US is Seizing $12 Billion in Bitcoin, But What Will They Do With It?

The US Treasury’s effort to seize $12 billion in Bitcoin from Cambodia’s Prince Group marks a turning point in crypto crime enforcement. If successful, these assets could significantly strengthen Trump’s Strategic Reserve—unless victims reclaim their stolen funds.

The US is moving to seize around $12 billion in Bitcoin from Prince Group, a Cambodian-based pig butchering operation. It’s also applying massive sanctions to the Huione Group for facilitating money laundering.

If Treasury can acquire and gain ownership of these assets, it could substantially boost Trump’s Strategic Reserve. However, many defrauded Americans may attempt to reclaim their stolen money.

More Bitcoin For The US Government

Pig butchering scams were already a huge problem before 2025’s unprecedented crypto crime wave, but escalating fraud is making all these problems much larger.

One recent incident shows the scale of these incidents, as the Treasury is moving to seize $12 billion in Bitcoin from a long-running scheme:

The Treasury also released a statement on this pig butchering operation, although it does not directly address the effort to seize these bitcoins.

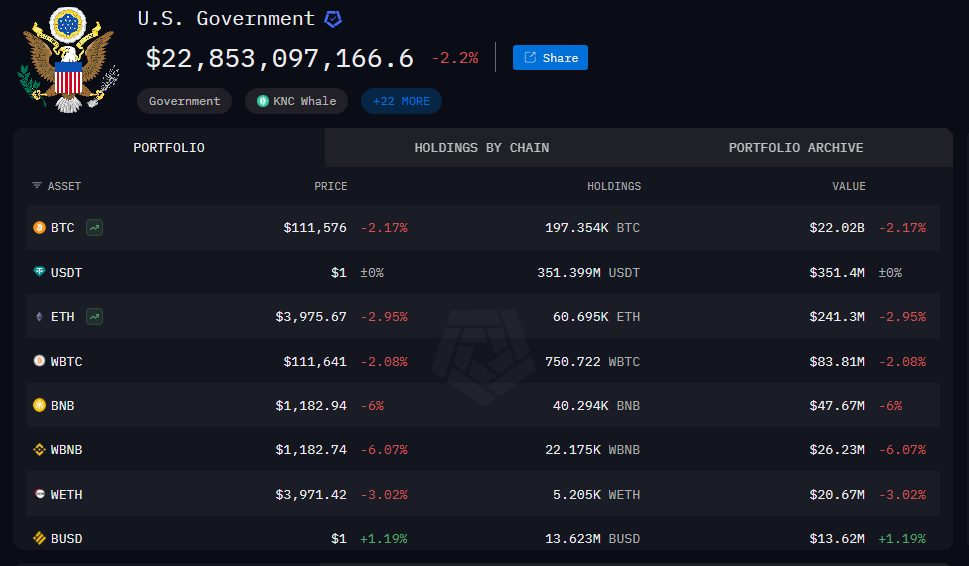

US Government Bitcoin Portfolio Till Now. Source:

US Government Bitcoin Portfolio Till Now. Source:

It claimed that a multinational investigation targeted the Prince Group, a Cambodian-based crime ring. By 2024, this group apparently stole at least $10 billion from US citizens.

Additionally, the Treasury finalized its efforts to sever the Huione Group from the US financial system, due to its history of facilitating money laundering.

Private crypto firms have levied restrictions upon the Cambodian financial conglomerate, but the US government is making a major escalation here.

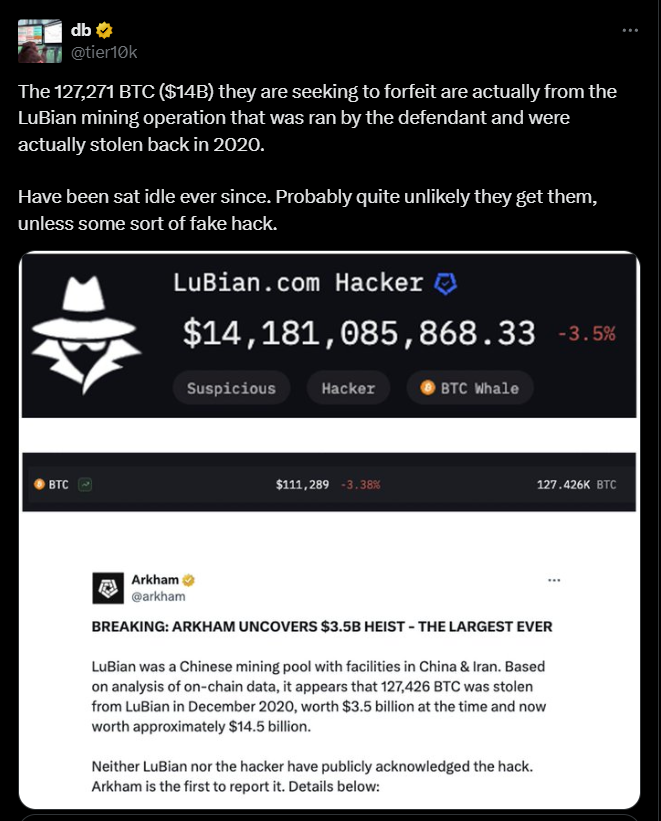

Some reports suggest these funds could actually be linked to the biggest crypto hack till date involving LuBian mining pool.

Source:

Source:

Strategic Reserve Implications?

The Prince Group’s operations were truly frightening, including human trafficking, torture, sexual exploitation, and more. Treasury’s report details all these unseemly aspects, which may be too lurid for our coverage.

However, as far as the crypto community is concerned, there’s one crucial point to realize. If the Treasury can successfully seize this Bitcoin, it could be a huge windfall for Trump’s planned Strategic Reserve.

Specifically, the administration has run into a major problem: it custodies huge quantities of seized bitcoins, but it doesn’t have legal ownership. It can’t exactly put these assets into a Strategic Reserve if it’s legally obligated to return them to the actual fraud victims.

There may be an opportunity here, depending on a few things. If the Treasury can acquire these assets, $12 billion is a huge windfall. If even a tiny fraction of initial theft victims fail to pursue reimbursement, this Bitcoin may be up for grabs.

In short, there are many factors in the air right now. The US may fail to seize these bitcoins, or a huge chunk may simply return to their initial owners. If, however, it can retain a few billion dollars’ worth, this could make a Bitcoin Reserve truly formidable.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin buries the tulip myth after 17 years of proven resilience says ETF expert

Dash's Price Soars 150%: Temporary Volatility or the Start of a Lasting Rally?

- Dash (DASH) surged 150% in June 2025, driven by Platform 2.0 upgrades, institutional adoption, and pro-crypto policies. - Institutional inflows ($780M+), cross-chain interoperability, and retail payment integrations boosted DASH's utility and speculative demand. - Privacy features and 0.80 Bitcoin correlation fueled gains, but 77% PrivateSend opacity and regulatory risks question sustainability. - DASH's future hinges on balancing privacy-transparency trade-offs, macroeconomic clarity, and expanding merc

Investing in Educational Technology as Demand for AI and STEM Expertise Grows

- Global EdTech market valued at $277.2B in 2025 is projected to surge to $907.7B by 2034, driven by AI integration in personalized learning and VR/AR tools. - Investors prioritize platforms aligning academic programs with AI/STEM workforce needs, achieving 20-75% higher ROI through systemic AI adoption across institutions. - Case studies like MIT's $350M AI college and OpenClassrooms' 43,000 career-advancing learners demonstrate scalable ROI from workforce-aligned education models. - Despite uneven AI int

Zcash’s Unpredictable Rise: Immediate Drivers and Future Outlook for Privacy

- Zcash (ZEC) rebounded 20% after a 55% drop, testing $375 as liquidity events and technical indicators fueled short-term optimism. - RSI/MACD signals suggest potential $475 breakout if bulls reclaim $375, though ZEC remains 57% below its 2025 peak. - Institutional adoption grows with Grayscale Zcash Trust assets surging 228%, driven by optional privacy tech attracting both retail and institutional users. - Regulatory scrutiny under MiCA and FinCen rules, plus Zcash's hybrid privacy model vs. Monero/Dash,