XRP ETF could reignite price if SEC rules positively

- SEC decision between October 18 and 25

- Possible institutional entry into XRP via ETF

- Optimistic projections range from $5 to $15

XRP ETFs Approach a Decisive Window, with the US SEC scheduled to judge applications between October 18 and 25, 2025. Issuers such as Grayscale, 21Shares, Bitwise, CoinShares, Canary Capital, and WisdomTree are lined up to obtain approval — and many have already revised their applications to be eligible once the commission resumes operations.

The first application to be evaluated will be Grayscale's, on October 18th. 21Shares is among those awaiting deliberation in the following days. This moment is considered crucial for the regulatory future of XRP in the spot ETF market, especially after repeated delays that have prolonged uncertainty among investors and platforms.

Part of this disruption stems from the suspension of U.S. government activities, which impacted the SEC's review of applications. Even so, some issuers—such as Grayscale, Bitwise, Canary, 21Shares, and WisdomTree—have filed amended S-1 documents, signaling their readiness to resume processing once the agency is reactivated.

The approval of these ETFs could significantly boost institutional capital attraction for XRP. Historically, regulated funds have expanded traditional investors' access to crypto assets like Bitcoin and Ethereum, leading to significant gains. As a result, optimistic projections point to XRP breaking through again and reaching $5, $10, or even $15, depending on institutional appetite.

Currently, the token is facing pressure: XRP is trading at $2,47, down 6,1% daily and down 17% weekly. These figures reflect market caution as it awaits the regulatory ruling, which could redefine not only the token's value but also XRP's institutional positioning.

While the SEC's green light doesn't guarantee immediate appreciation, many see the XRP ETF approval as a potential catalyst for robust institutional inflows. The market is closely monitoring the regulatory decision, which could open new doors for the token while also reversing its recent downward trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

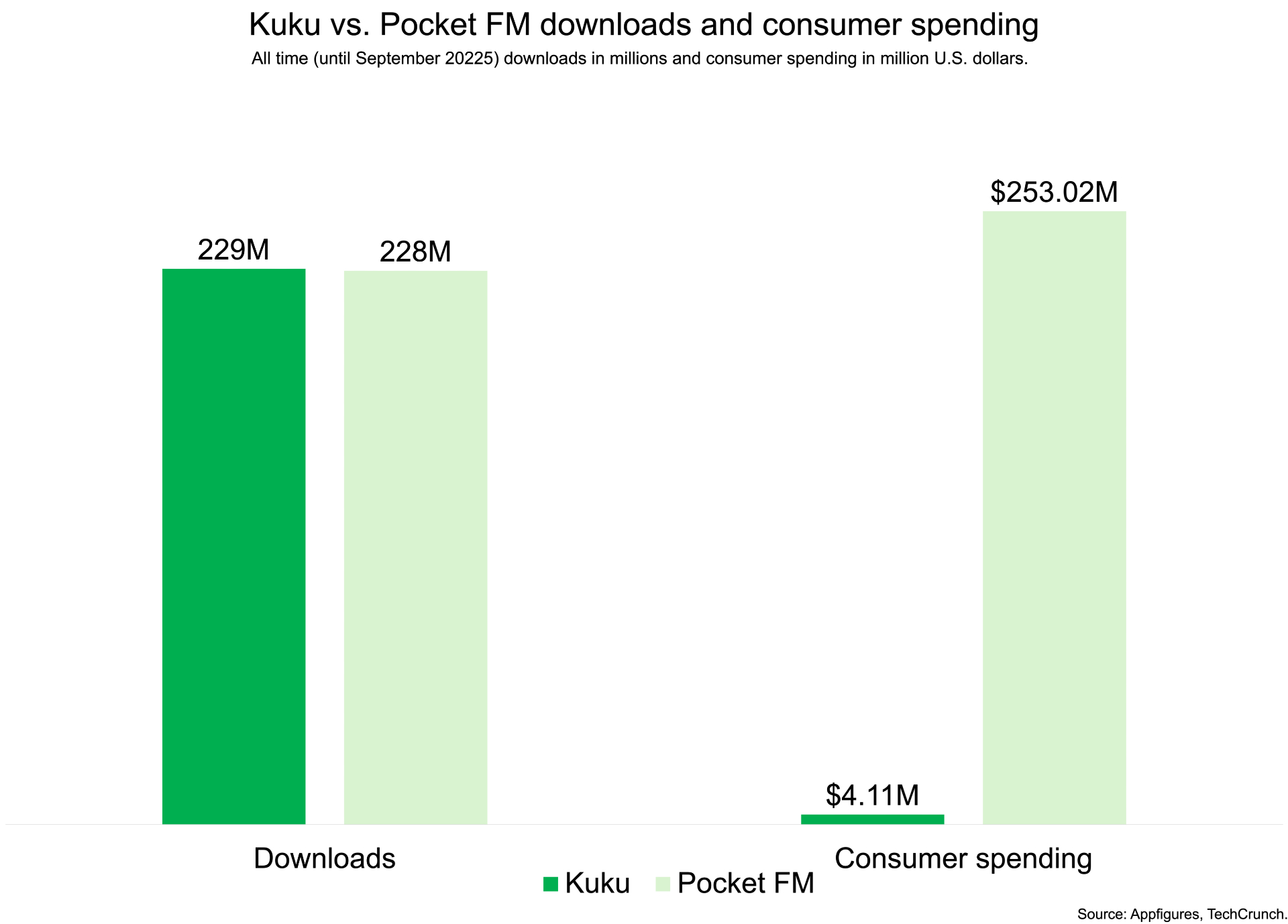

India’s Kuku secures $85 million amid escalating competition in the mobile content space

Only 48 hours left to take advantage of savings before the TechCrunch Disrupt 2025 flash sale concludes