Here’s why Russia ranks highest in Europe for crypto adoption: Chainalysis

Crypto adoption in European countries like the United Kingdom and Germany is lagging behind Russia, according to the latest report from US blockchain analytics firm Chainalysis.

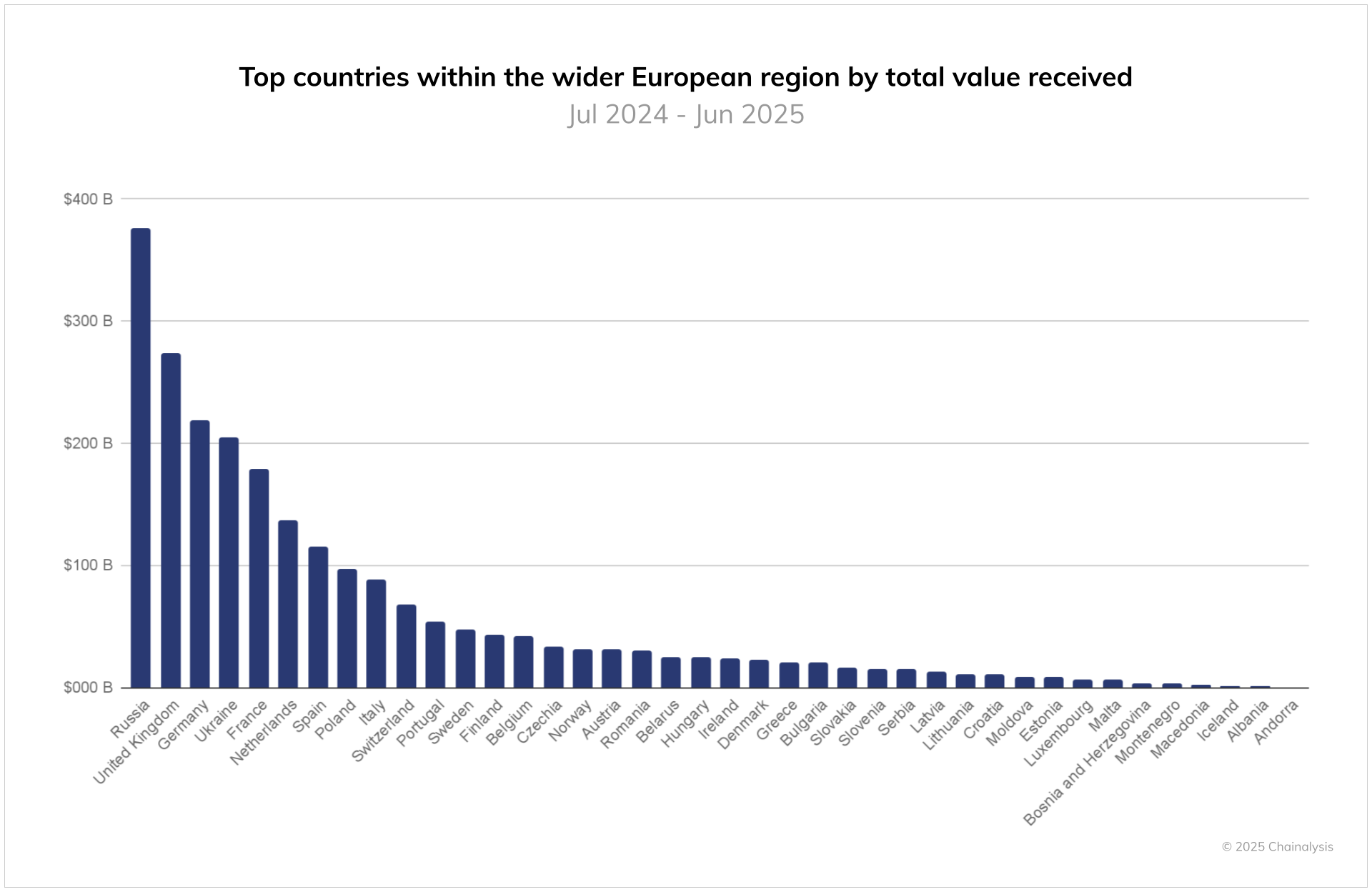

Russia emerged as the leading crypto market in Chainalysis’ latest European Crypto Adoption report, receiving $376.3 billion in crypto between July 2024 and June 2025.

Published Thursday, the report combines analyses of regions previously examined separately, covering Central, Northern, and Western Europe, as well as Eastern Europe as a whole.

“For this year’s analysis, we’ve reorganized our regional classifications to better reflect both current crypto activity and geopolitical realities,” Chainalysis said.

Russia’s volumes up almost 50% since last year

Russia’s received crypto volumes have increased 48% from last year’s $256.5 billion, widening its lead over major economies such as the UK, which recorded $273.2 billion in the past year, about 30% less.

Chainalysis attributed Russia’s surge in crypto adoption to two primary factors: a spike in large institutional transfers and the growing use of decentralized finance (DeFi).

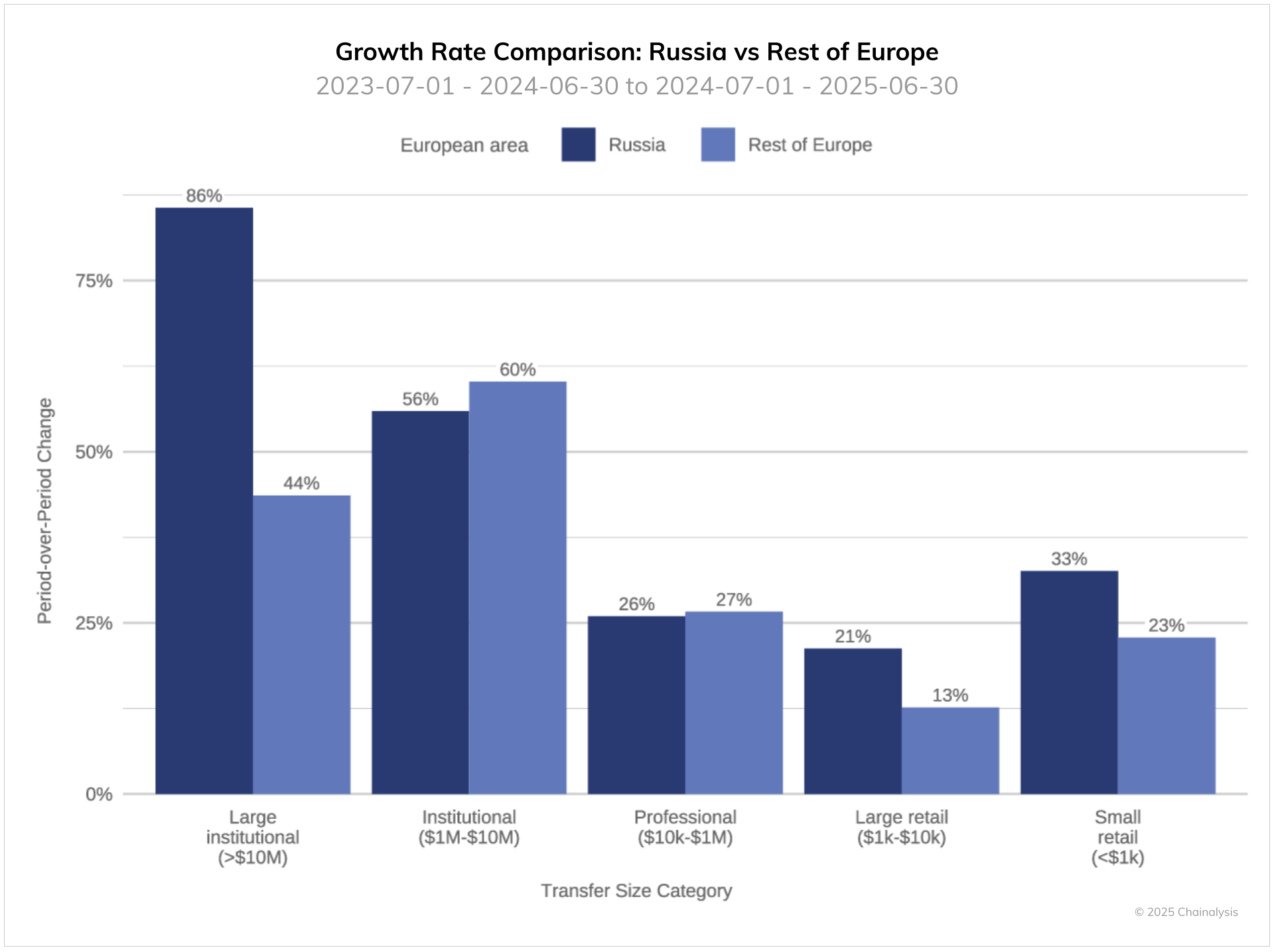

“The scale of institutional activity is particularly notable,” Chainalysis said, referring to large transfers — those exceeding $10 million — surging 86% year-over-year (YoY). The surge pace is nearly double the 44% growth observed in the rest of Europe, it added.

DeFi and retail among contributors

Beyond institutional activity, Russia also leads in both large and small retail segments, with YoY growth outpacing the rest of Europe by about 10%.

“DeFi adoption patterns reveal an even more dramatic shift,” Chainalysis said, referring to Russia’s DeFi activity surging eight times its previous levels in early 2025.

Russia’s rapid DeFi expansion and the increase in large-value transfers indicate growing adoption of crypto for financial services, Chainalysis concluded.

It also mentioned that A7A5 — a sanctioned ruble-pegged stablecoin issued in Kyrgyzstan — is a major example of this trend as it facilitates cross-border payments for both institutional and business users.

Launched in early 2025, A7A5 has emerged as the world’s largest non-US dollar stablecoin by market capitalization, despite facing multiple sanctions.

The stablecoin has been criticized by the European Union for being used as a tool for sanction evasion by Russia. The US government has also linked A7A5 to Grinex, the successor of Garantex, which was allegedly involved in money laundering and ransomware attacks with $100 million in transactions related to illicit activities.

Related: US rises to 2nd in crypto adoption as APAC sees most growth: Chainalysis

The ruble-pegged stablecoin reached $500 million in market cap in late September, overtaking major non–US dollar rivals such as Europe’s euro-pegged EURC, issued by Circle.

Chainalysis’s findings on Russia’s crypto market growth over the past year come amid mounting sanctions and an intensifying regulatory focus in the region. Notably, Russia was excluded from the Financial Stability Board’s peer review on cross-border regulation, also published Thursday.

Magazine: Binance shakes up Korea, Morgan Stanley’s security tokens in Japan: Asia Express

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Risks and Insights from the COAI Token Fraud: A 2025 Handbook for Cryptocurrency Due Diligence and Safeguarding Investors

- COAI Token's 2025 collapse caused $116.8M losses, exposing systemic risks in algorithmic stablecoins and centralized governance. - Project's 96% supply concentration in ten wallets, opaque team identities, and weak tokenomics flagged regulatory red flags. - Global regulators froze $150M in assets but exposed jurisdictional gaps, while EU and US introduced crypto frameworks with conflicting standards. - Investors now prioritize AI audits, multi-sig wallets, and KYC compliance to mitigate risks in speculat

COAI's Unexpected Downturn in Late 2025: A Warning Story on AI Stock Valuations and Governance Risks

- COAI Index's 88% YTD drop highlights systemic risks in speculative AI equities and crypto assets amid strong AI infrastructure growth. - C3 AI's Q3 revenue growth contrasts with non-GAAP losses, underscoring AI sector's profitability challenges vs. disciplined tech peers like Benchmark Electronics. - CLARITY Act's regulatory ambiguity and EU AI Act compliance costs deter institutional investment, exacerbating COAI's governance and liquidity issues. - COAI's "fake decentralization" and C3 AI's leadership

Vanguard opens platform to Bitcoin ETFs and ends two-year blockade

3 Strong Altcoin Picks Showing Clear Growth Momentum — GIGA, ALGO, and NOT