The new meme has been memed, why are players angry this time?

Players want nothing fancy, just fairness

The day before yesterday, Binance launched the "Rebirth Support" plan and distributed the first batch of "Rebirth Support" airdrops yesterday, undoubtedly giving meme players on BSC another good topic to discuss.

However, a "forking" event sparked controversy among players.

The first "Rebirth" coin that gathered players' consensus and launched, had a contract address ending in "4444." As seen from the following candlestick chart, after a successful launch, the "Rebirth" coin with a contract ending in "4444" began to rise, reaching a peak market cap that once exceeded $15 million.

Approximately 8 hours later, another "Rebirth" coin, with a contract address starting with "4444," also successfully launched and quickly rose in the next 2 hours, reaching a peak market cap that once exceeded $12 million.

During the rapid rise of the new "Rebirth" coin, the OG "Rebirth" coin suffered a heavy blow, dropping by more than 50% at one point. At this time, a tweet from KOL Li Ping supporting the new "Rebirth" coin made him the target of players' criticism:

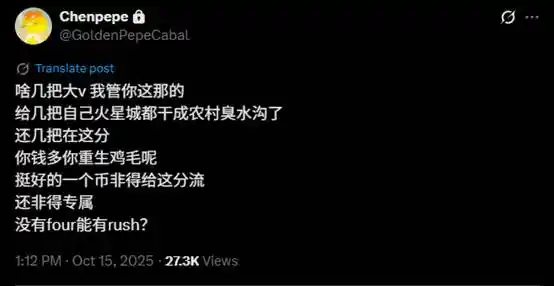

Soon after, another prominent supporter of the OG "Rebirth" coin, KOL Chenpepe, criticized this "forking" behavior:

Previously, "forking" situations have occurred in the crypto world, such as the cases of lowercase and uppercase Neiro, CZ's dog "Broccoli," and so on. However, this time, looking back at yesterday's scenario, Binance was still at the center of public opinion under a massive player "siege," and the BSC meme market was not as hot as before. Furthermore, the OG "Rebirth" coin had already reached a peak market cap of $15 million based on its spontaneous consensus. In this context, the sudden surge of the new "Rebirth" coin, accompanied by KOL endorsements, made it difficult for players supporting the OG "Rebirth" coin to believe that the new coin's uptrend was a result of a spontaneous consensus migration, rather than a conspiracy.

If these two coins had launched successfully at the same time and migrated to external trading to compete, players would not have such strong emotions. In the eyes of many players, if a highly influential KOL has a positive outlook on a topic and, in a situation where their financial capacity alone surpasses that of many ordinary players, joins in to develop the market cap further, what's the harm? Even if initially both coins had identical themes and tickers, competing on the same starting line would still be relatively fair.

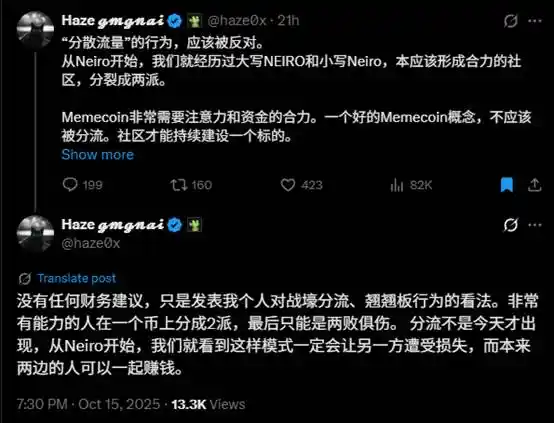

Last night, the founder of gmgn.ai, @haze0x, also expressed his opinion, stating that the act of "forking" should be opposed:

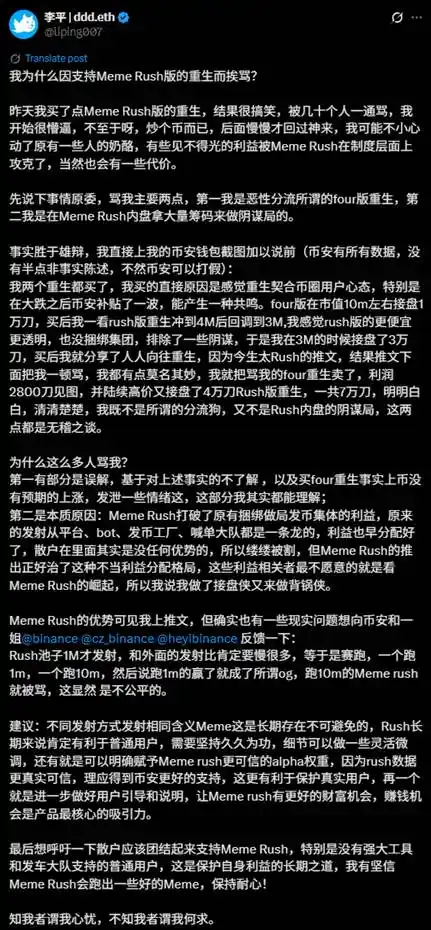

The controversial KOL Li Ping responded this morning, stating that he initially bought both coins but later shifted his support to the new "rebirth" coin, once again expressing support for the new "rebirth" coin:

Currently, the market capitalization of the new "rebirth" coin and the OG "rebirth" coin is both around $3.7 million, putting them back on the same starting line.

With CZ's tweet supporting Chinese tickers and the news of Binance possibly testing Chinese ticker contracts, Chinese ticker tokens in the BSC meme market have started to heat up. The turmoil between "rebirth" coins is unlikely to be resolved quickly but is expected to continue with the potential arrival of the second wave of Chinese market trends.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Significance of Financial Well-being in Investment Strategies

- Investors increasingly prioritize financial wellness, integrating emotional intelligence (EI), ESG principles, and fintech to align wealth strategies with holistic well-being and ethical values. - Research shows higher EI improves investment resilience, prompting advisors to address emotional biases like loss aversion through AI-driven tools and personalized guidance. - ESG-linked assets surpassed $50 trillion by 2025, with fintech platforms enabling tailored sustainable portfolios and AI-powered debt ma

COAI Experiences Significant Price Decline in Late November 2025: Is the Market Overreacting or Does This Present a Contrarian Investment Chance?

- ChainOpera AI (COAI) plummeted 90% in late 2025 due to CEO resignation, $116M losses, and regulatory ambiguity from the CLARITY Act. - Market panic and 88% supply concentration in top wallets amplified the selloff, while stablecoin collapses worsened liquidity risks. - Contrarians highlight C3 AI's 26% YoY revenue growth and potential 2026 regulatory clarity as signs of mispriced long-term AI/crypto opportunities. - Technical indicators suggest $22.44 as a critical resistance level, with analysts warning

Hyperliquid (HYPE) Price Rally: An In-Depth Look at Protocol Advancements and Liquidity Trends

- Hyperliquid's HYPE token surged 3.03% amid HIP-3 upgrades enabling permissionless perpetual markets and USDH stablecoin launch. - Protocol innovations boosted liquidity by 15% but failed to halt market share erosion to under 20% against competitors like Aster. - Structural challenges persist through token unstaking, unlocks, and OTC sales, yet HyENA's $50M 48-hour volume signaled renewed engagement. - Whale accumulation of $19.38M near $45-46 and HYPE buybacks aim to stabilize price, though long-term suc