Venus Labs to Compensate for WBETH Decoupling Losses

- Venus Labs compensates WBETH decoupling losses using a risk fund.

- Incident date: October 10, 2025.

- WBETH plunged, affecting Ethereum market prices.

Venus Labs announced compensation for users affected by the WBETH price decoupling, utilizing the protocol’s risk fund. During a volatile market window on October 10, 2025, WBETH experienced significant devaluation, leading to liquidations and abnormal market behavior.

Venus Labs announced on October 10, 2025, plans to compensate verified users affected by the WBETH price decoupling via its protocol risk fund. The compensation was confirmed on Venus Protocol’s X account.

Venus Labs’ compensation plan addresses the depegging’s financial impact during significant price movement, showcasing commitment to user loss recovery.

The event involved the WBETH asset experiencing a sharp decoupling, affecting market stability. Venus Labs pledged to reimburse verified losses from the protocol’s risk fund. The official notifications were disseminated through the protocol’s formal communication channels.

“Venus Labs will compensate verified users who suffered losses due to the WBETH decoupling issue that occurred between 21:36 and 22:16 (UTC) on October 10, 2025, through the protocol risk fund.”

During the volatility, WBETH’s rate dropped dramatically, affecting Ethereum-related positions. The decision to use the protocol’s risk fund aims to mitigate the financial repercussions for affected users. Venus’s governance snapshot shows efforts to manage financial resources responsibly.

The crypto market observed substantial liquidation events linked to macroeconomic triggers, with WBETH’s price drop affecting overall market sentiment. Venus Protocol’s improvements in risk management strategies signal a proactive approach to future-proofing.

Industry leaders expect ongoing vigilance and improvements in oracle protection. The potential for increased regulatory scrutiny and technological enhancements might influence Venus’s governance decisions and its ability to foster resilience in crypto operations.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

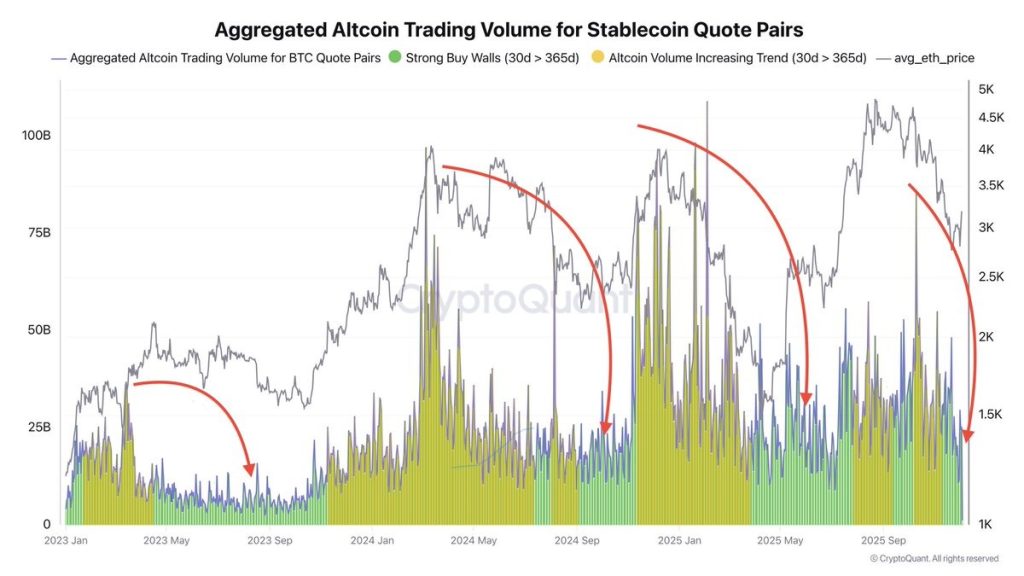

Altcoin Market Enters Historic Buying Zone — 5 Coins to Watch Before the Next Breakout

Crypto News: CZ Denies Trump Ties, But His Bitcoin Moment With Schiff Breaks the Internet

Russia to Include Crypto Payments in Balance-of-Payments Data

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?