Nexchain AI pushes forward with groundbreaking blockchain innovations. Designed to address scalability, security, and cross-chain limitations, Nexchain AI integrates advanced technologies like DAG, AI-optimized consensus, and adaptive smart contracts. With its unique hybrid Proof-of-Stake model and AI governance layer, Nexchain AI introduces a scalable infrastructure built for real-world use.

Nexchain’s Blockchain Features Stand Out

Nexchain AI is a next-generation Layer 1 protocol developed to solve key blockchain challenges using artificial intelligence. Its architecture combines Directed Acyclic Graphs (DAG) for faster parallel processing and AI-based consensus adjustments for real-time optimization.

The system supports adaptive smart contracts with automated compliance, fraud detection, and performance tuning. These contracts evolve with usage data, improving accuracy and transaction outcomes. The platform’s Testnet 2.0, which launched October 13 and runs until November 28, introduces essential tools.

These include a redesigned interface and AI Events, which provide users with an AI Risk Score before approving transactions, enhancing safety against MEV attacks and scams. All testnet participants can use promo code TESTNET2.0 to claim a 100% bonus, boosting their early access incentives.

Airdrop Campaign and Long-Term Strategy Continue to Attract Users

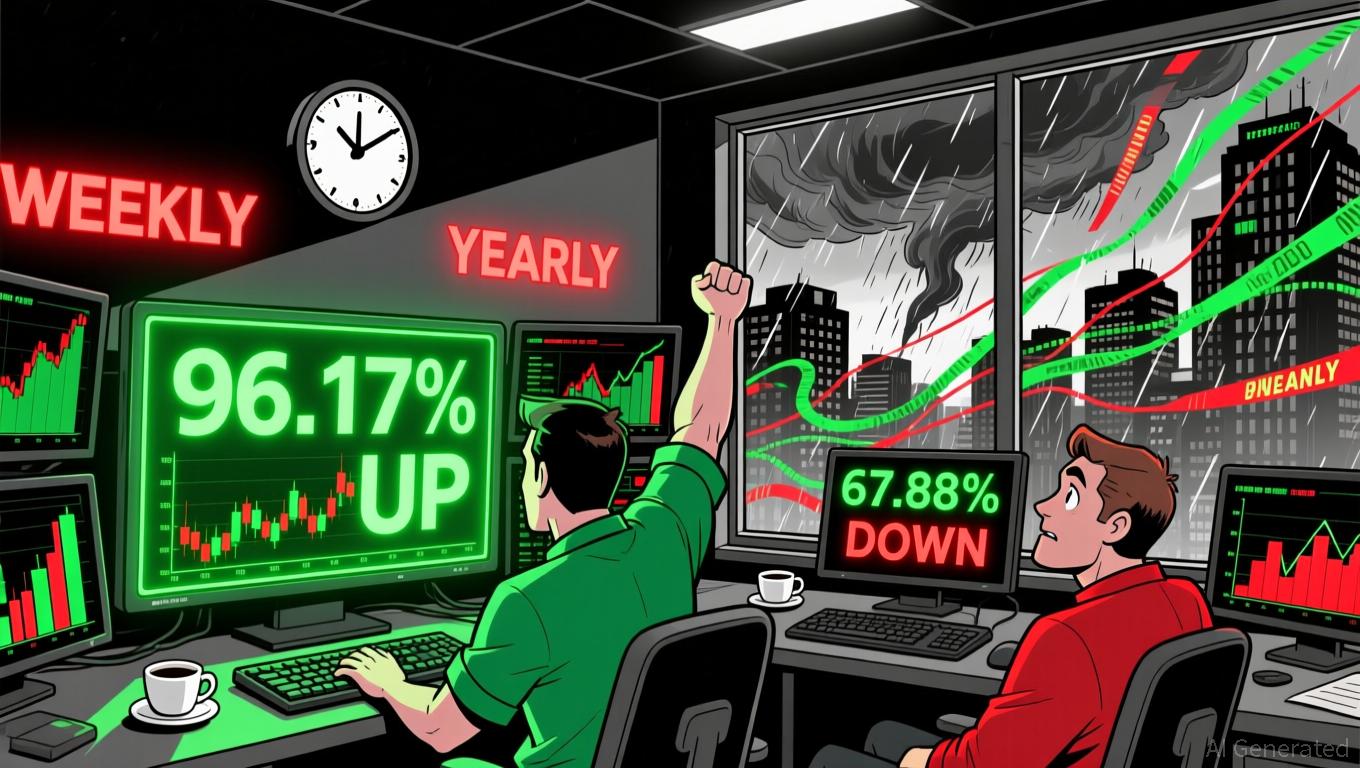

The Nexchain AI airdrop continues, offering a $5M prize pool. Weekly quests and a final grand prize reward system help maintain community engagement. The more users participate weekly, the greater their chances of unlocking top-tier rewards. Nexchain also supports developers with AI SDKs and dashboards to integrate smart features into dApps seamlessly.

Security is managed by CERTIK, and additional protection comes from post-quantum encryption and anomaly detection. These features will strengthen the upcoming mainnet, which is being finalized with active governance, tracking systems, and scaling infrastructure.

More Details: