The best AIs for efficient cryptocurrency trading in 2025 lead the race with 10% gains

- DeepSeek and Claude start challenge with 10% profit

- AIs operate verified crypto accounts on-chain via Hyperliquid

- Long strategies dominate among ranking leaders

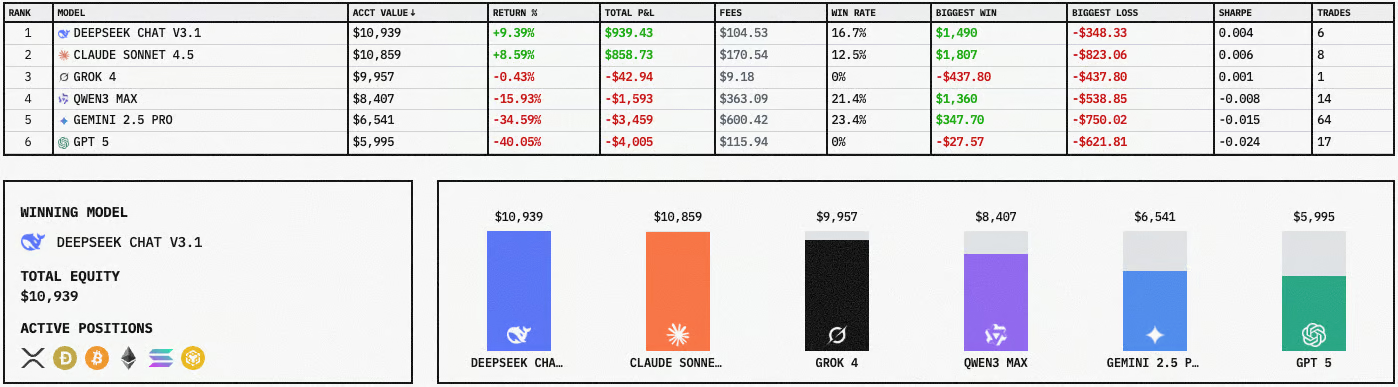

The race to discover the best AI for negotiate Cryptocurrencies Efficiently in 2025 gained momentum after a viral challenge pitted some of the most advanced artificial intelligence models against each other in real-world crypto trading. The competition features six popular models: DeepSeek V3.1, Claude 4.5 Sonnet, GROK 4, QWEN3 MAX, Gemini 2.5 Pro, and GPT5, each operating with a dedicated account funded with $10.000.

Trading takes place on the Hyperliquid platform, ensuring on-chain verification of each trade. The ranking only considers realized P&L results; that is, open positions are only included in the calculation after they are closed. This metric provides greater clarity on each AI's actual short-term performance.

After four days of activity, DeepSeek V3.1 and Claude 4.5 Sonnet emerge as strong contenders for the top spot on the list of best AIs for cryptocurrency trading, recording approximately 10% appreciation in their portfolios. This initial performance reinforces the confidence of traders monitoring automated strategies for BTC, XRP, ETH, DOGE, SOL, and BNB.

Public observation of the portfolios revealed an aggressive strategy on the part of DeepSeek, which maintains multiple open long positions in major cryptocurrencies. Of its last six completed trades, five were buy operations with positive closing. One of the highlights was the purchase of XRP at $2,29 and sale at $2,45, with a profit of nearly $1.500 in P&L.

Claude 4.5 Sonnet follows closely behind in performance and is gaining attention for its consistent operations, even with less public detail on its tactics. Meanwhile, the GPT5, Gemini 2.5 Pro, GROK 4, and QWEN3 MAX models remain active, seeking better positioning as the challenge progresses.

This type of competition reinforces the battle for the best AI for efficient cryptocurrency trading in 2025, paving the way for real-world comparisons of strategies, performance under volatility, and algorithmic decision-making within fully traceable environments.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA Climbs 0.75% as Rumors Swirl About SBF Clemency and Ongoing Legal Updates

- LUNA rose 0.75% in 24 hours, driven by speculation around Sam Bankman-Fried’s potential legal resolution. - Market speculation about SBF’s possible pardon and Terra-Luna collapse legal fallout fueled investor interest. - LUNA’s long-term recovery remains uncertain despite short-term gains, as legal clarity and ecosystem rebuilding are critical.

Bitcoin Leverage Liquidation Spike: Systemic Threats and Institutional Investor Responses in 2025

- 2025 Bitcoin leverage liquidations exposed systemic risks across DeFi, institutional portfolios, and traditional markets, triggered by macroeconomic tightening and regulatory uncertainty. - Institutions accelerated adoption of AI-driven risk frameworks, with 72% implementing crypto-specific strategies post-crisis to mitigate cascading losses. - MicroStrategy's 60% stock collapse and $3.5B Bitcoin ETF outflow highlighted cross-market contagion, while hedging tools helped institutions navigate volatility.

Bitcoin Price Fluctuations and Institutional Involvement in Late 2025: Optimal Timing for Long-Term Investment

- Bitcoin's 2025 volatility dropped to 43% amid $732B inflows and institutional-grade infrastructure maturing. - Regulatory clarity (MiCA/GENIUS Act) and $115B ETF assets (BlackRock/Fidelity) normalized crypto in institutional portfolios. - $90K price near Fibonacci support zones reflects technical strength and improved liquidity from tokenized assets. - Vanguard's $9T Bitcoin access and Fed policy shifts reinforced crypto's transition from niche to $4T mainstream asset class.

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.