Ark Labs Launches Arkade, a New Bitcoin Native Layer 2

- Ark Labs Launches Arkade Layer 2 Public Beta

- Platform allows instant and programmable Bitcoin transactions

- Arkade Assets will bring stablecoins and tokens to Bitcoin

Ark Labs announced the public beta launch of Arkade, a native layer 2 blockchain built directly on Bitcoin. After two years of development and backed by investors including Draper Associates, Axiom, and Fulgur Ventures, the startup presents what it describes as the most significant evolution of Bitcoin's infrastructure since the Lightning Network.

Arkade is based on the Ark Protocol, proposed in 2023, and introduces instantaneous and programmable off-chain transactions through so-called Virtual Transaction Outputs (VTXOs)—off-chain representations of Bitcoin's UTXOs. This architecture allows users to perform complex operations, such as lending, swapping, and trading, without altering the network's consensus rules.

According to the company, the technology leverages Bitcoin's security, but with batch settlement, which reduces costs and congestion. Ark Service Providers (ASPs) coordinate thousands of off-chain transactions and consolidate them into on-chain blocks, without ever taking custody of the funds. Each VTXO is secured by a pre-signed Bitcoin transaction, ensuring that users maintain full control over their assets, even if an ASP goes down.

“The Bitcoin phase two scenario has been full of promise, but little promise,”

said Marco Argentieri, CEO of Ark Labs.

"Today's launch marks the beginning of Bitcoin's evolution as a programmable currency." He added that Arkade "unlocks Bitcoin's full potential without compromising what makes it valuable."

Unlike sidechains or bridges that rely on custody, Arkade operates within Bitcoin's native security model. The network is also interoperable with the Lightning Network, enabling liquidity transfers between the two through integrations like Boltz. Launch partners include Breez, BlueWallet, BTCPayServer, and BullBitcoin.

Ark Labs also unveiled Arkade Assets, an extension that brings support for stablecoins and other tokens to the off-chain environment. The first asset to be integrated will be Tether's USDT. "Arkade finally provides the foundation for bringing stablecoins back to Bitcoin, the most secure blockchain in the world," Argentieri noted.

The project aims to transform Bitcoin into a programmable decentralized finance platform, maintaining its original security and decentralization, while reintroducing stablecoins and advanced applications into its infrastructure.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Solana: Short-term pain, long-term hope? SOL faces liquidation test

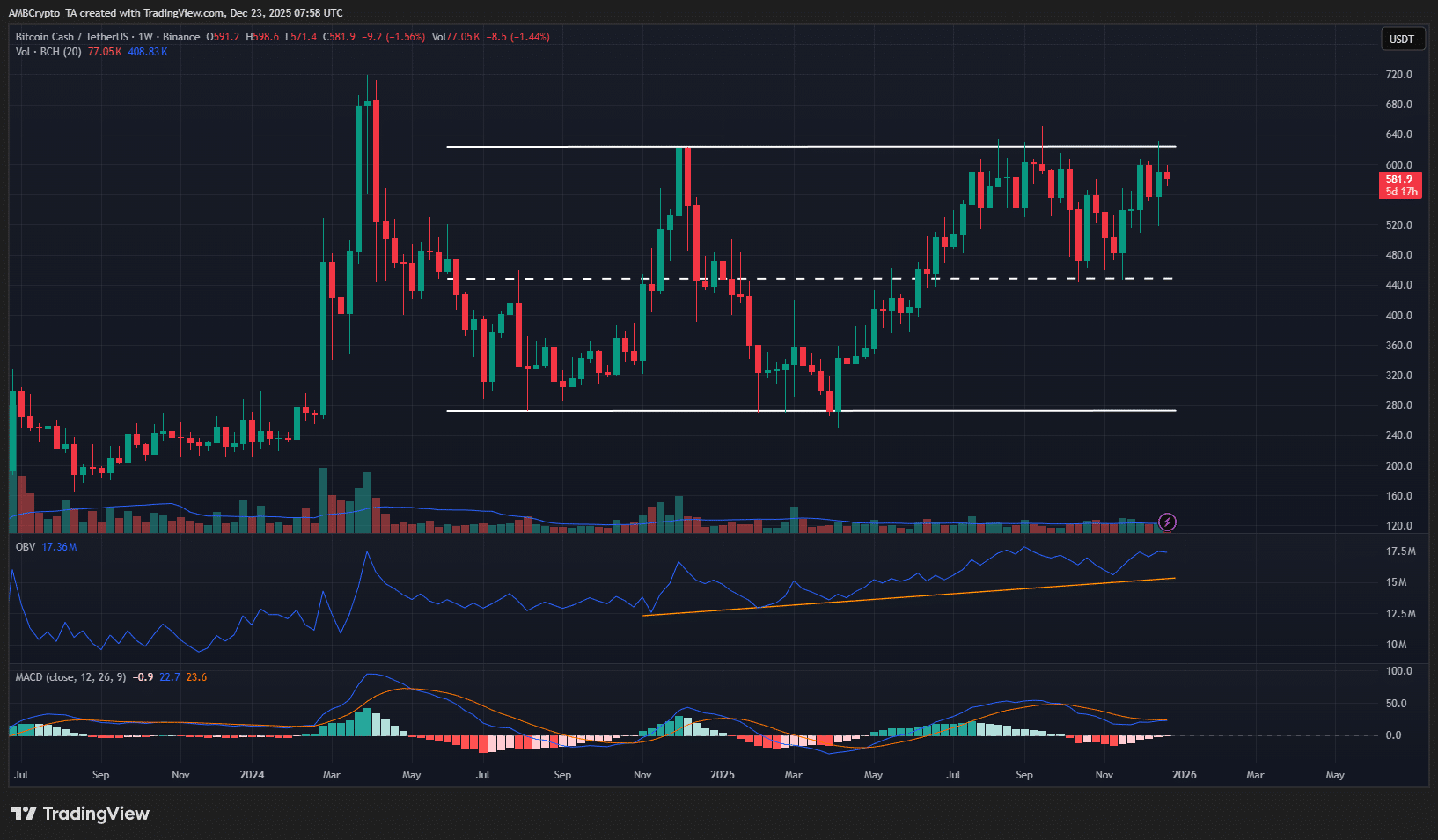

Bitcoin Cash – Why buying BCH before a $624 breakout is risky

Falcon Finance Strengthens USDF Expansion Through Chainlink Price Feeds and CCIP

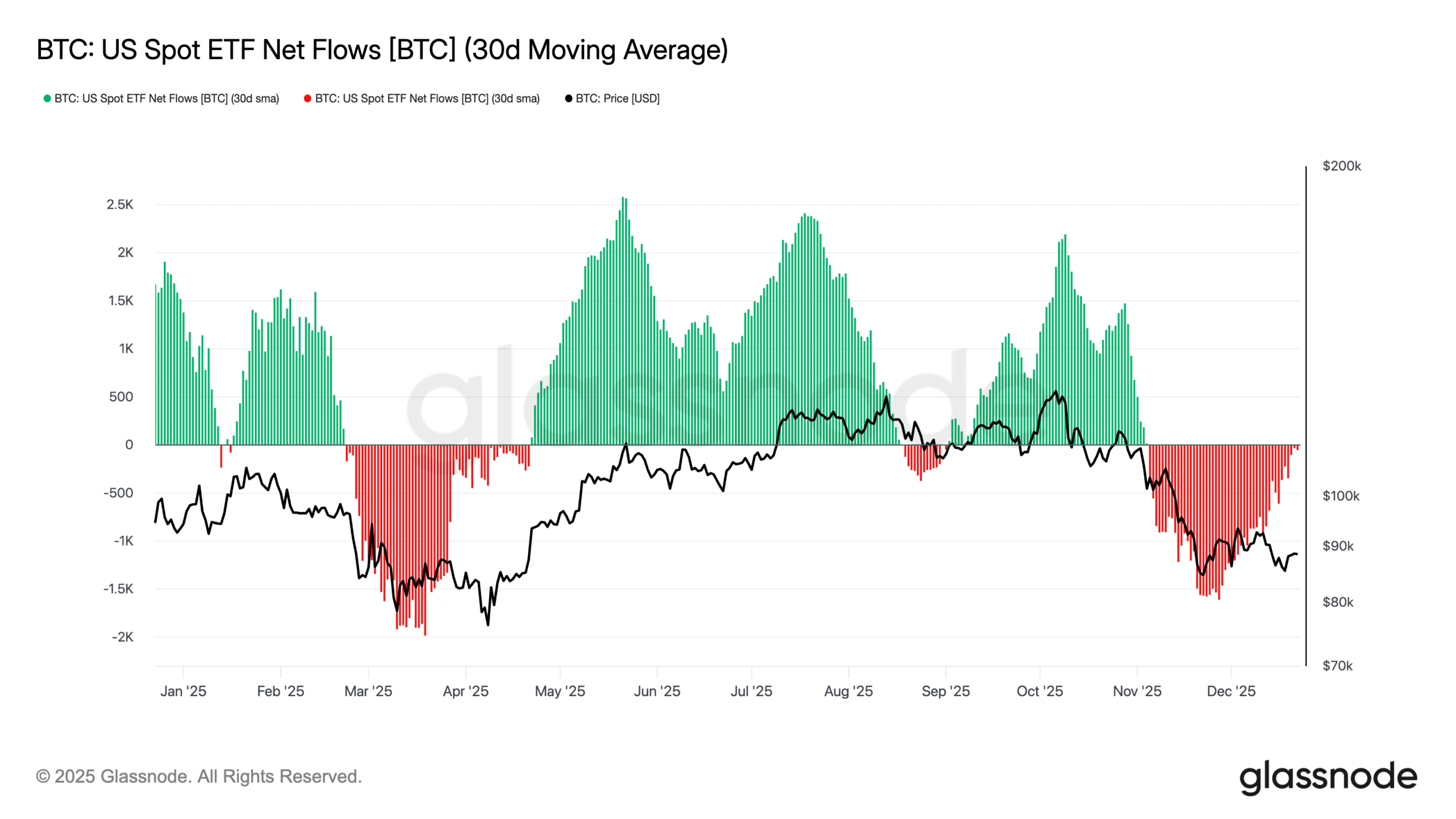

Bitcoin and Ethereum ETFs see persistent outflows as institutional appetite weakens