Key Market Information Discrepancy on October 20th, a Must-See! | Alpha Morning Report

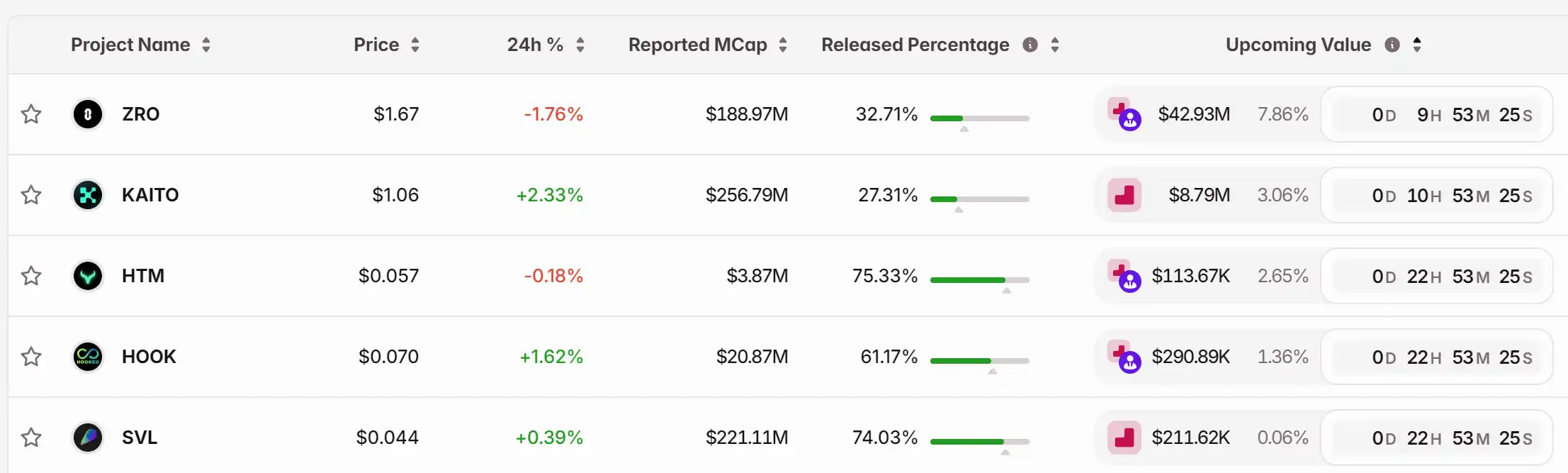

1. Top News: This week's CPI Data is Coming, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization 2. Token Unlock: $ZRO, $KAITO, $HTM, $HOOK, $SVL

Top News

1.This Week's CPI Data Released, Fed to Hold Payment Innovation Meeting to Discuss Stablecoins, Tokenization

2.pump.fun Launches X Account Spotlight Aimed at Accelerating ICM

3."1011 Insider Whale" Once Again Shorts Bitcoin with 10x Leverage, Entry Average Price at $109,133.1

4.MLN Surges Over 73% in 24 Hours, Market Cap Reaches $25.5 Million

5.Binance Alpha to List SigmaDotMoney (SIGMA) on October 21

Articles & Threads

1. "$15 Billion Bitcoin Private Key Accidentally Cracked by U.S."

In October 2025, a massive cryptocurrency seizure case was revealed in the U.S. Federal District Court for the Eastern District of New York, where the U.S. government confiscated 127,271 bitcoins worth approximately $15 billion at market prices.

2. "New York Times: Trump Family's Cryptocurrency Scam Worse Than Watergate"

In American political history, no president has intertwined national power, personal brand, and financial speculation on a global scale like Trump. As cryptocurrency enters the White House and the digital shadow of the dollar entangles with national will, we must rethink a fundamental question: In this era of "on-chain sovereignty," do the boundaries of power still exist?

Market Data

Daily Market Overall Funding Heatmap (as reflected by Funding Rate) and Token Unlocks

Data Source: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: "As ETFs Experience Rapid Growth, Metaplanet Remains Steadfast in the Battle for Bitcoin Leadership"

- Metaplanet holds 30,823 BTC, aiming for 210,000 by 2027 via preferred shares. - MicroStrategy's market value discounts raise debt concerns despite CEO's confidence. - ETF growth and institutional interest shift Bitcoin's perception as a long-term asset. - Japan's $2T assets drive Metaplanet's Bitcoin-backed fixed-income strategy.

Bitcoin News Today: Bitcoin’s Plunge Below $96K Sparks Concerns Over a Bear Market Resurgence Similar to 2024

- Bitcoin fell below $96,000, erasing 2025 gains and triggering $44M in liquidations as ETF outflows hit $870M. - Market cap dropped 5.4% to $3.36T, with Ethereum and XRP hitting multi-month lows amid weak demand. - Chain metrics show 815,000 BTC sold by long-term holders, while Bull Score Index collapsed to 20 from 80. - Technical indicators warn of further declines below $93,500, testing 2024 bear market lows if support breaks. - MicroStrategy added $835M BTC despite criticism, but fear/greed index hit 1

Bitcoin News Today: Bitcoin ETFs See $870M Outflow as Long-Term Holder Selling Drives Price Near $80k

- Bitcoin’s price nears $80,000 as fear indices hit 16, signaling panic-driven capitulation. - $870M ETF outflows and 815,000 BTC sold by LTHs accelerate downward pressure since October. - Key technical levels breached: 365-day SMA broken, 50-week SMA at risk, bear market risks rising. - Ethereum faces 200-day EMA resistance; whales accumulate ETH despite $3.66B in ETF outflows. - STHs near 12.79% losses, 6-12M holder cost basis at $94,000 may offer temporary support.

Bitcoin News Update: Bitcoin ETF Sees $1.5 Billion Withdrawals While Institutional Investors Increase Their Holdings

- BlackRock's IBIT ETF saw $1.5B net outflows over 10 days as investors reassess Bitcoin exposure amid volatility. - Harvard University boosted IBIT holdings to $442.8M, surpassing its combined stake in major tech firms, while diversifying into gold . - Institutional ownership in IBIT rose to 29% QoQ, with UAE entities and sovereign wealth funds among key holders, signaling crypto's growing institutional acceptance. - KuCoin expanded institutional services as ETF outflows highlight market recalibration, wi