Key Notes

- Ledger Live now supports TRX staking with dual reward streams, offering both block and vote rewards to millions of hardware wallet users.

- TRON processes over $21.5 billion in daily USDT transfers, holding 28% of stablecoin network dominance as of June 2025.

- Increased on-chain stablecoin activity insulated TRX from downswings affecting Bitcoin and major Layer-1 altcoins during the session.

Tron TRX $0.32 24h volatility: 1.1% Market cap: $30.05 B Vol. 24h: $962.84 M price saw a rare 1.8% bounce on Thursday, October 16, emerging the only top 10 ranked cryptocurrency trading in green. TRON standout performance coincides with the launch of TRX staking on Ledger, one of the world’s largest crypto storage platforms.

In a post on X, TRON-based DeFi protocol Yield.Xyz confirmed that millions of Ledger users can now stake TRX directly from their hardware wallets.

TRX staking is available globally in Ledger Live today.

Stake directly from your hardware wallet, and let handle the complexity.

🔗— Yield.xyz (@yield_xyz) October 16, 2025

TRON founder, Justin Sun confirmed the move in a press release shared with Coinspeaker, emphasizing safety and inclusion as key strategic targets for the integration.

“By combining Yield.Xyz’s infrastructure with Ledger Live’s trusted platform, we’re bringing enterprise-level staking to users everywhere and strengthening TRON’s role as a leading network for secure and scalable global adoption,” said TRON founder, Justin Sun.

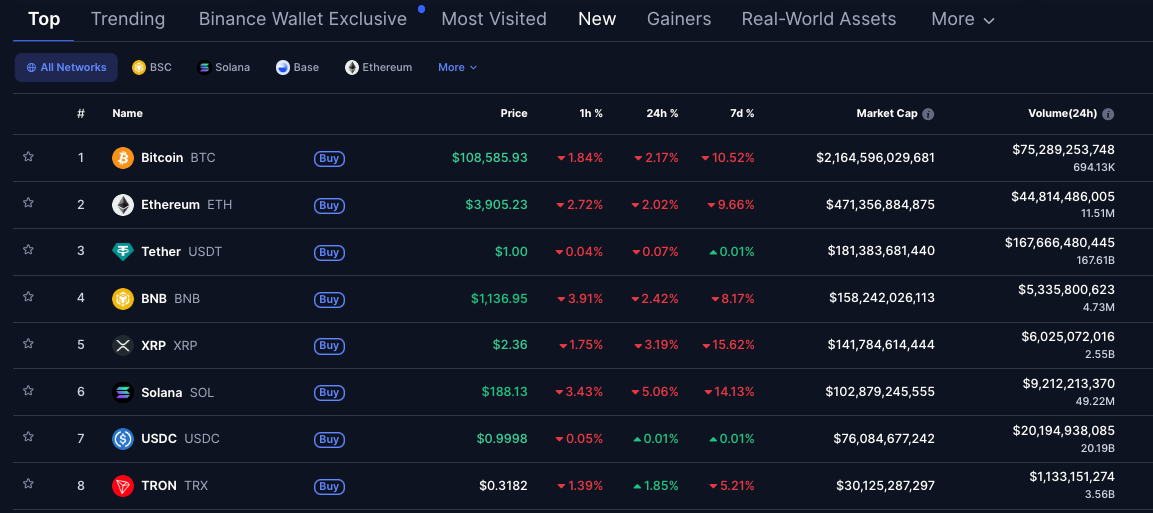

Tron (TRX) trading up 1.9% after announcing TRX staking on Ledger, on Thursday, Oct 16, 2025 | Source: Coinmarketcap

Serafin Lion Engel, Founder of Yield.Xyz, also lauded the combination of liquidity provision and leveraged strategies, all accessible through a single platform.

According to official details , the integration also introduces dual reward streams for TRX stakers, allowing both block and vote rewards to be distributed natively.

Markets reacted positively, with TRX rising 1.8% to $0.32, becoming the only top 10 cryptocurrency trading in green on Thursday. According to CoinMarketCap , Solana SOL $187.2 24h volatility: 3.0% Market cap: $102.31 B Vol. 24h: $9.96 B and Ripple XRP $2.35 24h volatility: 2.4% Market cap: $140.85 B Vol. 24h: $6.89 B led the losers as Bitcoin BTC $108 819 24h volatility: 2.1% Market cap: $2.17 T Vol. 24h: $83.40 B retraction below $109,000 soured market sentiment around top Layer-1 altcoins .

TRX Price Action Benefits From Stablecoin Rotation

With the US government shutdown extending into another week, risk-off sentiment has pushed investors toward Gold (XAU) and US equities, while the crypto market remains subdued following the $19 billion liquidation event on October 11. TRON historically benefits from heavy stablecoin rotation during weak market sentiment.

According to Coindesk data , Tron processes over $21.5 billion in daily Tether USDT $1.00 24h volatility: 0.0% Market cap: $181.42 B Vol. 24h: $141.59 B transfers, the world’s largest stablecoin network where it held nearly 28% market dominance as of June 2025.

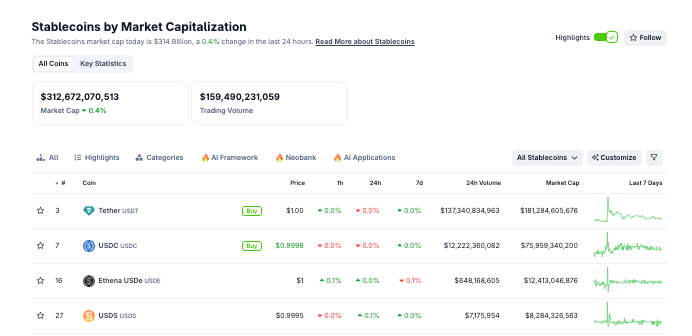

Global stablecoin market capitalization rises 0.4% to $312.6 billion | Source: Coingecko

According to Coingecko , the global stablecoin market cap rose 0.4% to $312.6 billion, driven by increased TRON-based USDT issuance. Combined with new staking participation from Ledger’s user base, increased on-chain activity from stablecoin demand intensifies buy-side pressure on TRX, insulating it from downswings seen in top layer-1 altcoin markets on Thursday.

next