Jerome Powell’s Speech May Influence Cryptocurrency Movements

- Jerome Powell discusses monetary policy influencing cryptocurrency markets.

- Potential impact on BTC and ETH prices observed.

- Precedents show volatility post-Fed speeches in crypto sector.

Federal Reserve Chair Jerome Powell will address the Institute of International Finance today in Washington, D.C. at 12:20 p.m. ET, discussing economic outlook and monetary policy.

Powell’s remarks could influence asset volatility in BTC, ETH, and other cryptocurrencies, as markets adjust to potential policy changes impacting economic growth and inflation expectations.

Jerome Powell’s speech at the Institute of International Finance is anticipated to affect the cryptocurrency sector. Investors closely watch his views on economic growth and inflation for indicators.

The Federal Reserve Chair, Jerome Powell, focuses on the economic outlook. Interest rates and inflation trends are critical topics, given their impact on both traditional and crypto markets.

Market reactions

Market reactions are immediate, with potential price volatility in assets like BTC and ETH. Institutional traders will particularly monitor remarks for indications of further policy changes.

Such Federal Reserve addresses often reshape financial landscapes. The cryptocurrency market is no exception, as investors adapt their strategies to the latest monetary policy directions.

Potential outcomes from Powell’s address include shifts in capital flows into risk assets. Historical data suggests crypto market volatility frequently follows such speeches, impacting liquidity and pricing trends.

Expert analysis highlights the importance of Fed commentary on market sentiment. Should Powell signal policy shifts, the long-term effects on cryptocurrencies like BTC and ETH may become apparent.

Jerome H. Powell, Chair, Federal Reserve – “Our commitment to combating inflation remains unwavering as we navigate the complexities of the current economic landscape.”: Federal Reserve Events and Meetings Calendar

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

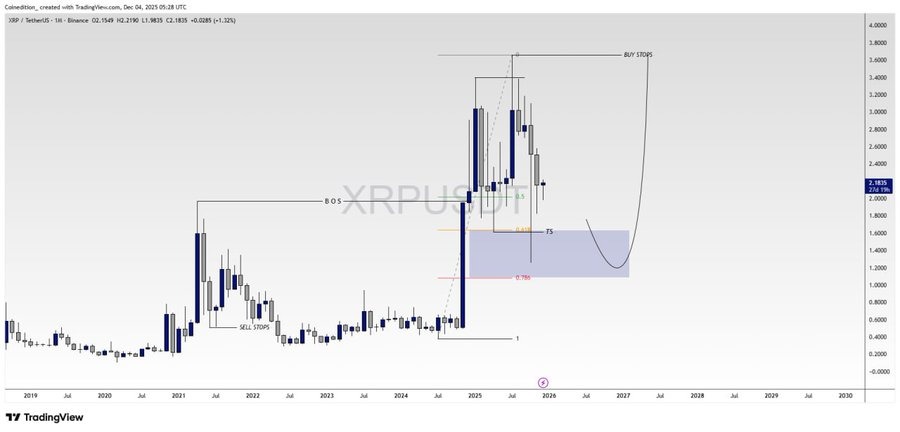

XRP News: XRPL Velocity Hits Record 2025 High, Will XRP Price Explode

Bitcoin price forecast: BTC eyes breakout to $100k as technicals improve

Bitget and Chorus One expand Monad staking access in emerging markets

Avalanche price jumps above $14 on rising onchain adoption; analysts see path to $9 or $35