Bitcoin falls below $110,000, is the market turning bearish?

Even Tom Lee has stated that the crypto treasury bubble may have already burst.

Original Title: "Bitcoin Falls Below $110,000, Whose Wallets Are Losing Money Again?"

Original Author: 1912212.eth, Foresight News

After the black swan plunge on October 11, the market was generally worried about a "second dip." Just a few days later, another sharp drop occurred. On October 17, Bitcoin fell for four consecutive days on the daily chart from its rebound high of $116,000, and at around 4 p.m. today, it briefly dropped to around $104,500, getting very close to the October 11 crash low of $102,000. ETH was also not spared, dropping to $3,706 at one point, while SOL fell to around $175, and a number of altcoins saw widespread declines.

According to Coinglass data, in the past 24 hours, the total amount of liquidated open contracts across the network reached $1.189 billion, with long positions accounting for $935 million. The largest single liquidation occurred on Hyperliquid - ETH-USD, valued at $20.4274 million. Alternative data shows that the current market fear index has dropped to 22, plunging into extreme fear.

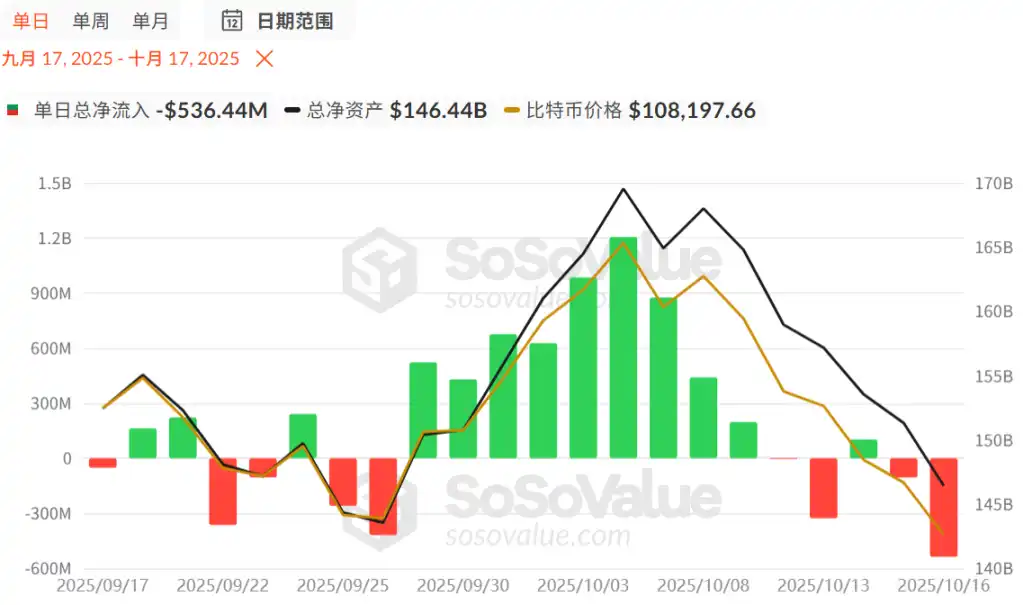

Significant Net Outflows from US BTC and ETH Spot ETFs

Since the crash event, US BTC spot ETF data has shown significant net outflows. From October 10 to October 16, only October 14 recorded a net inflow of $102.58 million, while all other days saw net outflows. Notably, the net outflow on October 1 exceeded $536 million, marking a new low since August this year.

The outlook for Ethereum spot ETFs is equally pessimistic, with continuous large net outflows since October 9. On October 13, the net outflow exceeded $428 million, setting a new high for net outflows since September this year.

The Crash Event Has Weakened Market Confidence

DeFiance Capital, which gained fame in the last cycle by betting on multiple DeFi projects, suffered losses in this crash event. On October 14, its founder Arthur posted on social media, "We are fine, the fund has suffered some losses, but it doesn't rank in our top five days of profit and loss volatility. I am just very angry and disappointed. This crash has set the entire crypto space back significantly, especially for the altcoin market, because most price discovery happens on offshore CEXs."

He even pessimistically believes that this crash event marks the end of the crypto era.

Meanwhile, the previously hyped treasury DAT trend has now cooled off. Tom Lee, chairman of BitMine, the largest Ethereum holding institution, stated that this bubble may have already burst.

Previously, US Nasdaq-listed company QMMM Holdings announced on September 9, 2025, that it planned to spend $100 million to establish a cryptocurrency reserve, and its stock price rose 9.6 times within three weeks. At the end of September, the US Securities and Exchange Commission (SEC) believed the company was suspected of manipulating its stock price via social platforms and ordered it to suspend trading from September 29. The company has been suspended ever since. On October 16, Caixin visited its Hong Kong headquarters and found the office deserted. When asking an employee of another nearby company, they said QMMM had moved out in September, but they did not know where it had relocated.

In response, Changpeng Zhao commented, "All crypto treasury (DAT) companies should use third-party crypto custodians and have account setups audited by investors."

US Small Banks Blow Up, Market Sells First and Asks Questions Later

Zions Bancorp and Western Alliance Bancorp, two US regional banks, disclosed on Thursday that they suffered losses due to fraud involving bad commercial mortgage investment funds. Although the scale of losses is relatively small compared to other recent credit blowups, involving only tens of millions of dollars, the market reaction was unusually severe.

The German DAX index fell 2.13%, the UK FTSE 100 index fell 1.6%, the Nikkei 225 index fell 1.44%, the Australian S&P/ASX 200 index dropped 0.81%, and all three major US stock index futures fell.

Panic quickly spread, dragging down the entire banking sector. The total market value of 74 large US banks lost more than $100 billion in a single day.

This "sell first, ask questions later" mentality spread rapidly. JPMorgan analysts Anthony Elian and Michael Pietrini pointed out in a report that they are also questioning "why all these credit 'isolated incidents' seem to be happening in such a short period of time." However, the sell-off did not spare large bank stocks, with Citigroup and Bank of America both falling more than 3%.

The 2023 US banking crisis also once triggered a significant correction in the crypto market.

Will the Market Turn Bearish Next?

Chris Burniske, partner at Placeholder VC, posted, "I'm increasingly convinced that last Friday's plunge has left the crypto market stagnant in the short term. After such a crash, it's hard to quickly form sustained buying. This cycle has been disappointing for most people, which may limit action as everyone waits for the market to recover or for previous highs. It's easy to get caught up in chart details, but if you look at the monthly charts for BTC and ETH, it shows we're still in a high range (though cracks are appearing), if you're considering taking profits.

MSTR is falling, gold is flashing warnings, so is the credit market, and stocks will be the last to react. We can always expect a weak rebound, but I've already taken action (remember, cashing out is never all or nothing). I'll watch how BTC reacts to $100,000, but if BTC reaches $75,000 or lower, I might become interested in the market again. This bull market is different from previous ones, and the next bear market will be different too."

McKenna, partner at Arete Capital, stated that the market is in the process of forming a bottom, which will take 40-60 days to establish. All price action within this interval is just choppy consolidation. "By mid-November, we should start to expect constructive results and look forward to a positive December and Q1 2026."

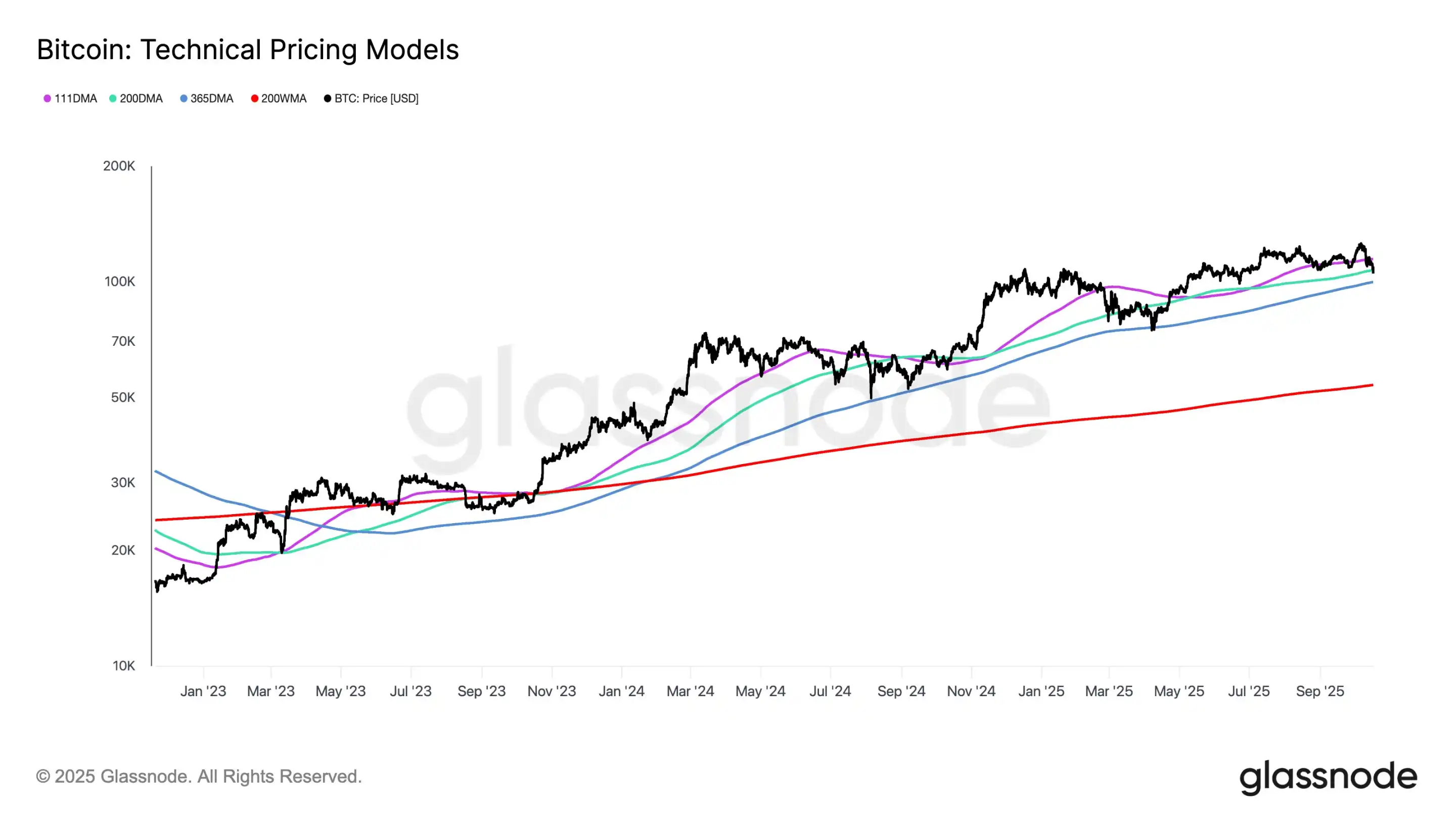

glassnode tweeted that Bitcoin is currently at a key support range, with the price below the 200-day moving average ($107,400), just above the 365-day moving average ($99,900), and facing resistance from the 111-day moving average ($114,700) above.

If the 365-day moving average can be held, the trend may stabilize; if it breaks below this level, a deeper correction risk may arise.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Stablecoins in 2025: You Are in Dream of the Red Chamber, I Am in Journey to the West

But in the end, we may all arrive at the same destination through different paths.

XRP’s Extreme Fear Level Mirrors Past 22 % Rally

Critical Bitcoin Bear Market Signal: 100-1,000 BTC Wallet Buying Slows Dramatically

Stunning Bitcoin Whale Awakening: Dormant Addresses Move $178M After 13 Years