3 Altcoins That Could Hit All-Time Highs In The Third Week Of October Despite Market Crash

Three altcoins—USELESS, Mantle, and Ethereum—are edging close to new all-time highs this week as strong recoveries drive renewed investor optimism.

The recovery of the crypto market has pushed multiple altcoins upwards, closing in on their record highs. Investors will likely look at this as an opportunity to book profits, but until then, support will follow.

BeInCrypto has identified three such altcoins that could form new all-time highs in the coming week.

Useless (USELESS)

USELESS remains among the few cryptocurrencies trading close to their all-time highs despite enduring steep losses during Friday’s market crash. The meme coin currently sits just 19.7% below its peak of $0.444, showcasing notable resilience compared to most altcoins that continue struggling to recover.

Up 67% in the past 24 hours, USELESS is trading at $0.368 and attempting to establish $0.364 as strong support. The 50-day exponential moving average (EMA) is reinforcing bullish sentiment, suggesting continued momentum that could propel the coin toward retesting its all-time high level soon.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

USELESS Price Analysis. Source:

TradingView

USELESS Price Analysis. Source:

TradingView

However, if premature selling pressure emerges, USELESS could face a sharp pullback. A breach below the $0.292 support might drive the price down to $0.230. This would erasing recent gains and potentially invalidating the bullish outlook.

Mantle (MNT)

MNT is another one of the altcoins emerging as a strong contender for a new all-time high this week, provided market conditions remain favorable. The altcoin currently trades at $2.15, standing just 33% away from its previous ATH of $2.87.

Although a 33% climb might appear steep, MNT’s recent 32% surge in just 24 hours shows that such growth is attainable. If the altcoin successfully flips the $2.29 resistance into support, it could pave the way for a rally toward $2.87, marking another record-breaking milestone.

MNT Price Analysis. Source:

TradingView

MNT Price Analysis. Source:

TradingView

However, if selling pressure builds or broader market sentiment weakens, MNT could lose momentum. A decline below $1.92 could push the price toward $1.77, effectively invalidating the bullish outlook and signaling a potential shift to short-term bearish conditions.

Ethereum (ETH)

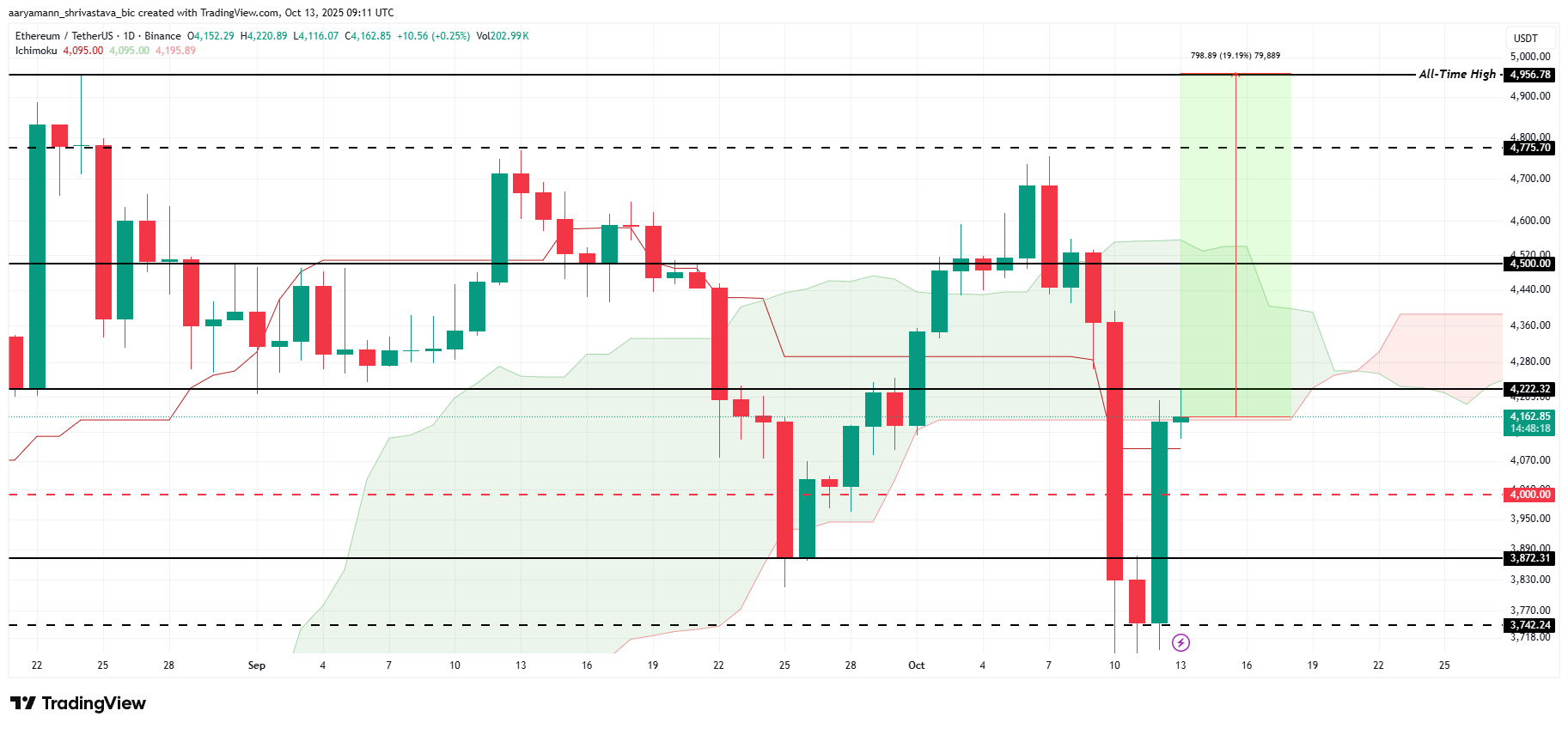

Ethereum is currently trading at $4,162, hovering just below the key $4,222 resistance level and awaiting a decisive breakout. The altcoin king rebounded strongly from $3,742, marking a 10% surge in the past 24 hours and signaling renewed investor confidence across the broader crypto market.

The Ichimoku Cloud indicator points to short-term bullish momentum for Ethereum. If ETH successfully flips $4,222 into support, the price could rally toward $4,500. Securing this level would further set the stage for Ethereum to test the next resistance at $4,956, reinforcing its upward trajectory.

Ethereum Price Analysis. Source:

TradingView

Ethereum Price Analysis. Source:

TradingView

However, if bullish conditions weaken or ETH fails to breach the $4,222 barrier, a reversal could occur. Ethereum might fall to $4,000 or even lower, erasing recent gains and invalidating the bullish outlook as selling pressure intensifies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

No wonder Buffett finally bet on Google

Google holds the entire chain in its own hands. It does not rely on Nvidia and possesses efficient, low-cost computational sovereignty.

HYPE Price Prediction December 2025: Can Hyperliquid Absorb Its Largest Supply Shock?

XRP Price Stuck Below Key Resistance, While Hidden Bullish Structure Hints at a Move To $3

Bitcoin Price Prediction: Recovery Targets $92K–$101K as Market Stabilizes