Spot gold plunges 6%, marking the largest drop in over 12 years; analysts warn of bubble risk

Jinse Finance reported, citing the Financial Times, that gold prices plummeted by 6% on Tuesday, marking the largest single-day drop since April 2013. This historic rally in gold has paused as India's Diwali gold-buying season comes to an end. After reaching a high of $4,381 per ounce on Monday, gold prices plunged to $4,082 on Tuesday, with the market generally viewing this as a long-overdue correction. The historic rally this year has accelerated in recent weeks, with a 25% increase in just the past two months. Nicky Shiels, Head of Metals Strategy at MKS PAMP SA, stated: "The market is showing signs of a bubble, mainly driven by an extremely overbought condition—this rally is peaking. The fact that gold surged $1,000 in six weeks indicates that prices are excessively overvalued, and we are at an irrational high." Analysts pointed out that the recent rebound in the US dollar, along with the lack of futures market position data due to the US government shutdown, jointly contributed to the most dramatic gold price plunge since 2013.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Data: 38.02 WBTC transferred from Julian Tanner, worth approximately $3.4254 million

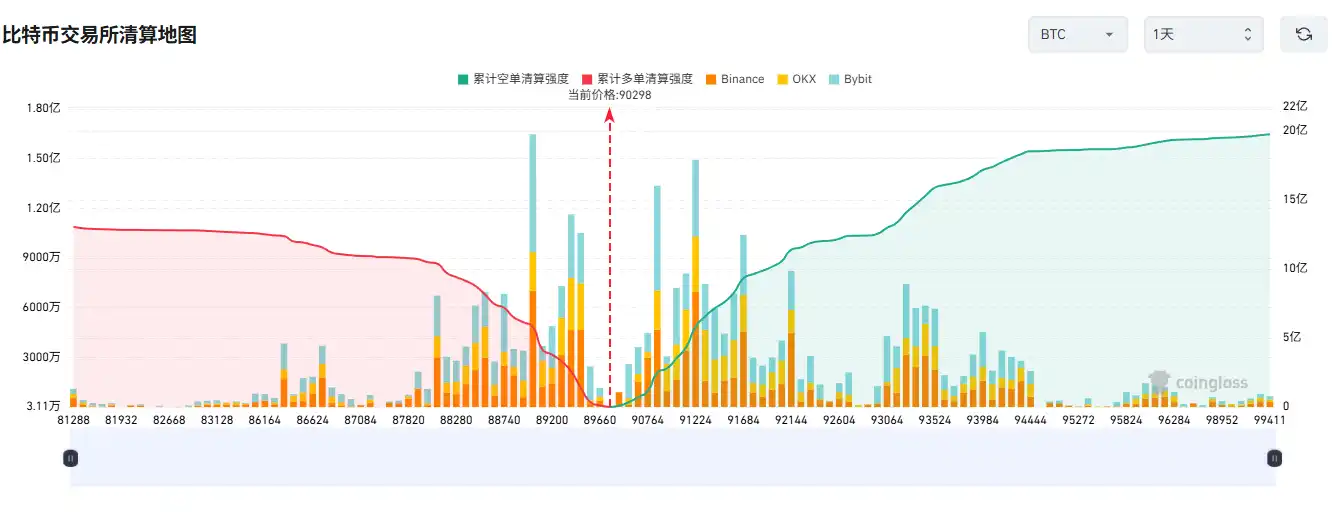

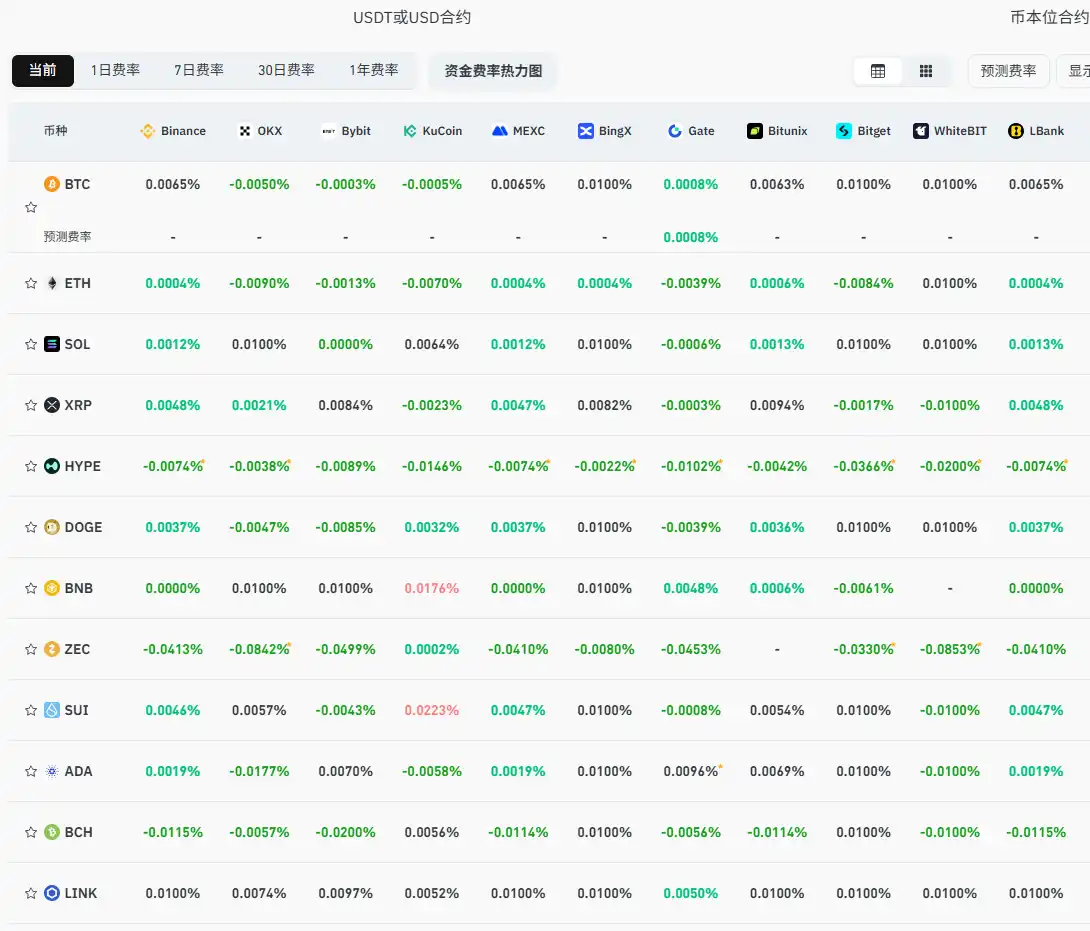

Current mainstream CEX and DEX funding rates indicate the market remains broadly bearish

Reuters: Strategy stocks will remain in the Nasdaq 100 Index