Chainlink's LINK Tumbles 4% as Selling Pressure Mounts

The native token of oracle network Chainlink LINK$21.80 encountered substantial institutional selling pressure over the 24-hour trading session, tumbling to its weakest price in more than a week.

LINK tumbled 4% to a session low of $21.30, reversing over 8% from Monday's local high, CoinDesk data shows. The decline happened in line with weakness in the broader crypto market. The CoinDesk 20 Index, a benchmark for that broader market market, was also down around the same amount.

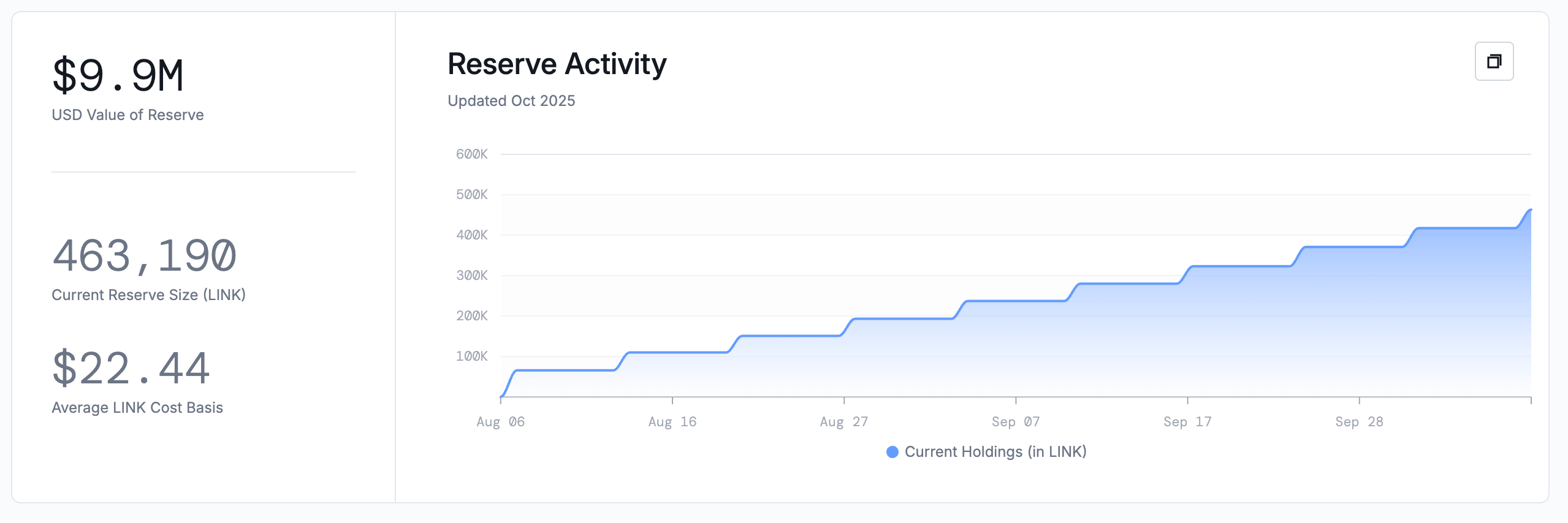

Meanwhile, the Chainlink Reserve, a facility that purchases tokens on the open market using income from protocol integrations and services, kept its weekly habit, buying another 45,729 LINK worth nearly $1 million on Thursday. The reserve currently holds nearly $10 million worth of tokens.

Thursday's decline, however, meant that the vehicle is now underwater with LINK trading below the average cost basis of $22.44, the dashboard shows.

Key technical indicators

CoinDesk Research's technical model pointed out bearish momentum, underscoring the weakening investor sentiment.

- The token's trading range expanded to $1.05, representing 5% volatility between the session low of $21.53 and peak of $22.68.

- Technical resistance materialized at the $22.68 level, where the token reversed course on exceptionally heavy volume of 1,981,247 units.

- Additional resistance formed at the $21.92 level.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.

Do Kwon Wants Lighter Sentence After Admitting Guilt