Fetch.ai CEO Offers $250K Bounty Over OCEAN Allegations

Fetch.ai CEO Humayun Sheikh has accused Ocean Protocol of misusing alliance funds, offering a $250,000 bounty for wallet details amid allegations of unauthorized FET transfers, Binance delistings, and potential class-action lawsuits tied to the ASI merger.

Fetch.ai CEO Humayun Sheikh has offered a $250,000 bounty for information on OceanDAO’s multisignature wallet signers. The announcement reignited tensions with Ocean Protocol over alleged misuse of alliance-linked funds before their 2024 merger.

The dispute dates back to token conversions made before the Artificial Superintelligence (ASI) Alliance—an initiative uniting Fetch.ai, Ocean Protocol, and SingularityNet—took effect.

Ocean Protocol Accused of Pre-Merger Transfers

Sheikh offered a $250,000 bounty to anyone providing information linking OceanDAO’s multisig wallet signers to the Ocean Protocol Foundation. A multisig wallet requires multiple users’ signatures to authorize a single crypto transaction, making it a common security mechanism for shared control.

According to on-chain analytics platform Bubblemaps, Ocean Protocol converted 661 million OCEAN into 286 million FET before the ASI merger occurred. Blockchain data indicates 270 million FET were later transferred to exchanges, including 160 million to Binance and 109 million to GSR Markets.

Sheikh alleged the conversions violated the alliance’s spirit of trust. “Funds intended for the community were diverted,” he wrote on X, urging Binance and GSR to investigate.

I’m offering a $250k reward to anyone who can uncover the OceanDAO signatories and their connections to Ocean Foundation !

— Humayun (@HMsheikh4) October 21, 2025

Ocean Protocol has denied the allegations, calling them “unfounded,” and announced it will issue a formal response.

Binance had already ended support for OCEAN deposits on October 15, days before Sheikh’s public statement. The exchange did not cite the dispute as a cause, but the timing raised speculation.

Also, Sheikh has since pledged to finance class-action lawsuits in multiple jurisdictions to hold Ocean Protocol accountable.

Legal Fallout and Market Implications

Analysts say the feud could reshape investor confidence in AI-token alliances. Once valued at over $7 billion, the ASI merger aimed to consolidate decentralized AI development but now faces reputational strain.

Sheikh’s bounty move may prompt deeper scrutiny of multisignature governance and token custody across crypto alliances. Legal proceedings could set precedents for future consortium-based blockchain projects, especially those involving asset conversions.

Ocean Protocol officially withdrew from the ASI alliance on October 9, yet it offered no clarification regarding the disputed token movements. The escalating conflict underscores the fragility of trust in joint crypto ventures that lack transparent governance mechanisms.

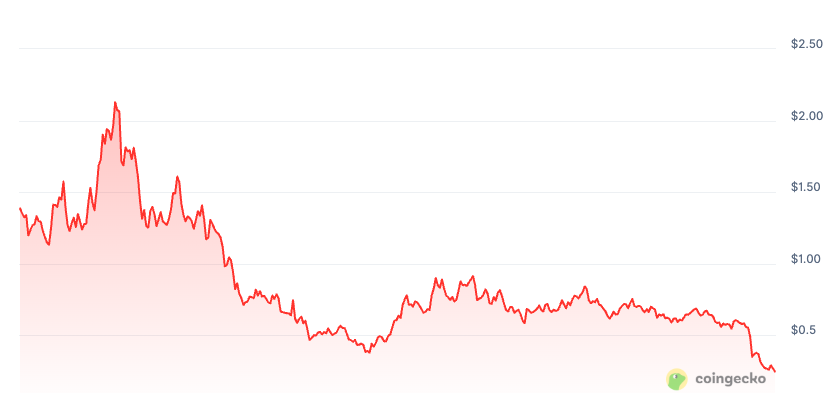

FET performance over the past year / Source: Coingecko

FET performance over the past year / Source: Coingecko

As of October 21, Fetch.ai’s native token FET was trading around $0.25, reflecting a 9% decline over the previous 24 hours amid heightened market volatility and community uncertainty. FET reached an all-time high of $3.45 in late March 2024, meaning the current price represents a decline of roughly 92% from that peak.

OCEAN performance over the past year / Source: Coingecko

OCEAN performance over the past year / Source: Coingecko

Ocean Protocol’s native token OCEAN also fell 4% from the previous day to around $0.25. Its all-time high was $1.93 in mid-April 2021, meaning the current price is roughly 87% below that peak.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Kodiak launches Berachain native perpetual contract platform—Kodiak Perps, enhancing its liquidity ecosystem

The native liquidity platform of the Berachain ecosystem, Kodiak, recently launched a new product, Kodiak Perps,...

Mars Morning News | Michael Saylor calls: Buy Bitcoin now

Trump Media & Technology Group’s Q3 losses widened to $54.8 million, and it holds substantial amounts of bitcoin and CRO tokens; US consumer confidence has fallen to a historic low; a whale bought the dip in ZEC and made a profit; a bitcoin whale transferred assets; Michael Saylor called for buying bitcoin; the Federal Reserve may initiate bond purchases. Summary generated by Mars AI. The accuracy and completeness of this content is still being iteratively updated by the Mars AI model.

MEET48: From Star-Making Factory to On-Chain Netflix — How AIUGC and Web3 Are Reshaping the Entertainment Economy

Web3 entertainment is moving from the retreat of the bubble to a moment of restart. Projects represented by MEET48 are reshaping content production and value distribution paradigms through the integration of AI, Web3, and UGC technologies. They are building sustainable token economies, evolving from applications to infrastructure, aiming to become the "Netflix on-chain" and driving large-scale adoption of Web3 entertainment.

Digital Euro: Italy Advocates for a Gradual Implementation