Alibaba Subsidiary Drives Attention to its Ethereum Layer 2 Blockchain

Jovay Network, an Ethereum Layer 2 (L2) network backed by Ant Digital, a subsidiary of Alibaba, is catching eyes today after it proclaimed its alignment with Ethereum on social media.

Despite many investors being surprised by the news, Jovay was originally revealed as an Ethereum L2 in April at the RWA Real Up conference in Dubai.

Jovay touts itself as financial-grade blockchain infrastructure, focused on global real-world asset (RWA) tokenization via its “modular Layer2 infrastructure that bridges Web2 and Web3.”

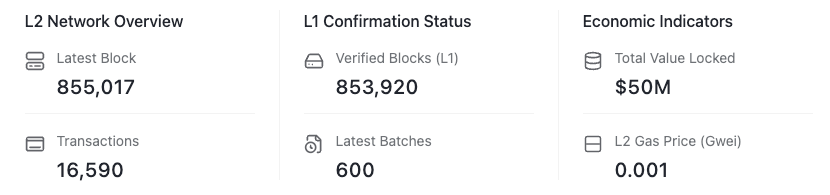

According to the chain’s block explorer, the network currently hosts $50 million in total value locked, but has only finalized 16,600 total transactions.

Alibaba Group ($BABA) is the 30th-largest company in the world by market capitalization, with a $385 billion valuation, making it the second-largest company in China.

The company first began exploring blockchain via Ant in 2019 with Alibaba Cloud, its blockchain-as-a-service (BaaS) platform for supply chain management tasks such as product traceability.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why the COAI Index Is Plummeting and Its Implications for Technology Investors

- The COAI Index, tracking AI-focused crypto assets, has dropped 88% year-to-date in late 2025 due to deteriorating market sentiment, regulatory uncertainty, and sector volatility. - C3 AI , a key index constituent, reported a $116.8M net loss and 19% revenue decline in Q1 2025, compounded by a lawsuit and CEO departure. - Regulatory shifts, including the U.S. CLARITY Act and EU AI Act, created compliance burdens, deterring investment and straining smaller firms. - The index's 97% token concentration in to

The Rise of Dynamic Clean Energy Markets

- CleanTrade’s CFTC-approved SEF platform in 2025 revolutionizes clean energy markets by enabling transparent trading of VPPAs, PPAs, and RECs. - The platform addresses institutional barriers through standardized protocols, reducing counterparty risk and aligning with traditional energy exchange frameworks. - Within two months, it facilitated $16B in notional value, offering real-time liquidity and ESG-aligned tools to track carbon impact and prevent greenwashing. - Institutional investors now access diver

KITE Price Forecast Post-Listing: Understanding Institutional Attitudes and Market Fluctuations

- KITE's post-IPO price fell 63% by Nov 2025 amid divergent institutional strategies and retail sector uncertainty. - Analysts split between "Buy" ($30 target) and "Hold" ratings, citing operational gains vs. macro risks like the $3.4T deficit bill. - Q3 net loss (-$0.07 EPS) and 5,400% payout ratio highlight structural risks despite industrial real estate pivots and 7.4% dividend hike. - Institutional trading directly impacted price swings, with COHEN & STEERS' stake increase briefly stabilizing shares be

The Financial Wellness Factor: An Overlooked Driver of Sustainable Wealth Building

- Financial wellness combines objective financial health and subjective well-being to drive long-term wealth creation, beyond mere asset accumulation. - Behavioral traits like conscientiousness correlate with disciplined investing habits, while neuroticism increases impulsive decisions during market volatility. - Studies show financially literate investors maintain portfolios during downturns, with 38% of "content" quadrant participants achieving superior risk-adjusted returns. - Debt management and saving