Bitcoin Crash Coming? Could BTC Really Drop From $110K to $65K?

Bitcoin’s rally past $110,000 had traders convinced the bull market was unstoppable. But in just days, that confidence cracked. A mix of global politics and technical weakness has triggered one of the sharpest pullbacks in months. Beijing’s new sanctions on five U.S. subsidiaries of South Korea’s Hanwha Ocean have reignited trade tensions with Washington, rattling investors across equities, commodities, and crypto alike. For Bitcoin, the timing couldn’t be worse— ETF outflows are mounting , liquidity is thinning, and volatility is spiking.

This correction isn’t random. It’s what happens when overextended technicals collide with a macro storm. The chart is flashing early warnings of exhaustion, and if sentiment continues to sour, a deeper drop toward $90K—or even $65K—can’t be ruled out. Let’s unpack what’s going on.

Bitcoin News: Why Is Bitcoin Falling Now?

Bitcoin price thrives on global risk appetite. When investors feel confident, they chase yield; when fear takes over, they retreat to safety. China’s sanctions against Hanwha’s U.S. units come as part of an escalating trade confrontation. Both Washington and Beijing are now hitting each other’s shipping industries with new fees and investigations. That’s a signal to global markets: uncertainty is back.

As a result, traders are unwinding leverage, and big players are rotating capital out of volatile assets. The mood across crypto desks has shifted from FOMO to defense. Bitcoin’s close below $115K confirms that momentum has broken.

Bitcoin Price Prediction: What the Chart Is Telling Us

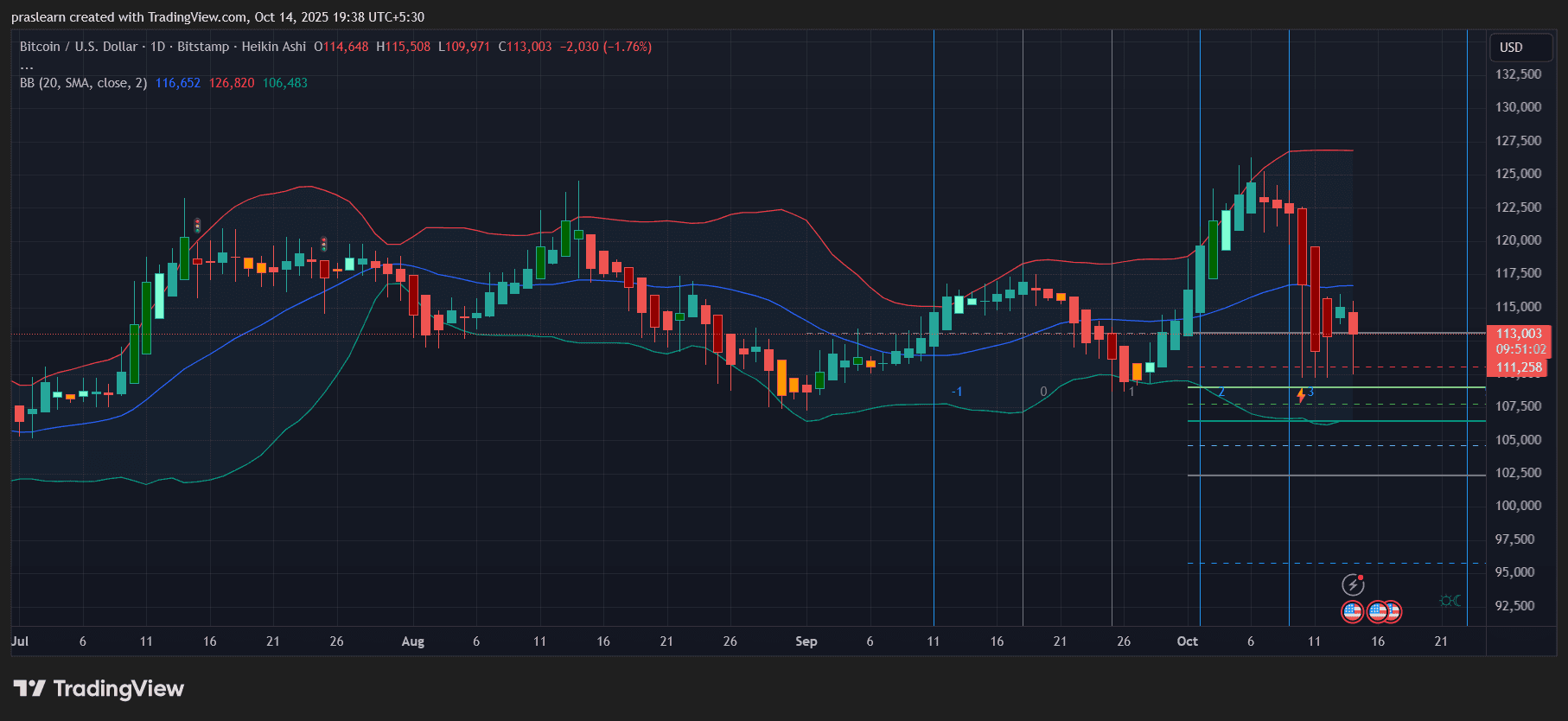

BTC/USD Daily Chart- TradingView

BTC/USD Daily Chart- TradingView

Look closely at the daily Heikin-Ashi chart. Bitcoin is hovering around $113,000, stuck under the 20-day SMA at $116,652—a line that once acted as strong support but now acts as resistance. The Bollinger Bands are wide and pointing downward, showing that volatility remains high and sellers are still in control.

The key level to watch is the lower band near $106,483. A daily close below that would likely accelerate the sell-off, pushing BTC toward $102K–$98K, the next cluster of support. Beneath that sits the psychological zone around $90K, which aligns with a 50% retracement from the July breakout. If panic selling sets in, $65K becomes a potential capitulation zone—painful, but technically plausible.

On the other hand, bulls need to reclaim $118K to restore confidence. A break above that could reset the short-term trend and open a path back toward $125K–$127K.

Bitcoin News: How Geopolitics Is Shaping Bitcoin’s Short-Term Future?

This isn’t just a chart story—it’s a global one. Beijing’s sanctions hit a nerve in the broader supply chain narrative. By targeting companies tied to U.S. investigations, China is signaling that the economic rivalry isn’t cooling anytime soon. Every flare-up between the world’s two largest economies adds pressure on markets that thrive on stability.

Bitcoin’s correlation to macro risk is rising again . Investors who once called it “digital gold” are realizing it behaves more like a high-beta tech asset when global uncertainty spikes. If trade tensions persist or spread to financial restrictions, the next few weeks could see further ETF outflows and continued selling pressure.

Bitcoin Price Prediction: Can BTC Price Recover Soon?

A rebound is possible, but not without catalysts. Bitcoin needs either a macro easing—like signs of de-escalation between the U.S. and China—or a return of ETF inflows to rebuild momentum. From a technical standpoint, the $106K–$107K zone must hold. If that floor breaks, the sell-off could deepen into a classic “washout” phase before long-term buyers step back in.

If BTC price stabilizes above that support and climbs past $118K, traders can start eyeing a recovery toward $125K–$130K by late October. But if volume continues to shrink and macro tension escalates, the slide to $95K or lower could arrive faster than most expect.

Bitcoin’s latest pullback isn’t the end of the bull market—but it is a serious reality check. The perfect storm of overheated charts, profit-taking, and geopolitical tension has forced traders to reassess. Until BTC reclaims its short-term moving averages, the bias leans bearish.

In plain terms: $BTC isn’t crashing—it’s resetting. But if global markets stay jittery, a deep correction toward $90K or even $65K could be the next chapter in this cycle’s story. Smart traders aren’t panicking—they’re preparing.

📈 Want to Trade Bitcoin?

Start now on Bitget: Sign Up Here

Check Live BTC Chart: BTC/USDT on Bitget

or You an check the Crypto Exchange Comparison.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Coinpedia Digest: This Week’s Crypto News Highlights | 29th November, 2025

QNT Price Breaks Falling Wedge: Can the Bullish Structure Push Toward $150?

Digital dollar hoards gold, Tether's vault is astonishing!

The Crypto Bloodbath Stalls: Is a Bottom In?