A 35% XRP Price Rally? One Metric Says “Yes”, Another Says “Wait”

XRP’s price has rebounded after the crash, but an old pattern may be repeating. The same on-chain signal that preceded a 35% rally last time has appeared again, while cautious long-term holders could delay the breakout above $2.72.

The XRP price has steadied after the recent crypto market crash, climbing over 7% in the past 24 hours to around $2.55. The move mirrors the broader recovery across major altcoins. Even after the turbulence, XRP’s one-year trend remains up more than 350%, showing that the broader uptrend is still intact.

This makes the crash look more like a short-term reset than a trend reversal. But while one key on-chain metric signals that XRP could be setting up for a 35% rally, another shows that a key group of holders isn’t ready to commit just yet — which could delay the move.

One Metric Flashes a Rare Bullish Signal Seen Before Major Rallies

The Spent Output Profit Ratio (SOPR) — a metric that shows whether investors are selling at a profit or loss — has dropped to 0.95 after the crash, its lowest level in six months. A reading below 1 means that most holders are selling at a loss, often marking exhaustion among sellers before a reversal.

The last time SOPR fell close to this low was on April 7, when it touched 0.92. Back then, XRP rebounded from $1.90 to $2.58 within a month — a 35% rise. With the XRP price forming a low of $2.38 (on the SOPR chart), a similar move this time would put the next potential target near $3.10-$3.35.

XRP’s Bullish Metric Hints at Upside:

Glassnode

XRP’s Bullish Metric Hints at Upside:

Glassnode

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

That setup makes SOPR one of the few early indicators hinting at a rebound, showing that selling may have reached its limit and buyers could soon regain control.

Long-Term Holders Are Still Reducing Exposure

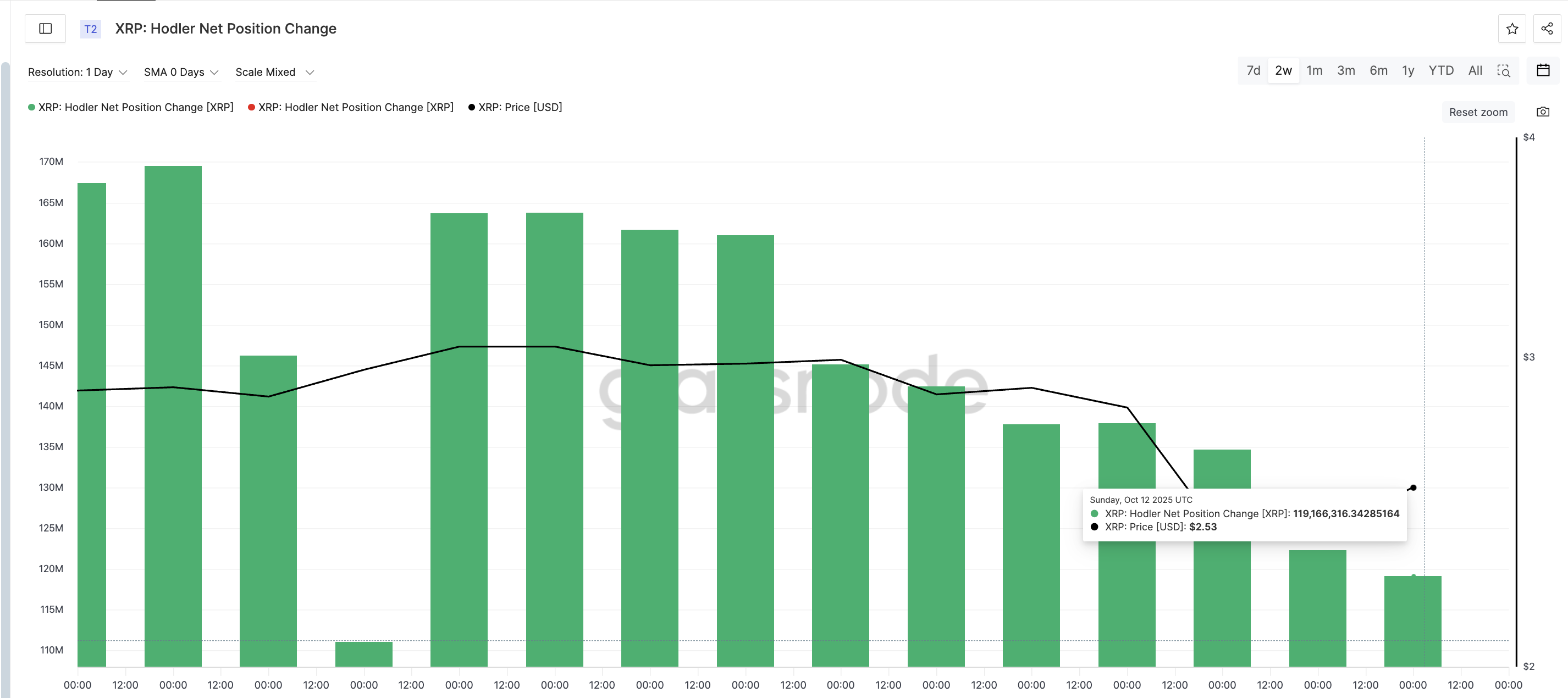

While SOPR suggests recovery, long-term holders are not fully on board yet. Data from Glassnode’s Hodler Net Position Change — which measures how much XRP long-term investors are adding — shows that accumulation has slowed since early October.

On October 2, long-term wallets added about 163.68 million XRP, but by October 12, that number had dropped to 119.16 million XRP, a 27% decline. This means older holders have been gradually reducing their positions even as the market stabilized.

Long-Term XRP Investors Are Dumping:

Glassnode

Long-Term XRP Investors Are Dumping:

Glassnode

These investors usually provide stability during volatile phases, so their hesitation suggests that the rebound may take time to build momentum. Until long-term wallets start buying again, any XRP price recovery could remain fragile and range-bound.

XRP Price Still Awaits a Breakout From Its Triangle Pattern

On the daily chart, the XRP price is still trading within a symmetrical triangle, signaling consolidation after weeks of volatility. The immediate resistance sits near $2.72.

XRP Price Analysis:

TradingView

XRP Price Analysis:

TradingView

A daily candle breakout above $2.72 would confirm renewed buying strength and could open the XRP price door to $3.10, $3.35, and $3.66, matching the 30%-40% (35% on average) rally projection based on SOPR’s historical behavior.

However, failure to hold above the $2.30 support could invalidate this bullish structure and push the XRP price lower.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin set for ‘promising new year’ as it faces worst November in 7 years

From "whoever pays gets it" to "only the right people get it": The next generation of Launchpads needs a reshuffle

The next-generation Launchpad may help address the issue of community activation in the cryptocurrency sector, a problem that airdrops have consistently failed to solve.

After bitcoin returns to $90,000, is Christmas or a Christmas crash coming next?

This Thanksgiving, we are grateful for bitcoin returning to $90,000.