Key Notes

- Gold cements its lead as the world’s top reserve asset amid rising global economic uncertainty.

- Bitcoin slips below $108,000, falling 13% from its recent high, as renewed U.S.

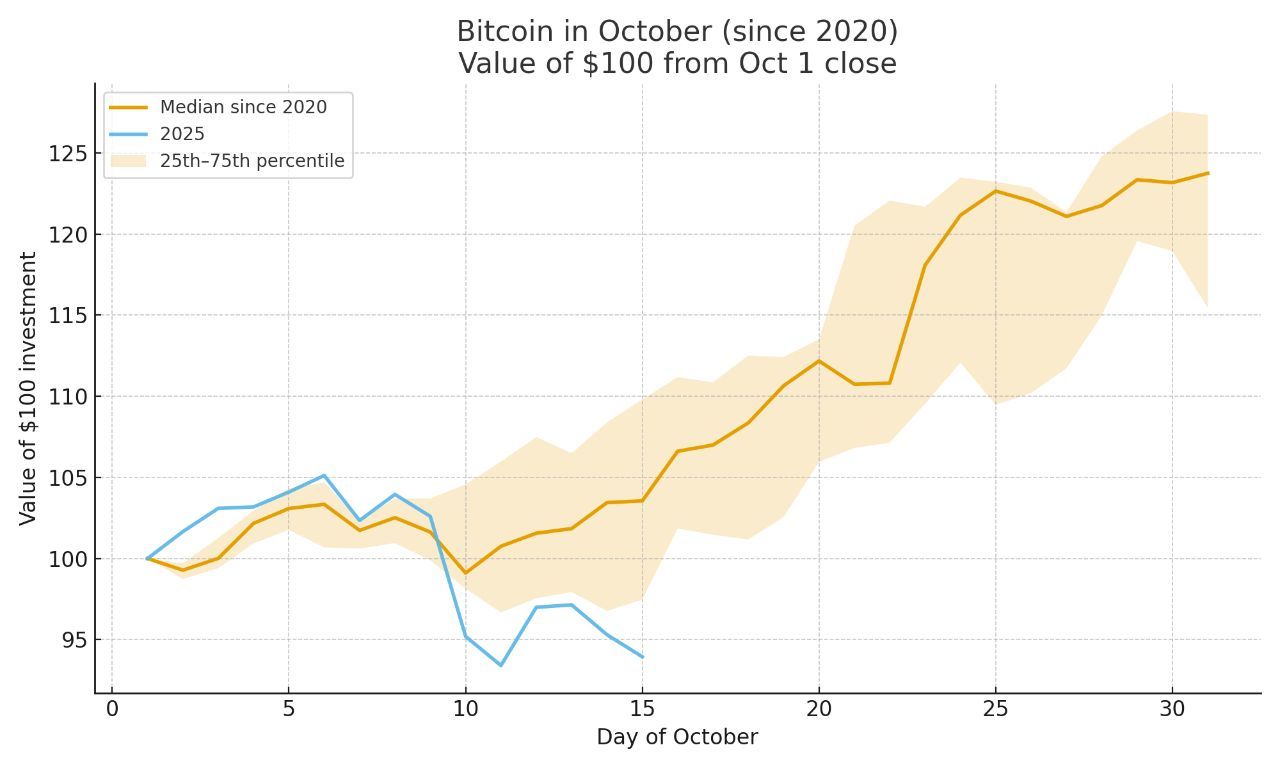

- China trade tensions.Despite the pullback, analysts note that Bitcoin’s strongest October rallies typically occur in the second half of the month.

Yellow metal gold has outperformed Bitcoin BTC $104 869 24h volatility: 5.5% Market cap: $2.09 T Vol. 24h: $109.65 B as a reserve asset class, hitting fresh highs above $4,350 levels, and becoming the first global asset to cross $30 trillion valuation.

On the other hand, Bitcoin price is down 3% today, slipping under $108,000, triggering another major crypto market liquidation .

Gold’s Dominance Over Bitcoin Continues

With macro uncertainty in the global market and trust in fiat currencies at an all-time low, gold has dominated the “reserve assets” market, outperforming every other asset class. The yellow metal is currently seeing demand at an all-time high, and trading at $4,358 per ounce.

With these gains, gold has risen over 60% in 2025. Valued at $30 trillion, it now surpasses the second-largest asset, Nvidia, by a staggering $25 trillion.

The precious metal has added over $11 trillion in value this year alone, further cementing its position as a safe-haven asset, amid global economic uncertainty.

In fact, the rally has further pushed crypto whales to purchase tokenized gold .

The recent U.S.-China tariff war has resulted in greater Bitcoin selling pressure . This has further widened the gap between BTC and gold.

For now, it is clear that the yellow metal is winning the hedge asset narrative.

Bitcoin’s “Uptober” Rally No More?

Bitcoin and the broader crypto market started October 2025 strong , but the 100% tariffs imposed by Trump on China dashed optimism, sending BTC and other cryptocurrencies lower.

Negotiations between the two largest global economies are ongoing ahead of the November 1 deadline.

Bitcoin price is already trading under $108,000 following further selling pressure today. According to on-chain analytics firm Ecoinometrics, renewed U.S.-China trade tensions are once again weighing on Bitcoin’s performance.

The U.S.–China trade tensions are back and so is Bitcoin’s struggle.

Earlier this year, a similar flare-up triggered a 30% correction that took nearly three months to find a bottom.

This time, Bitcoin is down about 13% from its high.

The similarities between these drawdowns… pic.twitter.com/5cTtzVQS9e

— ecoinometrics (@ecoinometrics) October 16, 2025

Earlier this year, a similar escalation led to a 30% correction, with prices taking nearly three months to find a bottom.

This time, BTC has fallen by 13% so far. A 30% correction from the top might push BTC all the way down to $90,000. However, another crypto analyst, Cryptos Rus hasn’t given up all hope for an “Uptober” rally.

He noted that Bitcoin’s best performance in October often occurs during the latter half of the month. This indicates that the current rally could still have room to run.

Bitcoin performance in the second-half of October. | Source: Cryptos Rus

On-chain data shows exchange reserves declining alongside a rise in stablecoin liquidity. Historical data shows that this exact combination has preceded late-month surges in Bitcoin prices.