Bitcoin’s Hashrate Hits the Stratosphere: Miners Flex 1.164 Zettahash of Pure Power

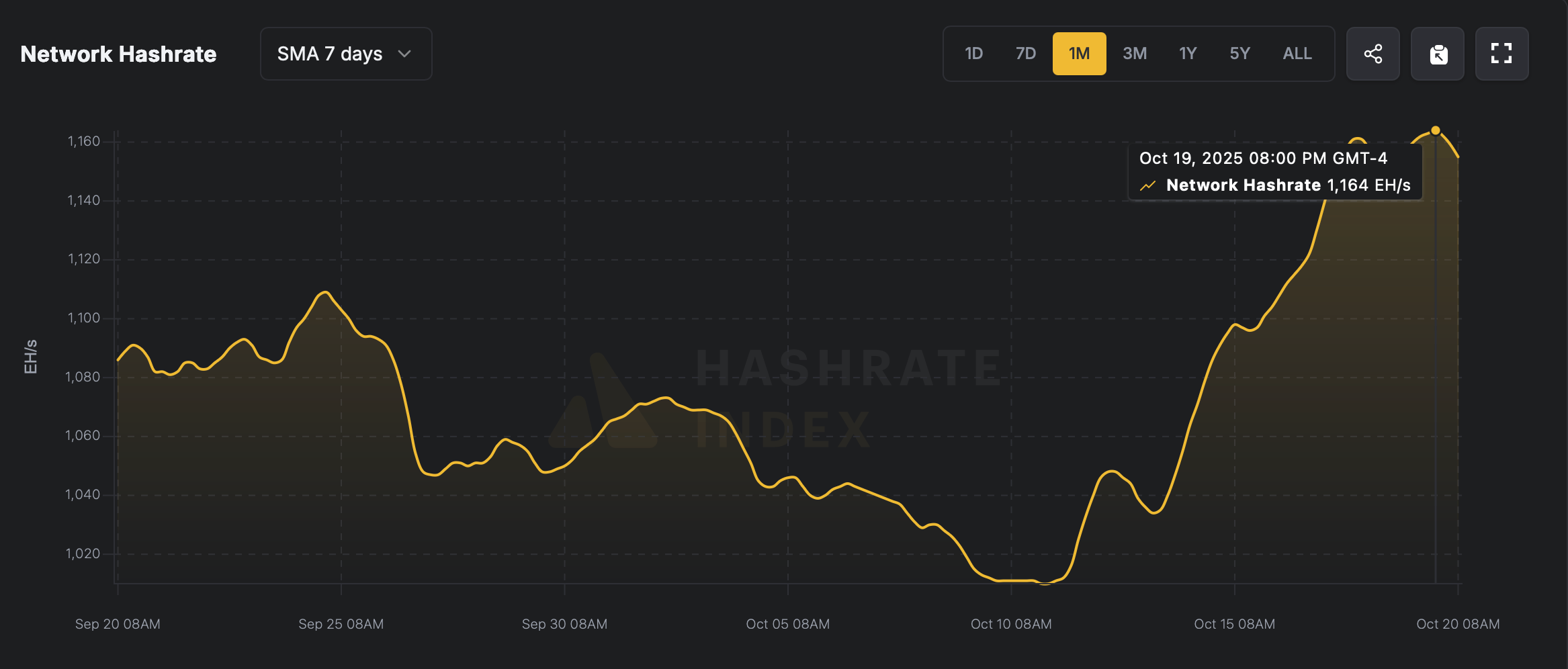

Bitcoin’s hashrate just cranked things up another notch, blasting to 1,164 exahash per second (EH/s) on Sunday at 2:40 p.m. Eastern time.

Bitcoin’s Hashrate Rockets While Revenue Improves

Fresh off its 1,157 EH/s high just two days back, Bitcoin’s hashrate has casually leveled up—adding another 7 EH/s to hit 1,164 EH/s, or for those who love big numbers, a cool 1.164 zettahash per second (ZH/s).

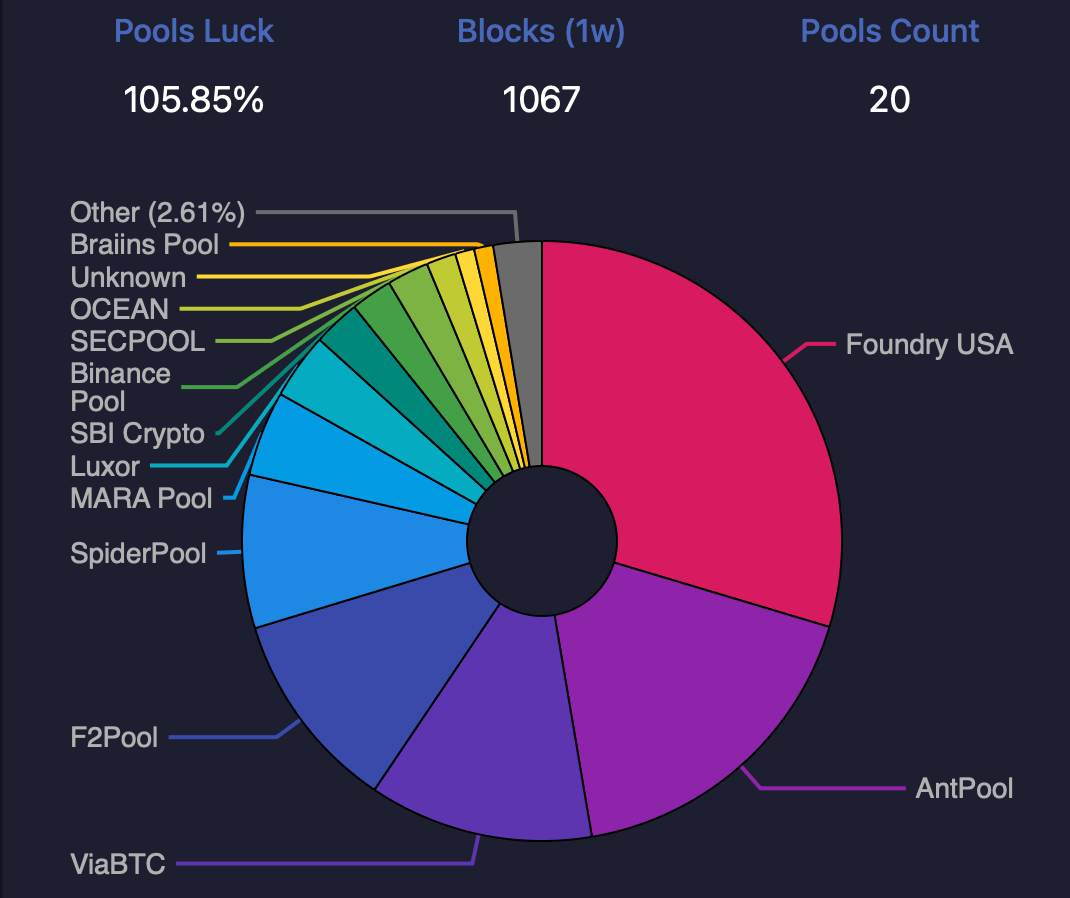

According to current hashrate stats, as of 11:45 a.m. on Oct. 20, Bitcoin’s hashrate is cruising at 1,154.16 EH/s. Leading the charge is Foundry USA, mempool.space metrics show, flexing 334.18 EH/s—roughly 28.96% of the entire network’s muscle.

Antpool’s holding steady with about 199.24 EH/s, making up 17.26% of Bitcoin’s total hashrate. Together with Foundry, this powerhouse duo controls a hefty 46.22% of the network.

Coming in third is ViaBTC with 135.99 EH/s, roughly 11.78% of the total, while F2pool and Spiderpool round out the top five at 122.29 EH/s and 92.77 EH/s, respectively. With BTC’s price on the upswing, hashprice—the estimated value of one petahash per second (PH/s)—has inched higher too.

In just 24 hours, the hashprice climbed 3.14%, rising from $46.51 to $47.97 per PH/s. Even so, the hashprice remains 6.89% below its Sept. 20, 2025 level. Over the past day, miners have been raking in an average of 3.14 BTC per block—though just 0.60% of that comes from onchain fees.

Bitcoin’s mining game is firing on all cylinders, with hashrate milestones stacking up and hashprice ticking higher in step with BTC’s price climb. Foundry and Antpool continue to dominate the charts, while 84 distinct smaller pools keep the competition lively.

Despite hashprice trailing its Sept. 20 level, miners remain locked in and laser-focused, proving once again that Bitcoin’s network isn’t just strong—it’s relentlessly pushing the limits of digital grit and computational endurance.

FAQ 🧭

- What is Bitcoin’s current hashrate?

As of Oct. 20, Bitcoin’s hashrate is cruising near 1,154 EH/s after recently touching 1.164 zettahash per second (ZH/s). - Which mining pools dominate the Bitcoin network?

Foundry and Antpool lead the pack, jointly controlling about 46% of Bitcoin’s total SHA256 hashrate. - How has Bitcoin’s hashprice changed recently?

The hashprice climbed 3.14% in 24 hours, rising from $46.51 to $47.97 per PH/s. - Are miners earning more from block rewards?

Miners earned an average of 3.14 BTC per block over the past day, which means only 0.60% stemmed from onchain fees.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin News Today: Bitcoin Drops 30%: Market Correction or On the Brink of a Crash?

- Bitcoin fell 30% from October's peak to $86,000, driven by regulatory uncertainty, macroeconomic risks, and institutional caution. - The U.S. government's Bitcoin for America Act proposal adds volatility by enabling BTC payments for federal obligations. - ETF outflows, whale liquidations, and bearish options signal market distress, though industry leaders call the correction "healthy." - A potential "death cross" and oversold conditions suggest further declines to $30,000 remain possible amid Fed policy

Bitcoin Updates: Bulls Encounter Major Challenge: Will Bitcoin Recover Important Levels After a 30% Decline?

- Bitcoin fell below $87,000 in Nov 2025, triggering $914M liquidations and pushing its unrealized loss ratio to 8.5%, signaling bearish sentiment. - ETF outflows hit $903M in one day, with BlackRock's IBIT losing $355.5M, attributed to institutional profit-taking and year-end risk-off moves. - Japan's $135B stimulus and Fed rate-cut uncertainty deepened selling, while Ark Invest added $39.6M in crypto firms amid price declines. - On-chain data shows $66.4M in losses from whale liquidations, but miners' ac

Bitcoin News Today: Bitcoin’s Sharp Decline: Gauging the World’s Appetite for Risk

- Bitcoin fell below $86,000, sparking stability concerns due to macroeconomic pressures, institutional caution, and shifting investor sentiment. - ETF outflows and $2B in exchange deposits, plus BlackRock's $523M redemption, intensified bearish fears as net unrealized profit hit 2025 lows. - New projects like Bitcoin Munari aim to leverage market fragmentation, but success depends on uncertain broader stability and regulatory progress. - Institutions show mixed signals: Strategy Inc. reported $2.8B gains

Fed Policy Changes and the Increasing Link with Solana (SOL)

- Fed's 2025-2026 shift from QT to QE injects liquidity, impacting Solana's volatile market dynamics. - Japan's rising JGB yields influence U.S. Treasury dynamics, while Solana's price drops 32.5% amid ETF inflows. - Solana's DApp revenue rises but active wallets plummet, while ETFs drive $342M inflows despite price declines. - Derivatives show reduced leveraged bets ($7.2B OI) but positive funding rates signal institutional bullishness on Solana's long-term potential. - Macroeconomic volatility and Solana