Dragonfly partner Haseeb: Has USDe really depegged?

During the market crash, the price of USDe on its main trading platform Curve dropped by only 0.3%.

During the market crash, the price of USDe on its main trading venue, Curve, only dropped by 0.3%.

Written by: Haseeb Qureshi, Partner at Dragonfly

Translated by: Luffy, Foresight News

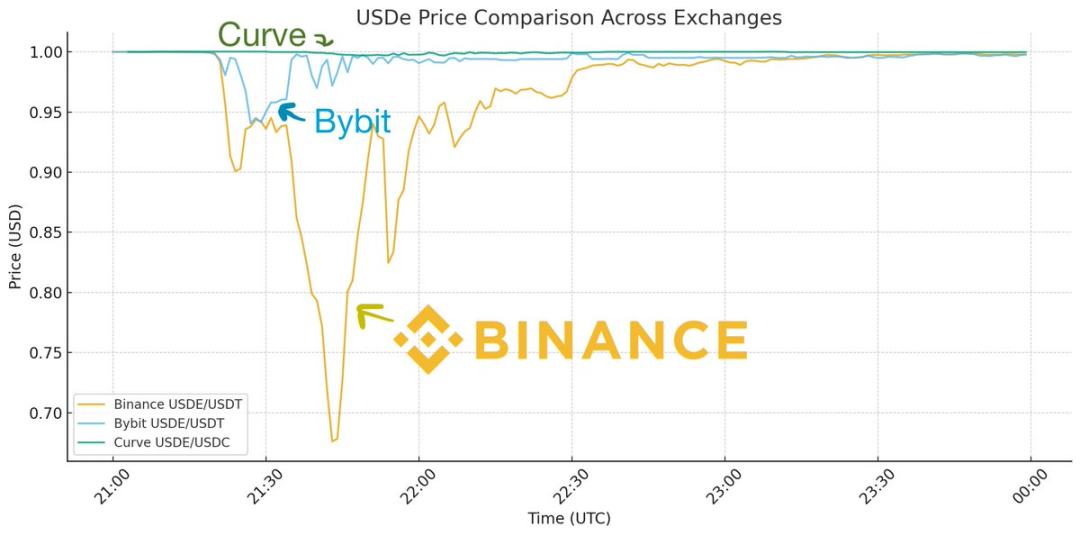

I’ve seen a lot of discussion about Ethena depegging during this weekend’s market turmoil. The situation is that USDe (the stablecoin issued by Ethena) briefly depegged to around $0.68 before recovering. This is the Binance chart everyone is referencing:

But after digging into the data and talking to many people over the past couple of days, I can now clearly say that this claim is incorrect—USDe did not depeg.

The first thing to understand is: the venue with the deepest USDe liquidity is actually not an exchange, but Curve. Curve has hundreds of millions of dollars in constant liquidity, while any exchange, including Binance, only has tens of millions of dollars in liquidity.

So if you only look at the USDe chart on Binance, it appears to have depegged. But if you overlay USDe’s liquidity across other venues, you get a different picture:

We can see that although USDe’s price dropped on every centralized exchange, the drop was not uniform. Bybit briefly fell to $0.95 before quickly recovering, while Binance’s depeg was much deeper and took a long time to recover. Meanwhile, the price on Curve only dropped by 0.3%. How do we explain this difference?

Remember, every exchange was under enormous strain that day—this was the largest liquidation event in crypto history. Binance was extremely unstable during this period; due to API failures, deposits and withdrawals were blocked, market makers couldn’t move positions, and no one could step in to arbitrage.

This is like a fire breaking out at Binance, but all the roads are blocked and firefighters can’t get in. This led to the situation on Binance spiraling out of control, but on almost every other venue, the fire was quickly put out by liquidity bridges. As Guy showed in his post, due to the same widespread instability, USDC also briefly depegged by a few cents on Binance—liquidity simply couldn’t get in—but this wasn’t a USDC depeg event either.

So, with unstable APIs, it’s not surprising that there were large price discrepancies across exchanges, because no one could take positions. But why did Binance’s price drop much deeper than Bybit’s?

The answer has two parts. First, Binance has no primary dealer relationship with Ethena and cannot mint or redeem directly on the platform (Bybit and other exchanges have integrated this feature), which allows market makers to stay on the platform and arbitrage. This is very important; otherwise, market makers would have to withdraw funds from Binance, go to Ethena for peg arbitrage, and then bring the position back. In a crisis when APIs are down, no one can do this.

Second, Binance’s oracle performed poorly and started liquidating positions that shouldn’t have been liquidated—a good liquidation mechanism should not trigger during a flash crash. If you’re not the main trading venue for an asset (Binance is not the main venue for USDe), you should reference the price from the main venue. If you only look at your own order book, you over-liquidate. This led Binance to start liquidating USDe at around $0.80, triggering a chain reaction. This is also a key reason why Binance is refunding users who were liquidated on USDe (as far as I know, other exchanges are not doing this). They only looked at their own price instead of the real external price, which was a mistake.

So this was a Binance-specific flash crash event, and better market structure could have prevented it. USDe on its main trading venue, Curve, actually maintained a relatively stable peg throughout the day. This is really different from the depeg scenario you described.

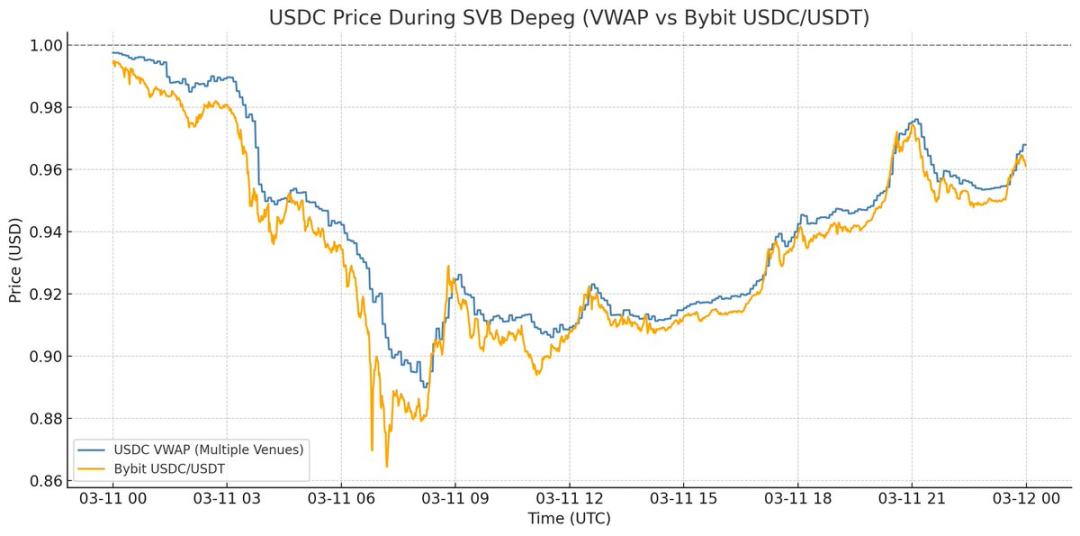

If you remember USDC during the 2023 Silicon Valley Bank crisis, that was a real depeg scenario:

During the Silicon Valley Bank crisis, USDC’s price dropped on every venue—there was nowhere you could sell USDC for $1. Redemptions were actually paused, so $0.87 was its real price. That’s what depegging means.

This time, it was just a Binance-specific price dislocation. It’s an important lesson for market infrastructure, but if you’re trying to infer something about USDe’s mechanism from this weekend’s events, understanding the nuance is crucial.

Throughout the entire event, USDe was fully collateralized on its main trading venue, valued at $1, and due to price volatility, its collateral actually increased over the weekend. In other words, this market instability ultimately had a positive effect by providing a lesson for the entire industry. Guy’s post explains how any exchange, including Binance, can avoid this kind of issue in the future.

In short: USDe did not depeg; it was a pricing issue on Binance.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoin Legislation Booms Globally, Why Is China Taking the Opposite Approach? An Article to Understand the Real National Strategic Choices

Amid the global surge in stablecoin legislation, China has chosen to firmly curb stablecoins and other virtual currencies, while accelerating the development of the digital yuan to safeguard national security and monetary sovereignty. Summary generated by Mars AI. This summary is produced by the Mars AI model and its accuracy and completeness are still being iteratively improved.

Liquidity migration begins! Japan becomes the Fed's "reservoir," 120 billions in carry trade returns set to ignite the December crypto market

The Federal Reserve has stopped quantitative tightening and may cut interest rates, while the Bank of Japan plans to raise rates, changing the global liquidity landscape and impacting carry trades and asset pricing. Summary generated by Mars AI. This summary is produced by the Mars AI model, and the accuracy and completeness of its content are still under iterative improvement.

Weekly Hot Picks: Bank of Japan Sends Strongest Rate Hike Signal! Is the Copper Market Entering a Supercycle Rehearsal?

The leading candidate for Federal Reserve Chair is being questioned for potentially "accommodative rate cuts." Copper prices have reached a historic high, and a five-hour meeting between the United States and Russia ended without results. Expectations for a Japanese interest rate hike in December have surged, and Moore Threads' stock soared more than fivefold on its first day... What market moves did you miss this week?

Monad Practical Guide: Welcome to a New Architecture and High-Performance Development Ecosystem

This article will introduce some resources to help you better understand Monad and start developing.