A New Altcoin Rally Is Brewing This October, And Dogecoin Millionaires Know It

Dogecoin millionaires know the power of spotting potential early. Many of them bought DOGE when it was worth almost nothing, driven by belief and patience rather than hype. That bold move transformed ordinary investors into Dogecoin millionaires, proving how timing and conviction can turn small bets into life-changing fortunes.

Created as a community-driven token fueled by hype, Dogecoin differs from Paydax (PDP), which brings real financial purpose by making borrowing, lending, and insurance more transparent and fair. Now, those same Dogecoin millionaires have found a new favorite altcoin that reminds them of DOGE’s early days, Paydax (PDP).

The Future Of On-Chain Banking And Insurance Starts With Paydax

Chartist and pattern analyst Trader Tardigrade noted in a tweet on X that DOGE is essentially following the same pattern as its 2014–2017 cycle, suggesting another potential rally ahead. Market expert BitGuru adds that Dogecoin is attempting a pullback after a correction from the $0.25 zone, with strong support near $0.18 and resistance between $0.23 – $0.25.

While bulls wait for confirmation of a breakout, Dogecoin millionaires who have mastered these cycles are already positioning for the next rally. This time, they are shifting their focus to the cheap altcoin Paydax (PDP) at $0.015, which they believe could ignite a 65,000% rally before October ends.

What Makes Paydax Different

Paydax Protocol steps into a gap that traditional crypto projects have yet to fill — becoming the first platform to offer fully decentralized on-chain banking and insurance. Unlike hype-driven projects like Dogecoin, Paydax already has a live dApp (v1.0) and a functioning ecosystem.

Borrowing Made Smarter With Paydax

Borrowing Power:

Paydax lets users borrow against over 100 cryptocurrencies and tokenized real-world assets (RWAs) such as:

-

Gold

-

Real estate

-

Luxury watches

Borrowers can access flexible loan-to-value (LTV) ratios of 50%, 75%, 90%, or 97%.

Multiple Earning Streams For Lenders

Lenders on Paydax earn yields through several layers of participation:

-

15.2% APY from peer-to-peer loans.

-

20% APY from underwriting defaults in the Redemption Pool.

-

6% APY through protocol staking with governance rights.

-

41%+ APY via leveraged yield farming strategies.

Redefining Credibility In On-Chain Banking

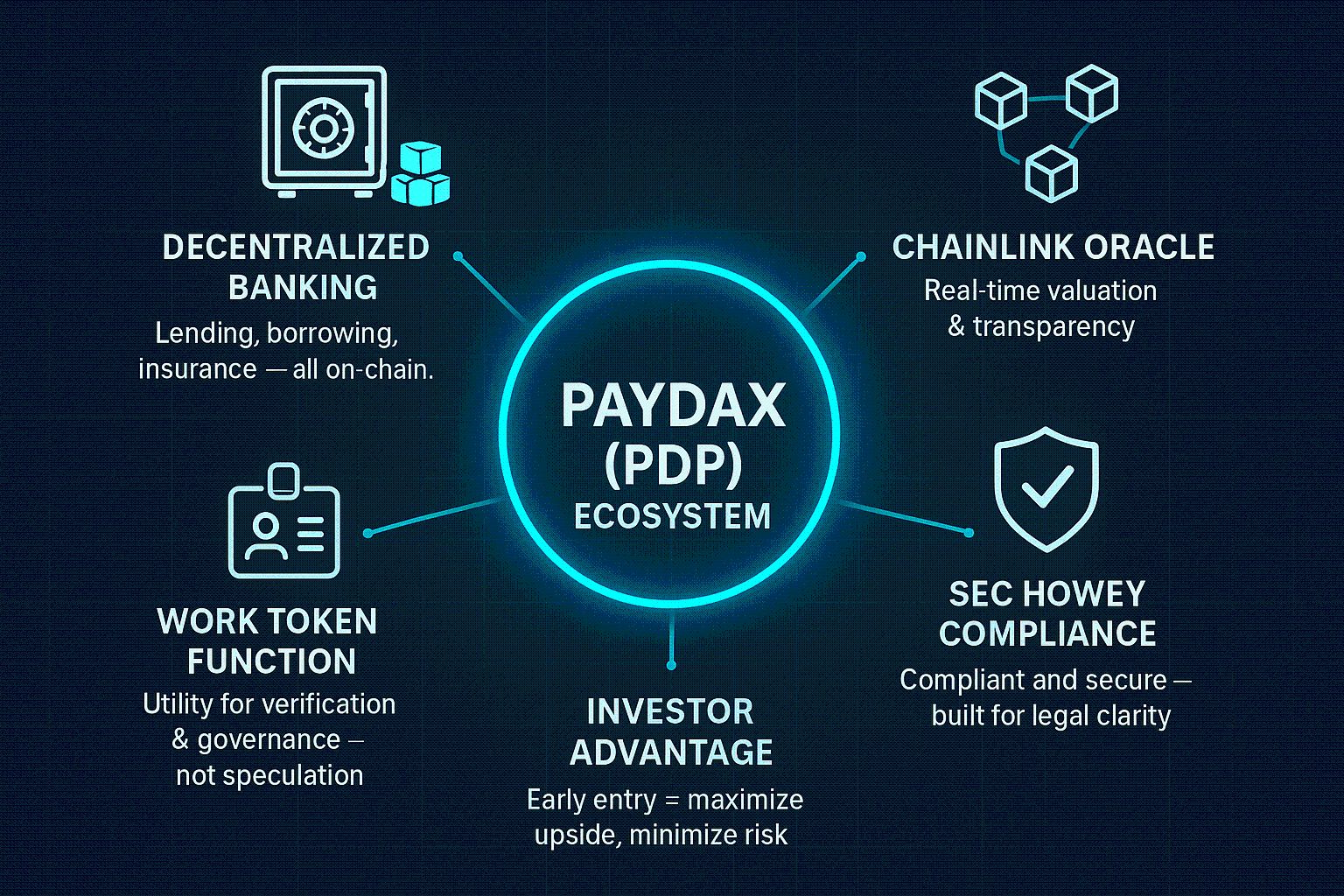

Designed to replace traditional banks, Paydax offers on-chain decentralized banking, lending, and insurance, with Chainlink price oracles ensuring real-time valuation and transparency. With SEC Howey Test compliance, PDP functions as a work token for ID verification and governance, not as a vehicle for speculation. Early entry lets investors maximize upside, mitigate risk, and tap into a new era of financial freedom.

Its partners ensure credibility at every step:

-

Sotheby’s authenticates and validates tokenized art and collectibles.

-

Brinks secures high-value assets, safeguarding deposits and collateral.

-

Onfido provides identity verification for seamless KYC compliance.