XRP Rally Started 1 Year Ago – And Traders Lost $700 Million In a Flash

Analysts say XRP’s downturn reflects profit-taking and fading bullish momentum, though potential ETF approvals could restore investor confidence.

XRP has plunged to its lowest level in six months amid a widespread crypto sell-off that wiped out nearly $20 billion from the market in 24 hours.

According to BeInCrypto data, the token dropped more than 13% to as low as $1.53 before recovering slightly to $2.44 at press time. This marks the second time in 2025 that XRP has fallen below the $2 threshold.

Is XRP Bullish Momentum Exhausted?

Data from Coinglass shows that the sudden price decline triggered over $700 million in liquidations from traders speculating on XRP’s price performance.

Notably, more than $600 million in long positions were liquidated as traders betting on a price rebound were caught off guard by the sharp downturn.

The sell-off also saw XRP’s open interest drop from over $8 billion to around $5 billion, signaling a rapid unwinding of leveraged positions.

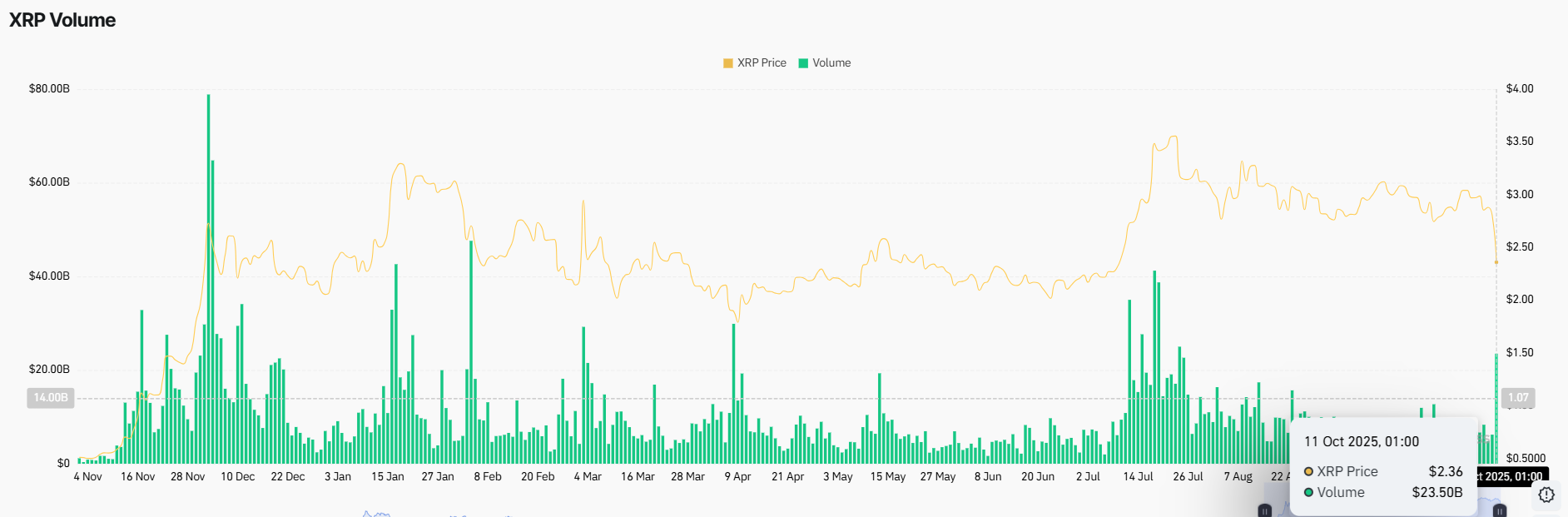

Despite this, derivatives activity surged, with XRP’s trading volume in futures and options exceeding $23 billion — its highest level since July. This spike suggests that traders rushed to hedge their positions or capitalize on short-term volatility.

XRP’s Derivatives Volume. Source:

Coinglass

XRP’s Derivatives Volume. Source:

Coinglass

The market slump coincided with renewed macroeconomic tension following President Donald Trump’s announcement of a 100% tariff on Chinese goods. The move rattled risk assets, including cryptocurrencies, and fueled a wave of selling pressure.

Yet XRP’s decline also reflects internal market dynamics of the token.

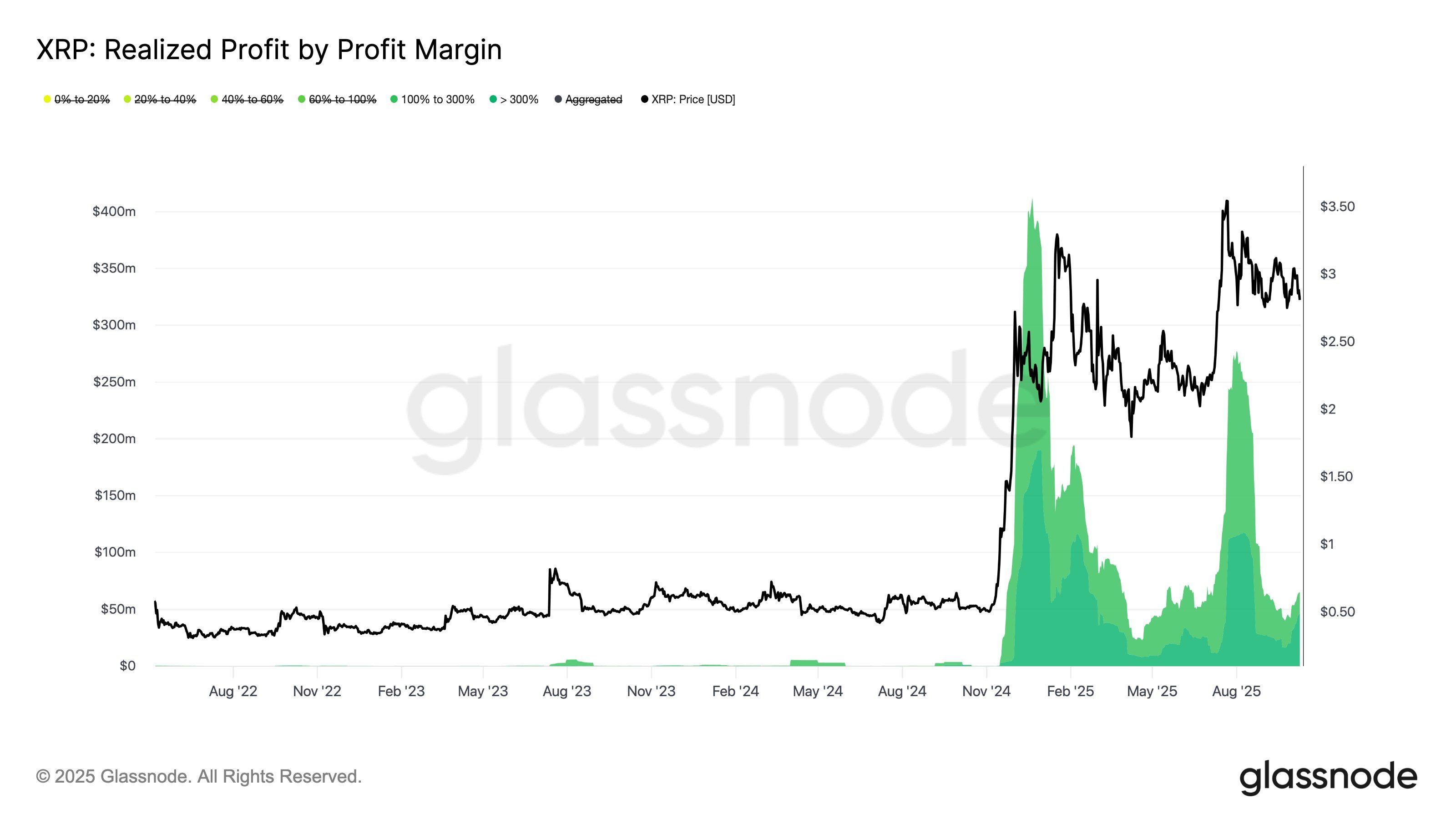

Glassnode data indicates that the token’s bullish momentum has waned since late 2024 as investors who accumulated below $1 took profits during rallies above $2 and $3.

XRP’s Realized Profit Margin. Source:

Glassnode

XRP’s Realized Profit Margin. Source:

Glassnode

Notably, the two profit-taking waves of December 2024 and July 2025 aligned with the asset’s price peaks and delivered over 300% gains for early holders.

Now, with those gains realized and broader market sentiment turning risk-averse, XRP appears to have entered a consolidation phase.

However, market analysts have pointed out that new catalysts, like the impending spot ETFs approval, could reignite investor confidence in the digital asset.

In addition, they noted that the continued growth and adoption of Ripple’s blockchain technology and XRP Ledger could also fuel the crypto token’s ascent.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data-Anchored Tokens (DAT) and ERC-8028: The Native AI Asset Standard for the Decentralized AI (dAI) Era on Ethereum

If Ethereum is to become the settlement and coordination layer for AI agents, it will need a way to represent native AI assets—something as universal as ERC-20, but also capable of meeting the specific economic model requirements of AI.

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.