Bitcoin (BTC) Price Analysis for October 19

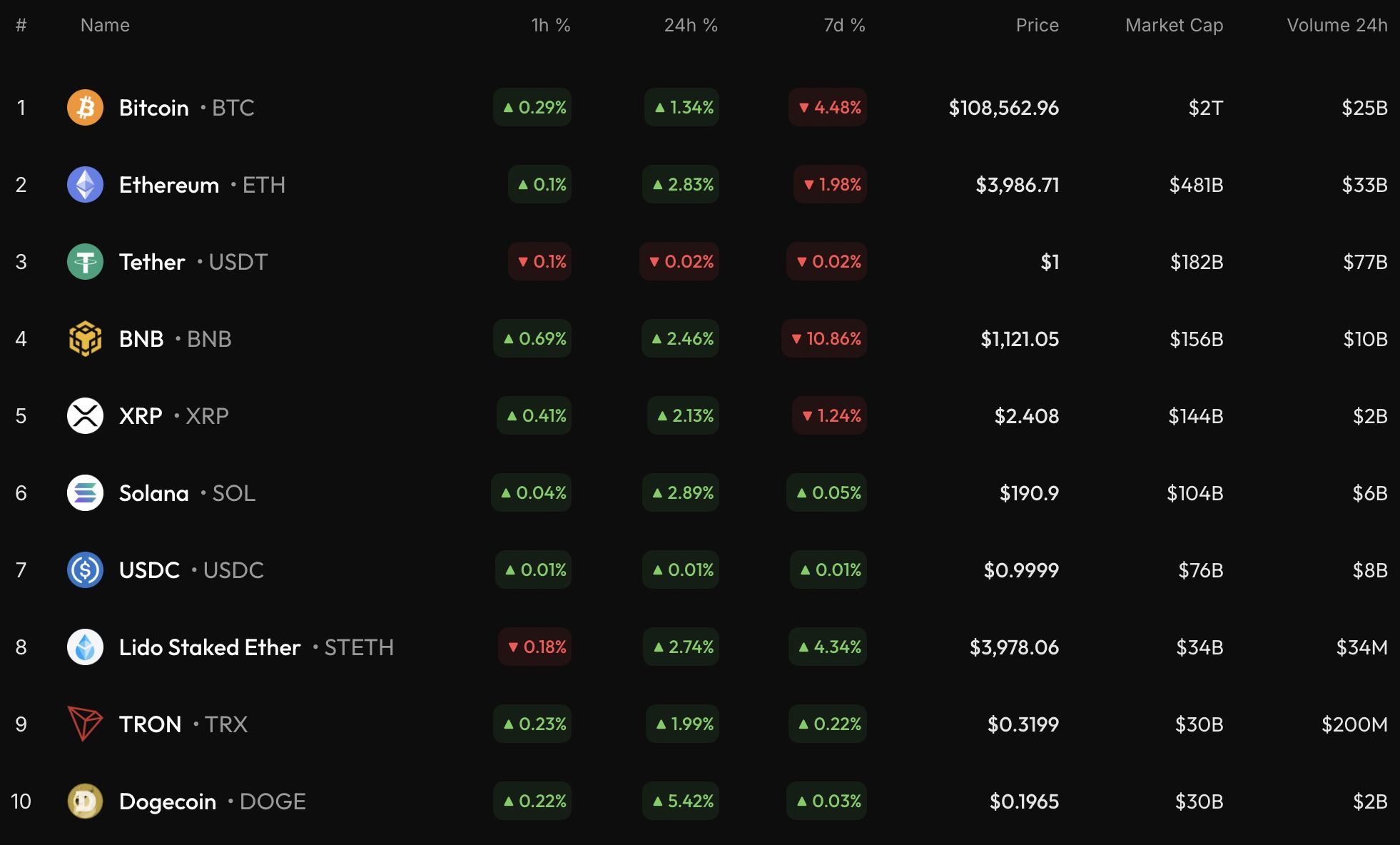

The rates of most coins keep rising on the last day of the week, according to CoinStats.

BTC/USD

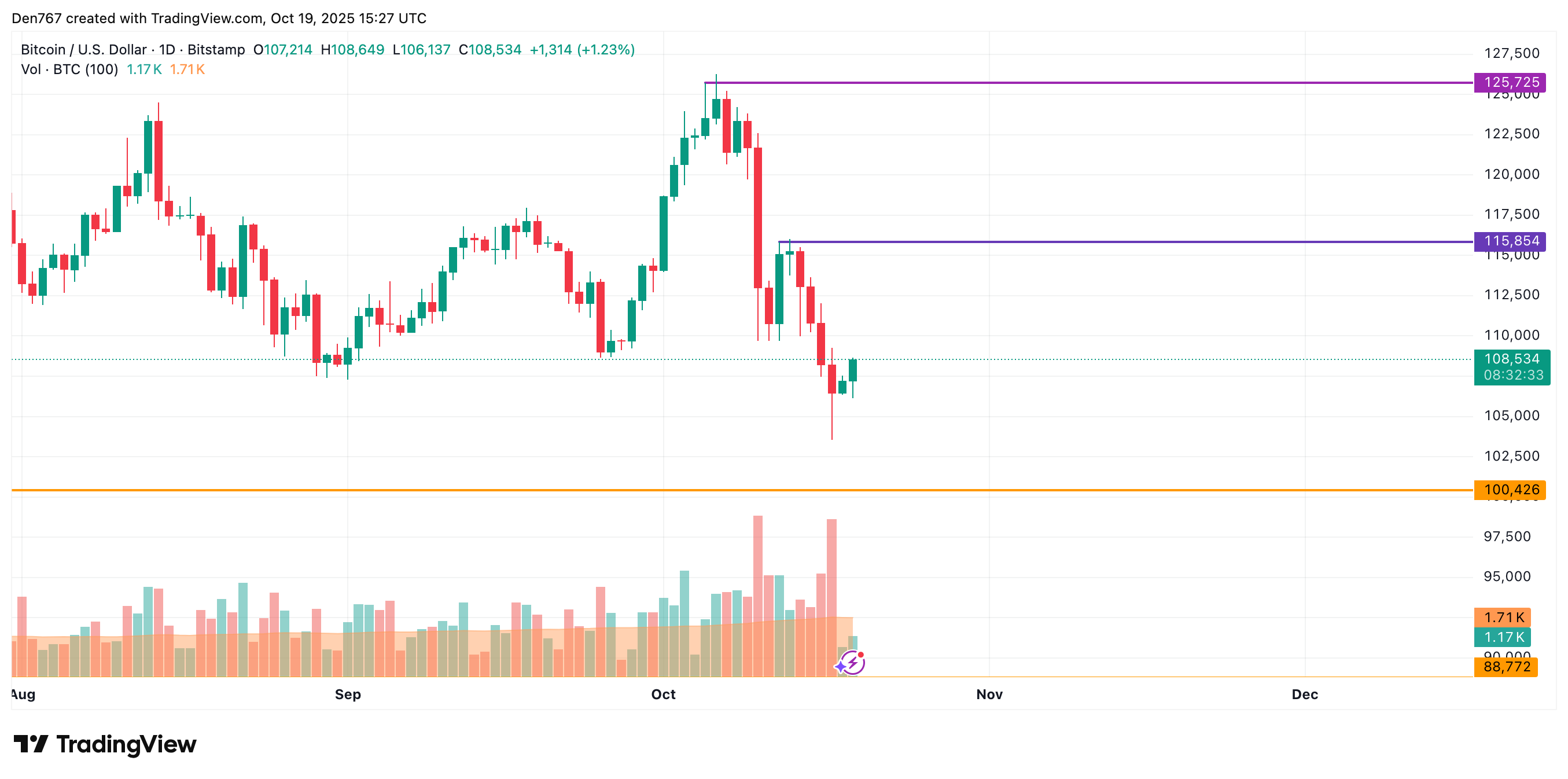

The price of Bitcoin (BTC) has gone up by 1.34% over the last 24 hours.

On the hourly chart, the rate of BTC has broken the local resistance of $108,234. If the daily bar closes above that mark, the upward move is likely to continue to the $109,000 range.

On the bigger time frame, the price of the main crypto is going up after yesterday's bullish closure. However, the volume is low, which means bulls might need more time to get strength for a continued move.

In this regard, consolidation in the narrow range of $108,000-$110,000 is the more likely scenario.

From the midterm point of view, the situation is less positive for buyers. If the weekly bar closes near its low, there is a high chance of a test of the support of $100,426 by the end of the month.

Bitcoin is trading at $108,455 at press time.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bloomberg: Power Theft Exceeds $1 Billion as Malaysia Bitcoin Mining Rigs Overwhelm

Malaysia has uncovered approximately 14,000 illegal cryptocurrency mining sites in the past five years, causing the state-owned power company losses of over $1.1 billion. In response, the local government established a special committee in November 2025 to consider a total ban on mining,

ProShares Withdraws 3x Leveraged Crypto and Tech ETF Plans After SEC Raises Concerns

PENGU Price Rally Explained: Is a Bigger Breakout on the Horizon?

SHIB Jumps 21% to $0.000009463: Analysts Eye Possible Zero Cut