MNT Demand Is Real, But So Is the Risk of a Price Hangover

Mantle’s MNT is rallying to record highs amid strong demand, yet indicators show the surge may be peaking. With RSI flashing overbought and leveraged positions rising, traders should brace for potential volatility ahead.

Mantle’s MNT is among today’s standout performers, soaring 12% amid strong market demand for the altcoin. Earlier today, the altcoin registered a new all-time high of $2.87, before retreating slightly to $2.59 at press time.

However, while demand remains underway, on-chain and technical data signal that the rally may be approaching euphoric levels, hinting at the possibility of a near-term pullback.

Mantle’s Momentum Hits Overdrive

MNT’s upward price momentum is evident on the daily chart, where the token now trades above its ascending parallel channel.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter

MNT Ascending Parallel Channel. Source:

MNT Ascending Parallel Channel. Source:

MNT Ascending Parallel Channel. Source:

MNT Ascending Parallel Channel. Source:

This channel is formed when the asset’s price consistently oscillates between two parallel trendlines — one acting as support and the other as resistance. Trading above this channel confirms a definitive bullish takeover and often triggers further price rallies.

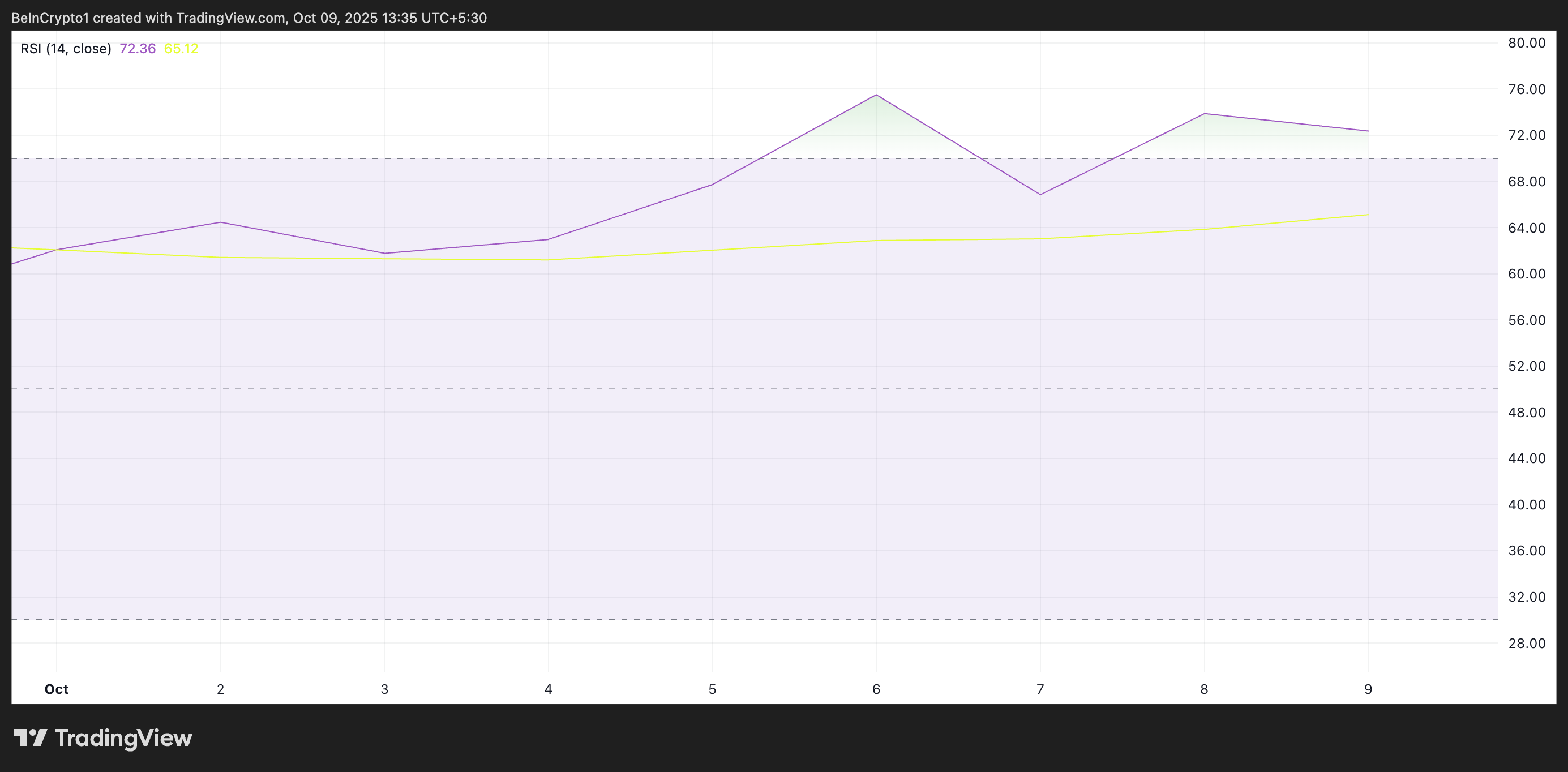

However, there is a catch for MNT. Readings from its Relative Strength Index (RSI) signal that the altcoin is overbought, suggesting that the rally may be nearing levels that are often unsustainable in the short term.

At press time, this key momentum indicator is at 72.36.

MNT RSI. Source:

MNT RSI. Source:

MNT RSI. Source:

MNT RSI. Source:

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

At 72.39, MNT’s RSI confirms that the market may be overheating and buyers may be nearing exhaustion. These could lead to a pullback in the token’s value over the next few trading sessions.

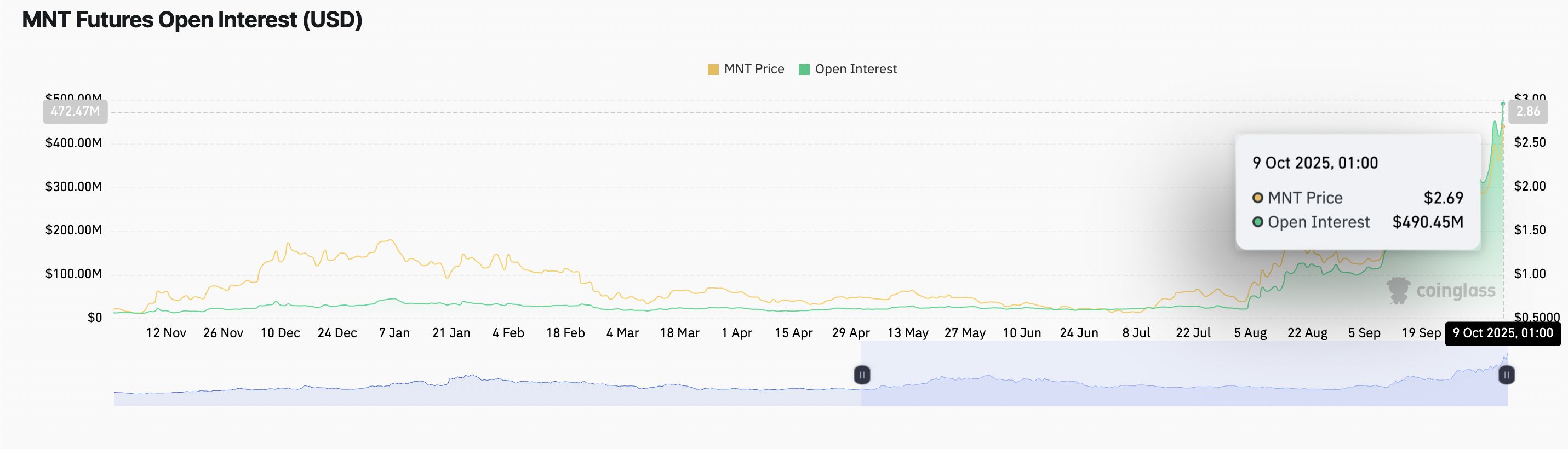

High Leverage Leaves Room for Sharp Reversal

MNT’s futures open interest has climbed to a year-to-date high of $490.45 million, up 20% in the past 24 hours, per Coinglass data. This surge signals increased leveraged exposure among traders, and may mean trouble for MNT’s price in the near term.

MNT Futures Open Interest. Source:

MNT Futures Open Interest. Source:

MNT Futures Open Interest. Source:

MNT Futures Open Interest. Source:

Open interest represents the total number of outstanding futures or options contracts that have not yet been settled and serves as a gauge of market participation and capital flow.

An asset’s price moving higher alongside a surge in futures open interest can indicate strong bullish sentiment. However, it also comes with heightened risk.

A minor price correction could trigger significant liquidations of some of these open positions, dampening market sentiment and risking recent MNT gains.

Short-Term Pressure Could Pull Prices Lower

Without continued buyer support, MNT could face short-term pressure and fall to test support at $2.36. If this level weakens, MNT’s price could drop deeper toward $1.95.

MNT Price Analysis. Source:

MNT Price Analysis. Source:

MNT Price Analysis. Source:

MNT Price Analysis. Source:

However, if demand persists, the altcoin may sustain its upward trajectory, at least temporarily. In that scenario, it could revisit its all-time high and attempt to rally past it.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Forbes 2026 Crypto Trend Forecast: Where Will the Market Go After Volatility Decreases?

The stablecoin frenzy, the financialization of bitcoin, and cross-border capital flows are accelerating the restructuring of the industry.

Once the most lucrative application, is it now completely abandoned?

The four-year bitcoin cycle is invalidated—who will lead the new two-year cycle?

You may have misunderstood JESSE; this is an attempt to bring revenue to the Base chain.