Solana’s Perp DEX Volume Reaches Record $4.49 Billion

- Record Solana DEX volume highlights market volatility and user activity.

- Jupiter platform processed over $2.34 billion.

- No statements from Solana or Jupiter leadership yet.

Solana’s decentralized exchanges (DEX) hit an unprecedented $4.49 billion in 24-hour perpetual trading volume, primarily driven by Jupiter Exchange with $2.34 billion. This surge occurred amid severe market volatility, reflecting increased trader activity.

Solana’s decentralized perpetual exchange trading volume hit a record $4.49 billion in 24 hours , predominantly driven by trader activity on the Jupiter platform, marking a significant milestone in Solana’s DeFi landscape.

The record trading volume in Solana’s perpetual markets underscores the dynamic nature of crypto trading, reflecting traders’ responses to market volatility. This milestone suggests a growing interest in decentralized exchanges.

Jupiter’s Leading Role

The trading activity on Solana’s decentralized exchanges was notably led by Jupiter Exchange, processing a significant portion of the record volume. This surge coincided with high volatility in the broader crypto market, particularly involving Bitcoin and Ethereum.

Despite the outstanding trading figures, neither Jupiter’s founding team nor Solana’s leadership have provided official acknowledgments or comments on this event. Information primarily originates from aggregated on-chain data, lacking direct leadership communication.

It appears there are no direct quotes available from key players, leadership, or influential figures regarding the record trading volume of Solana’s perpetual DEXs at this time. Most information derived about the event comes from on-chain analytics rather than first-hand official statements or commentary.

The massive trading volume has not directly translated to new funding rounds or institutional investments. The spike was primarily driven by organic trading activity amidst the broader market downturn, highlighting Solana’s capacity for handling high transaction volumes.

Impact on the SOL Token and Future Outlook

Increased activity in Solana’s DeFi sector could potentially stimulate demand for the SOL token itself, as it serves as the base layer for these exchanges. However, the industry is closely watching for any regulatory updates that might affect future trading volumes.

While Jupiter and Solana have been silent, data aggregators have highlighted this surge as an indicator of decentralized markets’ health. Moving forward, further analysis will depend on the emergence of regulation and market trends as decentralized finance continues to evolve.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Chicago Tribune files lawsuit against Perplexity

All the major highlights from AWS’s flagship tech event re:Invent 2025

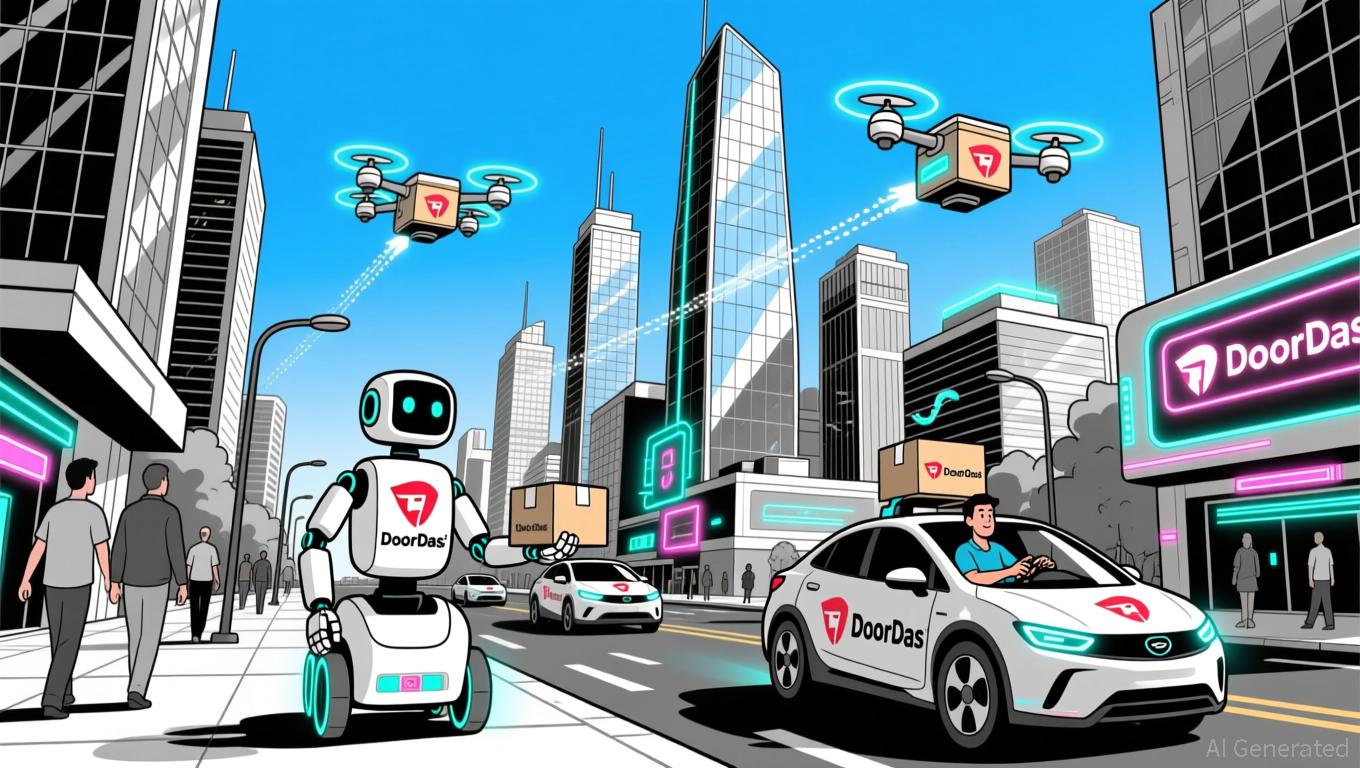

DASH Gains 5.78% Following DoorDash’s Expansion of Delivery Network and New Partnerships

- DoorDash's DASH stock surged 5.78% in 24 hours amid Q3 2025 results showing $3.4B revenue and $244M profit, driven by 27% YoY growth. - Strategic expansions include grocery delivery partnerships with Kroger/Family Dollar and robot delivery via Serve Robotics , enhancing its 68% U.S. food delivery market share. - Long-term investments in automation (Waymo, Dot robot) and $1.2B SevenRooms acquisition aim to boost efficiency but caused a 20% post-earnings stock pullback. - Favorable regulatory shifts (Prop

BCH sees a 32.36% increase over the past year as the network undergoes upgrades and mining adjustments

- Bitcoin Cash (BCH) surged 32.36% in a year due to network upgrades, mining shifts, and positive market sentiment. - Price hit $574.7 on Dec 5, 2025, with 6.34% 30-day and 0.03% 24-hour gains. - 2024 protocol upgrade boosted transaction throughput, fees, and real-world payment adoption. - Mining pools shifted hashrate to BCH, enhancing security and decentralization. - Institutional support and fixed supply model drive BCH’s appeal as a scalable payment alternative.