Bitcoin and Ethereum ETFs See Heavy Outflows as Market Holds Firm

Crypto Market Remains Resilient Despite ETF Outflows

The crypto market is showing resilience even as Bitcoin and Ethereum ETFs recorded $598 million in outflows.

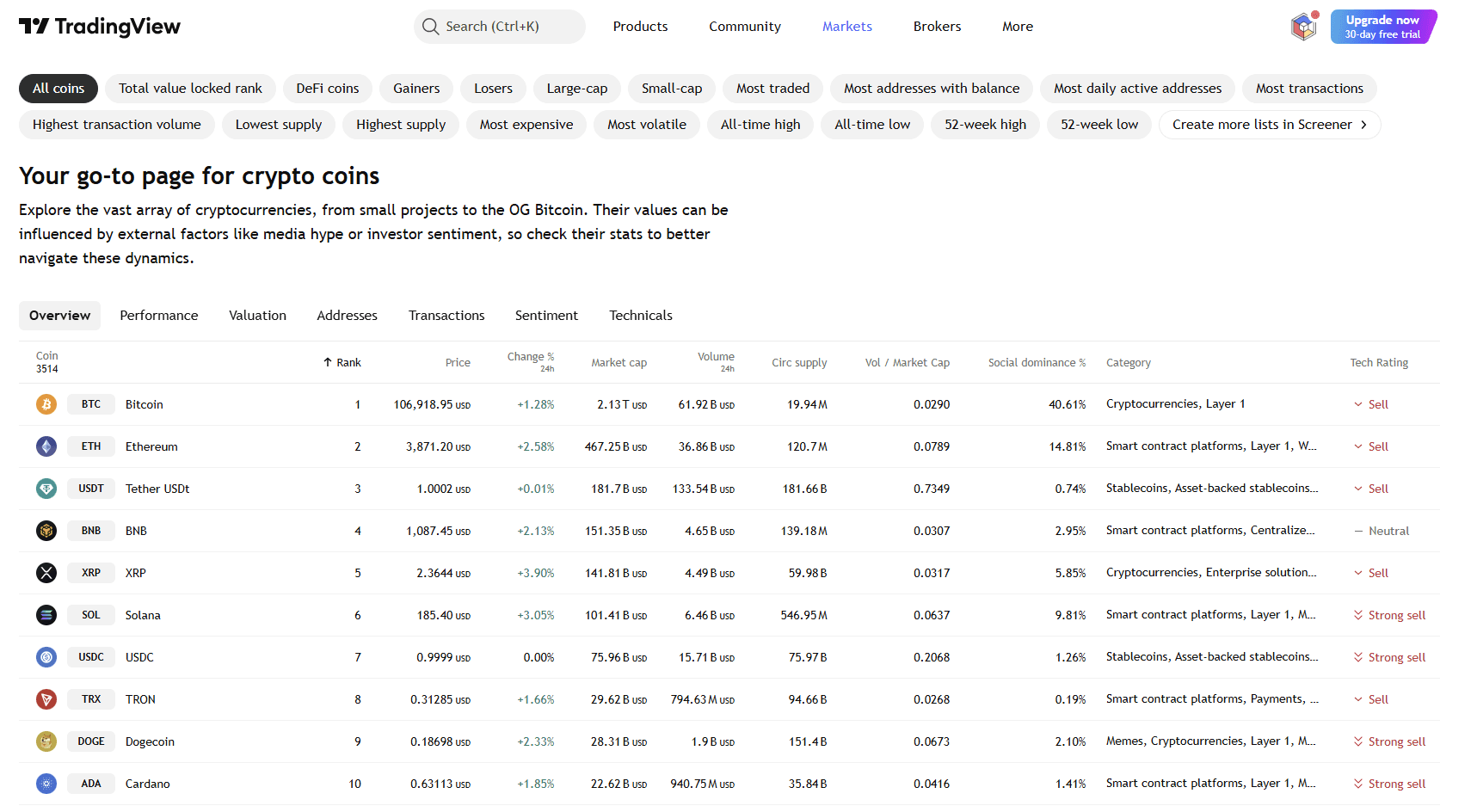

While such numbers often signal bearish pressure, prices tell a different story. Bitcoin is trading around $107,000 (+1.45%) and Ethereum has risen 2.35% to $3,876. This indicates investors are reallocating positions rather than exiting the market.

By TradingView - 2025-10-18

By TradingView - 2025-10-18

Analysts explain that ETF outflows may reflect short-term profit-taking or portfolio rotation instead of fear. Institutional sentiment remains cautious, but on-chain data shows strong retail buying activity supporting market stability.

Robert Kiyosaki Calls Government Money “Fake”

Author of Rich Dad Poor Dad , Robert Kiyosaki , reiterated his belief that government-issued money is “fake.”

He argues that continuous money printing by central banks devalues purchasing power, while assets like Bitcoin, gold, and silver preserve real wealth.

Kiyosaki’s comments reinforce Bitcoin’s image as a hedge against inflation and a store of value amid global economic uncertainty.

Peter Schiff Warns of a Correction but the Market Stays Calm

Economist Peter Schiff predicts that Bitcoin, Ethereum, and altcoins could soon face losses due to high leverage and speculation. He claims the market remains detached from fundamentals and could correct if liquidity tightens.

However, Schiff’s warning contrasts with current market data . Bitcoin dominance stands above 41%, trading volume exceeds $61 billion, and altcoins like XRP (+4.2%), BNB (+2.4%), and Solana (+2.3%) are also gaining.

The overall sentiment remains confident, showing that investors view current ETF outflows as temporary.

Security Flaw Exposes 120,000 Bitcoin Wallets

While prices remain steady, a new security concern surfaced this week. Researchers discovered a flaw in the Libbitcoin Explorer 3.x library, leaving over 120,000 Bitcoin wallets vulnerable to attacks.

The problem stems from a weak random number generator that could allow hackers to predict private keys. Experts advise users to move funds to wallets using cryptographically secure RNG (CSPRNG) and compliant BIP-39 seed phrases .

Although this issue affects a limited group of wallets, it highlights the importance of security as crypto adoption continues to grow.

Conclusion: Outflows Do Not Equal Fear

Despite concerns about ETF withdrawals and bearish predictions, the crypto market remains strong. Bitcoin’s network activity , Ethereum’s growth, and retail participation all support a stable trend .

The combination of cautious institutional positioning and resilient investor sentiment signals a balanced, maturing market. Strategic accumulation and improved wallet security remain the most important factors for long-term success.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Who decides the fate of 210 billions euros in frozen Russian assets? German Chancellor urgently flies to Brussels to lobby Belgium

In order to push forward the plan of using frozen Russian assets to aid Ukraine, the German Chancellor even postponed his visit to Norway and rushed to Brussels to have a working meal with the Belgian Prime Minister, all in an effort to remove the biggest "obstacle."

The "Five Tigers Competition" concludes successfully | JST, SUN, and NFT emerge as champions! SUN.io takes over as the new driving force in the ecosystem

JST, SUN, and NFT are leading the way, sparking increased trading and community activity, which is driving significant capital inflows into the ecosystem. Ultimately, the one-stop platform SUN.io is capturing and converting these flows into long-term growth momentum.

The End of Ethereum's Isolation: How EIL Reconstructs Fragmented L2s into a "Supercomputer"?

EIL is the latest answer provided by the Ethereum account abstraction team and is also the core of the "acceleration" phase in the interoperability roadmap.