Bitcoin (BTC) Price Analysis for October 18

Buyers are trying to seize the initiative on Saturday, according to CoinStats.

BTC/USD

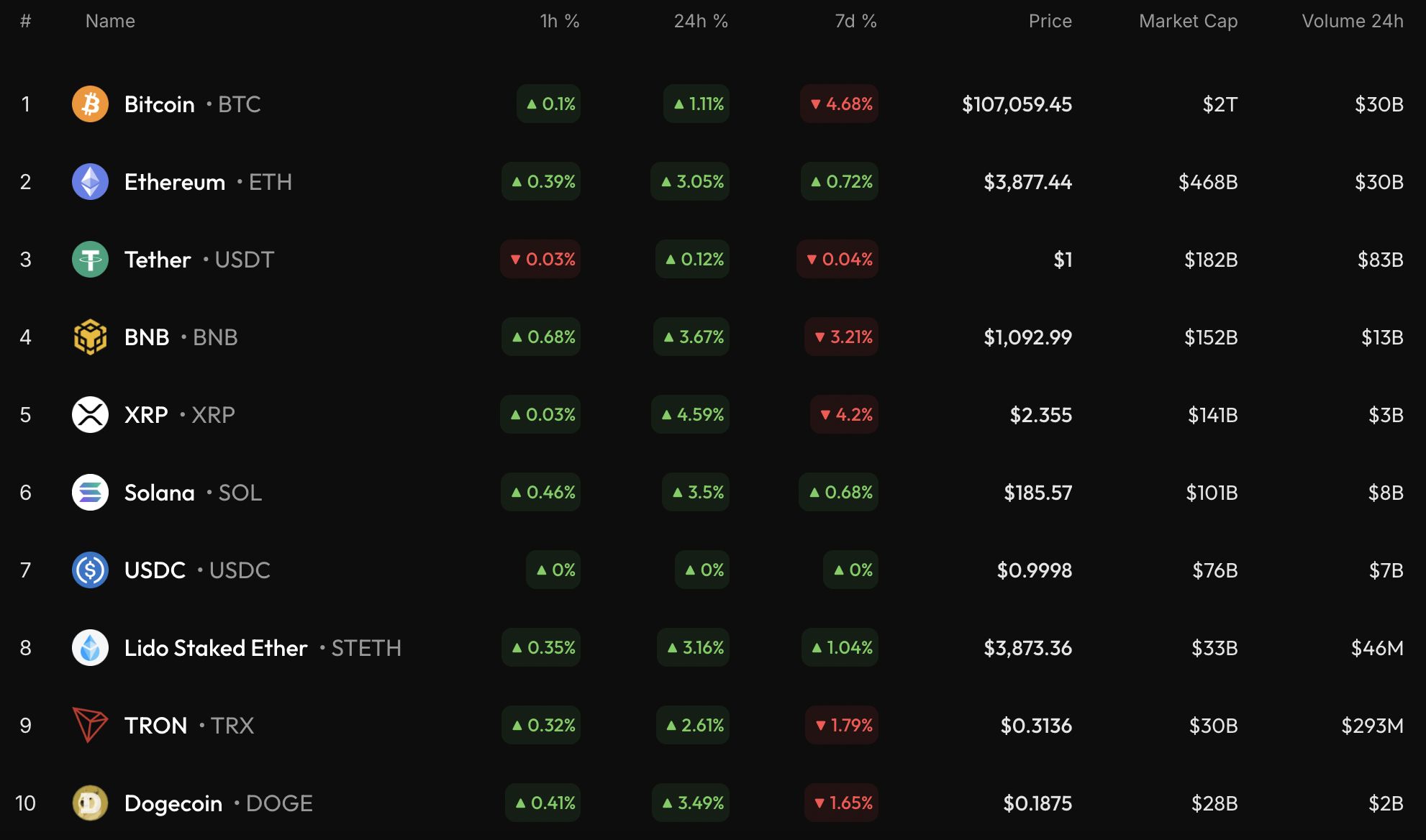

The rate of Bitcoin (BTC) has risen by 1.11% since yesterday.

On the hourly chart, the price of BTC is far from the support and resistance levels. The volume is low, which means traders are unlikely to witness increased volatility by tomorrow.

On the bigger time frame, there are no reversal signals so far. In this regard, one should pay attention to yesterday's bar low of $103,530.

If bulls lose it, the decline may continue to the $100,000 area.

From the midterm point of view, sellers are also more powerful than buyers. If a breakout of the $100,426 support happens, the accumulated energy might be enough for a move to the $95,000 zone.

Bitcoin is trading at $106,909 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How Platforms Endorsed by Regulators Are Transforming Clean Energy Markets: Ushering in Greater Transparency and Market Fluidity

- CFTC-approved CleanTrade platform addresses fragmented clean energy markets by enabling transparent trading of vPPAs, PPAs, and RECs with $16B in notional value within two months. - Integration with REsurety's CleanSight analytics and S&P Global benchmarks reduces financial risks and establishes pricing standards, attracting institutional investors seeking accountability. - The platform's success signals maturing clean energy markets, democratizing access and aligning financial flows with decarbonization

Clean Energy Derivatives: Pioneering the Next Era of Commodity Markets

- Clean energy derivatives market is projected to grow from $39T to $125T by 2032, driven by institutional adoption and CFTC-approved platforms like CleanTrade. - CleanTrade, a CFTC-sanctioned SEF, addresses market opacity by enabling transparent, liquid trading of VPPAs and other clean energy contracts. - High-profile transactions like Cargill-Mercuria trades validate the platform, while policy incentives and ESG alignment accelerate institutional investment in renewables. - Regulatory advancements and in

Strategic advancements in infrastructure and regulatory frameworks enhance liquidity in clean energy markets and improve PPA risk management

- Corporate demand for renewable energy drives PPA growth, with 83% of 2024 European PPAs led by tech giants like Google and Amazon . - EU regulations like CBAM and CSRD enforce 24/7 carbon-free energy standards, pushing 70% of companies to modernize PPA strategies with GOs. - Strategic infrastructure innovations, including long-duration storage and hybrid gas-clean energy models, address intermittency and grid stability. - Aggregated/virtual PPAs and EIB's €500M pilot program lower barriers for SMEs, expa

UK Treasury to implement regulation for Bitcoin and crypto by 2027