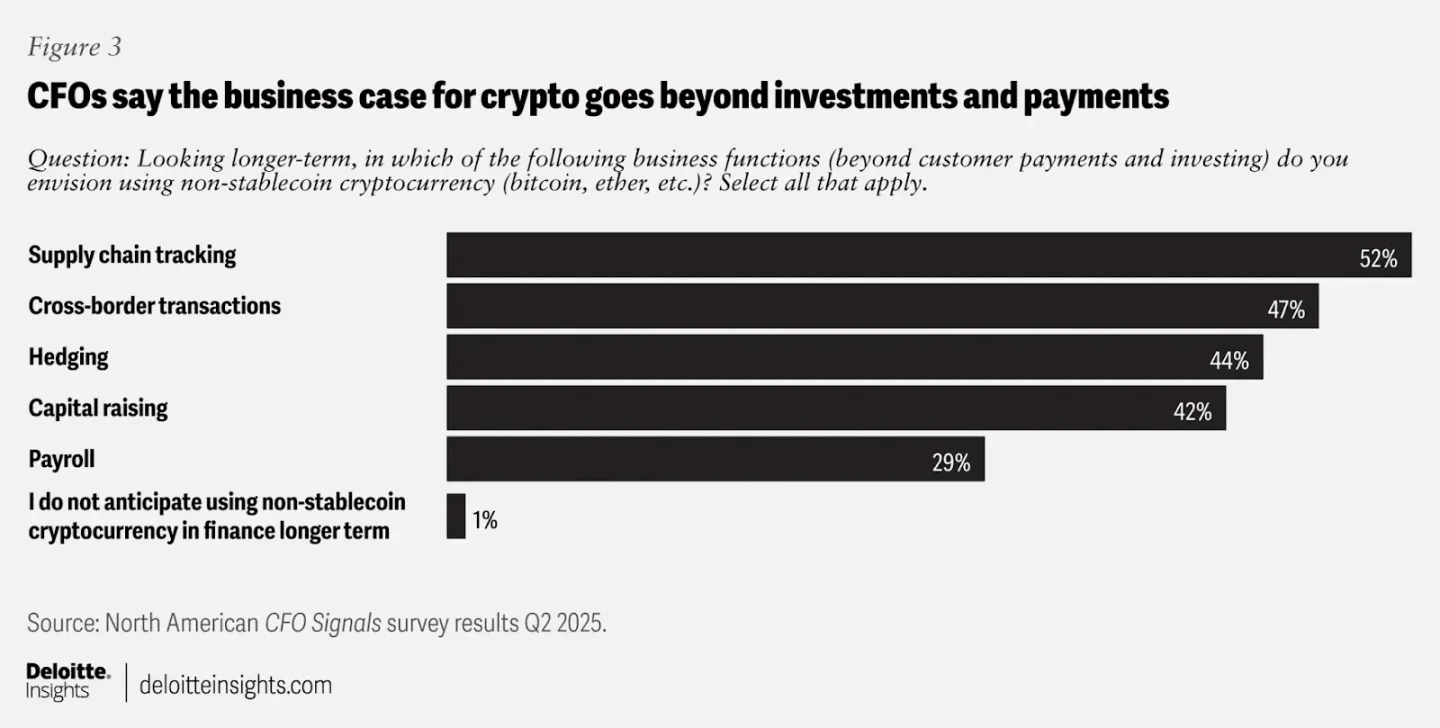

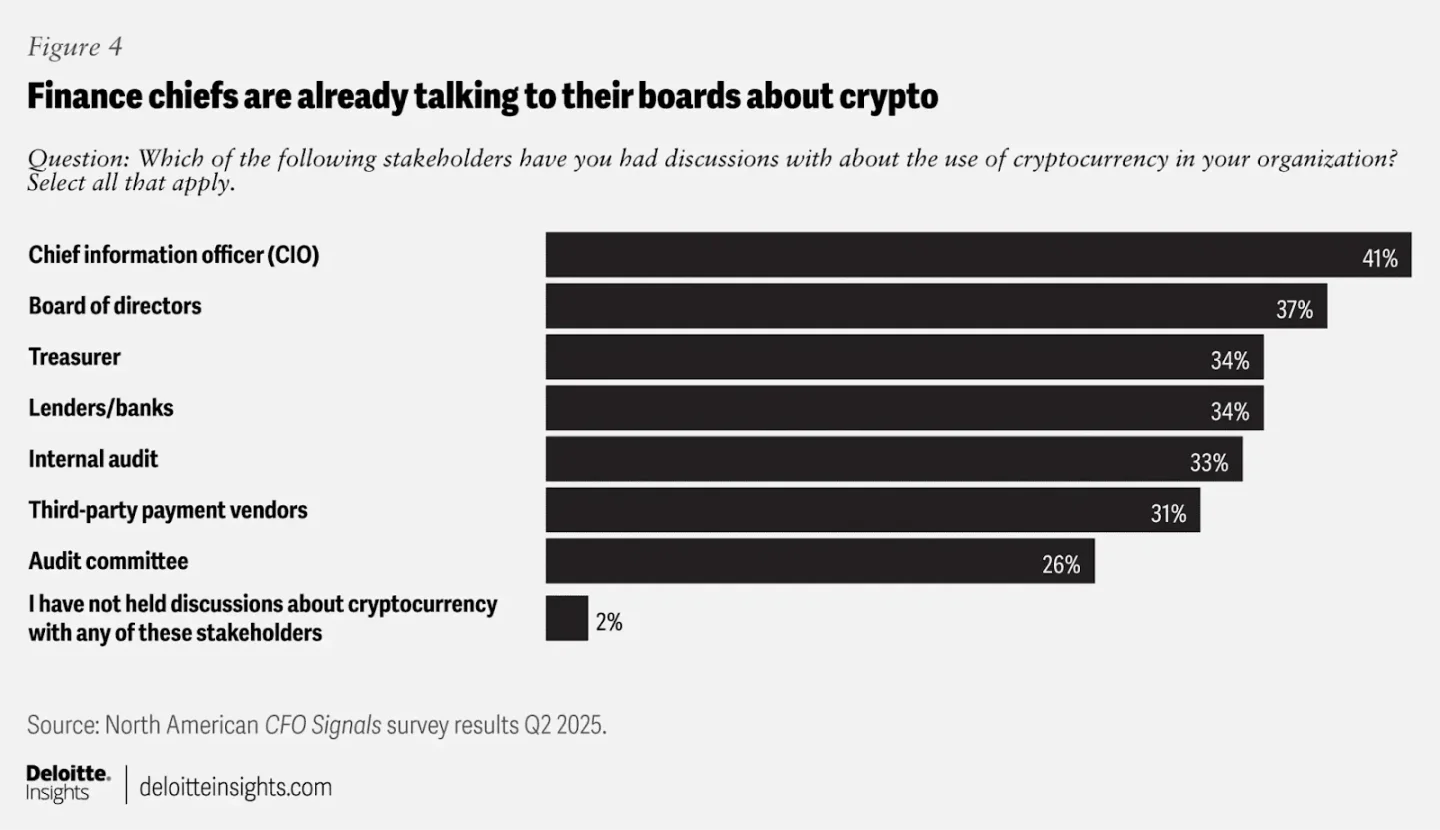

Deloitte released a survey in July, polling the CFOs of 200 companies with revenues of at least 1.1 billions USD, regarding the impact of tokenization. The survey showed that almost all CFOs expect "long-term use of cryptocurrencies for business functions." Only 1% of respondents said they had never envisioned this. 23% of respondents said their treasury departments "will use cryptocurrencies for investment or payments within the next two years," and for CFOs at institutions with revenues of 10 billions USD or more, this proportion is close to 40%. In addition, among these respondents, only "2% said they had never had any conversations with key stakeholders about cryptocurrencies."

A Deloitte executive mentioned that there are currently two narratives circulating in the U.S. financial sector: "One is whether to hold bitcoin on the balance sheet, and the other is a broader recognition of the future of tokenization, which seems increasingly inevitable." He added, "The first step is usually stablecoins—how to adopt them, whether to issue your own tokens. Today, there are more companies having these broader strategic discussions than those committing to holding bitcoin on their balance sheets."

In particular, stablecoins, as a tool that can serve U.S. interests both domestically and internationally, have already attracted the attention of Wall Street and Washington. This survey reinforces this growth trend, showing that 15% of CFOs expect their organizations to accept stablecoins as a payment method within the next two years, and for organizations with revenues of at least 10 billions USD, this proportion is "higher (24%)."

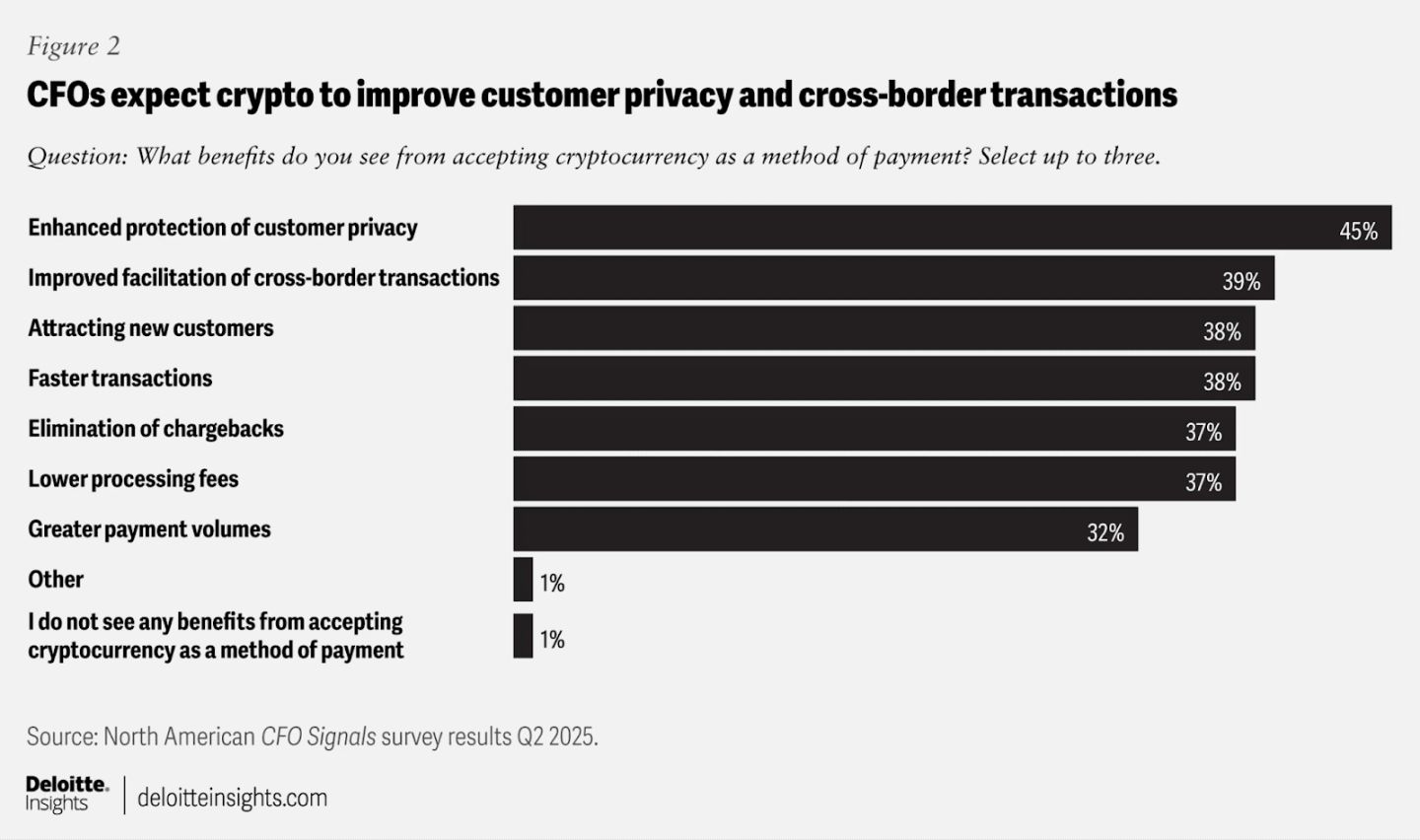

When asked about the benefits of "accepting cryptocurrencies as a payment method," CFOs listed enhanced customer privacy as the most valuable advantage, recognizing the significant harm to user privacy caused by customer data collection.

The financial industry is also tracking policy developments, such as "the U.S. Securities and Exchange Commission's 'crypto project' and similar efforts by the U.S. Commodity Futures Trading Commission, all of which are reshaping market structure." He also mentioned the CLARITY Act, which "has passed the House, is under review in the Senate, and has regulatory support. The Act defines the necessary structure," aiming to provide regulatory clarity for crypto-related businesses, including those involved in tokenization. Traditional financial companies see this infrastructure transformation as inevitable. "It will probably take another year, and people are thinking about what this means for their businesses."

"Before the COVID-19 pandemic, blockchain was considered dead, but we are emerging from that disillusionment. Performance has improved, the regulatory environment is better, and companies see their peers discussing the issue. Board members, often CEOs or CFOs of other companies, bring these strategic discussions back to their teams, spreading the sense of inevitability and the strategic choices required."

The bitcoin and cryptocurrency industry is merging with traditional finance, and the results are more profound than most people imagine. Terms like "tokenization" and "real world assets" or RWA are often mentioned together, almost as synonyms. But what does "tokenization" really mean to Wall Street and CFOs across the U.S., and why are they so interested?

The tokenization of stablecoins and real world assets is not about following trends, attracting younger customers, or expanding into overseas markets, but about upgrading financial infrastructure to bring new features such as higher currency circulation speed, greater user privacy, and also improving overall market transaction transparency and real-time data.

Satoshi Nakamoto on the Problems of Traditional Finance

The curiosity CFOs show towards financial "tokenization" may be a topic underestimated and misunderstood by bitcoin users. In fact, the problems traditional finance is trying to solve through "tokenization" may be essentially the same as those identified and attempted to be solved by Satoshi Nakamoto in his original bitcoin white paper—the technical document that gave birth to bitcoin and the modern cryptocurrency industry.

"Commerce on the Internet has come to rely almost exclusively on financial institutions serving as trusted third parties to process electronic payments. While the system works well enough for most transactions, it still suffers from the inherent weaknesses of the trust-based model," Satoshi Nakamoto wrote in his groundbreaking work at the end of 2008.

This statement hits the core of the issue. The technology underpinning traditional finance was conceived before the invention of the Internet. Back then, physical, high-trust international banking clubs made sense. But at the dawn of the digital age, many old business practices can benefit from transformation.

So, Wall Street's interest in tokenization is not just about following trends. "It's not about attracting the younger generation or expanding outside the U.S., but about using the blockchain of tokenization to change today's business models, and people are increasingly realizing how existing infrastructure can be improved."

"The benefits of upgrading financial infrastructure are enormous." "Short-term impacts include increased currency circulation speed; faster transaction settlement and global capital flows; it releases capital locked in inefficient systems."

Blockchain has already changed transaction timelines around the world, as they operate 24/7, unlike traditional finance.

If you are a bank, you basically have to pre-fund these payment channels.

Suppose you expect about 100 millions USD of funds to flow through a channel in a day, you have to provide 120% of the funds just in case. So over time, you have 20 millions USD of idle money sitting there, which actually doesn't need to be there. It's not just about increasing speed; you're also freeing up funds that would otherwise be trapped in outdated systems."

Diving deeper into how transactions are settled in today's traditional finance, the U.S. Securities and Exchange Commission has long had a plan to accelerate the settlement timeline for securities transactions."

"Today we are looking at T+1 instructions, adding a day's delay to settle trades. But increasingly, and indeed with the change of administration in the White House, people are realizing that if we want to achieve T+0, i.e., same-day settlement, ideally within hours if not minutes, we really need to take blockchain more seriously."

On the policy front, regulators, financial intermediaries involved in such settlements, and various government departments are making highly coordinated shifts to drive how financial markets operate and realize the benefits of this new technology." The benefits to the overall economy will be significant, and in this new paradigm, "the efficiency with which companies and individuals manage their funds and positions, whether in stocks, bonds, or real estate, will be greatly improved." This will enable people to make important financial decisions "without many of these outdated systems that add costs and, in some cases, even increase risk."

Why Satoshi Nakamoto Chose Proof of Work

There is a major problem with Wall Street's blockchain and tokenization: most blockchains are fundamentally insecure at the consensus layer. To achieve high transaction speeds and throughput, many cryptocurrency projects place the CPU and memory burden of running blockchain infrastructure on specialized "node operators," greatly increasing infrastructure costs. This contrasts with bitcoin's layered approach, which keeps the first layer lightweight and easy for anyone to run a copy, while enabling high-speed payment settlement on the Lightning Network.

To bypass the slow and risky process of building a proof-of-work mining community, many cryptocurrency projects launch these networks as proof-of-stake protocols, allowing token holders to vote on consensus decisions with their balances instead of mining. These votes represent power on the network, determining which transactions can enter the blockchain and even completely reversing transactions. The result is yet another trusted system, which, while potentially more efficient and fraud-resistant than traditional finance, is centralized from the start and may remain so, making it vulnerable to litigation.

Satoshi Nakamoto deeply understood the additional costs and systemic risks brought by trust-based settlement systems, which is why he chose proof of work as bitcoin's consensus protocol. "Completely non-reversible transactions are not really possible, since financial institutions cannot avoid mediating disputes. The cost of mediation increases transaction costs plus the possibility of reversal, and the need for trust spreads," he wrote in the first paragraph of the bitcoin white paper.

"Merchants must be wary of their customers, hassling them for more information than they would otherwise need. A certain percentage of fraud is accepted as unavoidable. These costs and payment uncertainties can be avoided in person using physical currency, but no mechanism exists to make payments over a communications channel without a trusted party," he added.

Bitcoin solved this problem.

While Wall Street is likely to overlook bitcoin as the superior blockchain for building their tokenization and settlement plans, if the consensus layer does matter, they will eventually learn the hard way through lawsuits and disputes that immutability has its benefits. Those who start building on bitcoin now may have an advantage.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years