Global ETP Inflows Hit $353 Billion in 2025 as Crypto and Active ETFs Lead the Charge

Quick Breakdown:

- Global ETP inflows hit $353.25 billion YTD, driven by strong demand for active and crypto-linked funds.

- iShares Bitcoin Trust (IBIT US) ranked among top performers, attracting $2.66 billion in new inflows.

- Active ETFs dominated, with $56.05 billion in September and $363.22 billion year-to-date.

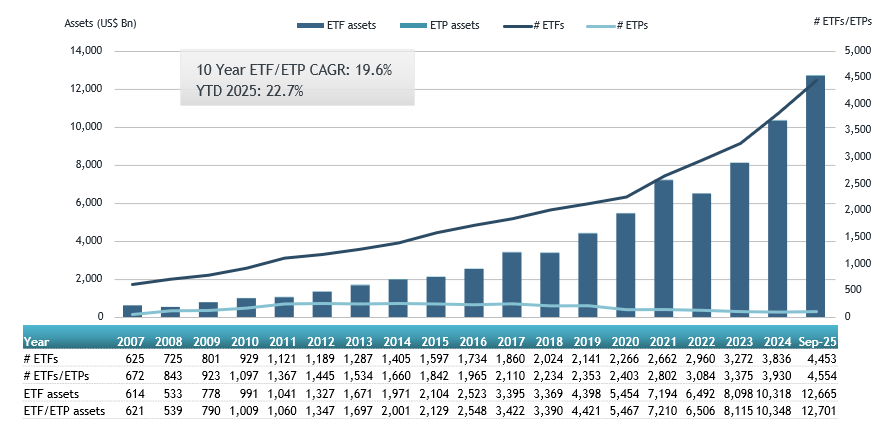

Global exchange-traded products (ETPs) extended their strong performance into September, with total year-to-date (YTD) net inflows reaching $353.25 billion — surpassing the $337.81 billion recorded during the same period in 2024. According to ETFGI data, this momentum reflects renewed investor appetite for crypto-linked and active ETFs, which have emerged as the standout performers of 2025.

Global ETP Inflows Hit $353 Billion in 2025. Source: ETFGI

Global ETP Inflows Hit $353 Billion in 2025. Source: ETFGI

Crypto and active ETFs dominate inflows

Active ETFs and ETPs drew $56.05 billion in net inflows during September alone, pushing their YTD total to $363.22 billion, up sharply from $206.87 billion a year ago. A large portion of this growth came from digital asset products, led by the iShares Bitcoin Trust (IBIT US), which attracted $2.66 billion in net inflows for the month.

Bitcoin-focused ETFs continue to anchor institutional participation, benefiting from rising adoption, regulatory clarity, and macro uncertainty that has boosted demand for alternative assets. Commodity ETFs also regained momentum, with SPDR Gold Shares (GLD US) and iShares Gold Trust (IAU US) bringing in $4.21 billion and $2.93 billion, respectively — signaling that investors are balancing inflation hedges with crypto exposure.

ETFs sustain record growth across asset classes

Fixed income ETFs and ETPs maintained strong growth, recording $22.52 billion in inflows in September and lifting YTD totals to $174.31 billion, up from $145 billion in 2024. Commodity ETPs added another $11.21 billion during the month — a sharp rebound from last year’s modest outflows of $9.17 million. The top 20 ETFs globally accounted for $73.71 billion of September’s inflows, led by the iShares Core S&P 500 ETF (IVV US) with $18.67 billion.

Market attention now turns to October, when the U.S. Securities and Exchange Commission (SEC) is expected to rule on 16 cryptocurrency ETF applications. Bloomberg ETF analyst James Seyffart noted that the outcome could mark a major milestone for the industry.

Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Investors Steer Through Sector Fluctuations: Diverging Paths in Crypto, Industrial, Retail, and Biotech Markets

- Mutuum Finance (MUTM) advances through 2025 crypto roadmap phases, with Phase 6 exceeding 88% allocation, reflecting strong investor demand for projects with clear technical milestones. - FLSmidth CEO Mikko Keto departs in 2026 after streamlining operations and improving financial resilience, underscoring industrial sector emphasis on strategic continuity and efficiency. - Home Depot's November 18 earnings report gains attention amid Trump's $82M bond investment, highlighting retail sector stability amid

FDIC Approves HSBC's Use of Tokenized Deposits in the United States and UAE

- HSBC plans to launch tokenized deposits in the U.S. and UAE, leveraging the $24B tokenized real-world assets market growth. - FDIC's proposed guidelines under the GENIUS Act aim to standardize stablecoin regulations, offering legal parity for blockchain-based deposits. - Leadership transition with George Osborne potentially accelerating HSBC's digital strategy amid scrutiny over its high debt and market risk profile. - Proactive FDIC reforms, including year-end stablecoin issuance applications, could red

Adobe’s $1.9 Billion Acquisition of Semrush: A Bold Move Toward AI-Powered Marketing

- Adobe agrees to acquire Semrush for $1.9B, boosting its shares 75% pre-market. - The deal aims to enhance Adobe's AI-driven marketing capabilities, aligning with digital trends. - Analysts see the move as a strategic response to AI's impact on digital marketing and Adobe's valuation challenges.

Cybersecurity’s AI Battle: Doppel Takes the Lead Responding to a 300% Increase in Social Engineering Threats

- Doppel raised $70M in Series C funding at $600M+ valuation to combat AI-powered social engineering attacks, which have surged 300% annually. - The AI platform uses machine learning to detect anomalies like deepfake voice modulation and AI-generated phishing emails in real-time. - While Doppel expands partnerships, VeriSign and C3.ai face scrutiny over stock sales and declining revenues amid AI adoption risks. - Doppel CEO Alex Johnson warns that AI security tools risk becoming vulnerabilities themselves