Solana Holds Key Support as Mid-Term Holders Sell—Is a Breakout Still on the Table?

Solana’s price shows resilience despite mid-term holders selling. A breakout above $192 could reignite bullish momentum and target $250, but failure to hold $175 risks a deeper pullback.

The recent price action of Solana (SOL) shows signs of resilience, though the broader crypto market remains unstable.

Despite attempts at recovery, the token faces mid-term holder selling pressure, casting doubt on its near-term strength. Still, technical patterns hint that Solana could mount another rally if momentum aligns.

Solana Holders Sell

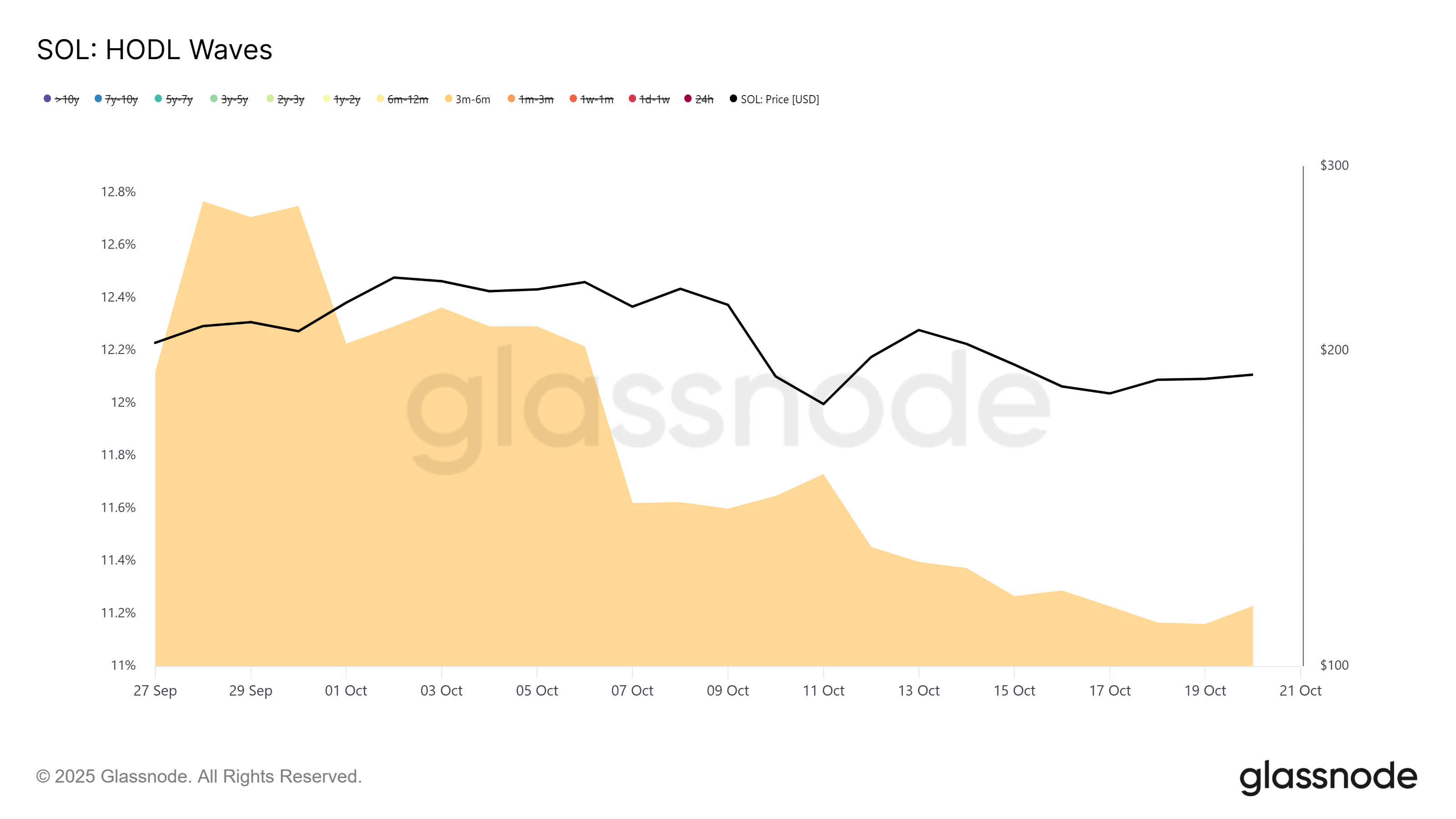

On-chain data from HODL Waves reveals an interesting trend among Solana investors. Mid-term holders—those who have held SOL for three to six months—are steadily reducing their holdings. This group’s supply has declined by 1.7% in October alone, suggesting that investors are offloading their tokens amid uncertainty.

What’s more, the supply of six- to twelve-month holders hasn’t increased, confirming that the coins aren’t maturing but are instead being sold. This pattern indicates growing skepticism and could add selling pressure on SOL’s price.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Solana HODL Waves. Source:

Glassnode

Solana HODL Waves. Source:

Glassnode

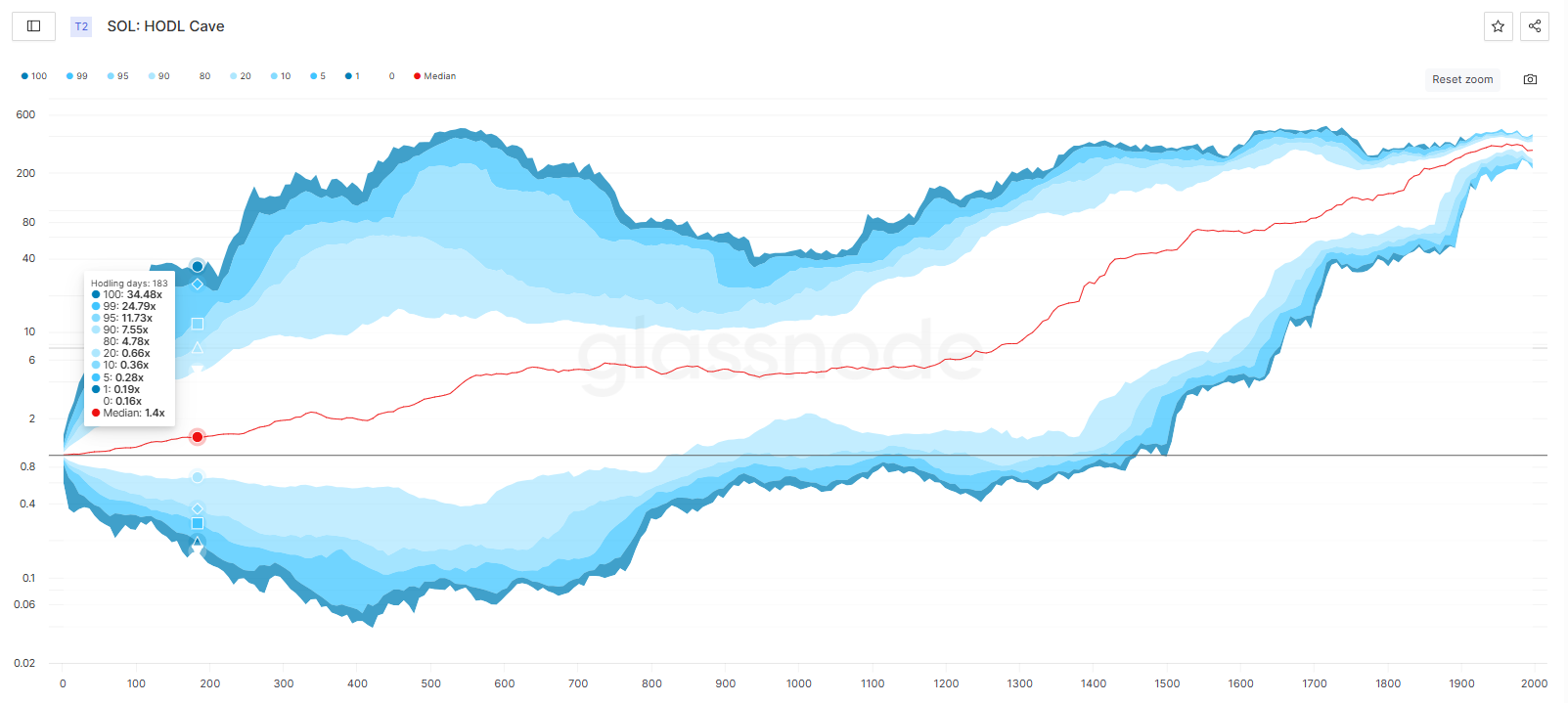

The HODL Cave metric sheds light on the motivation behind this selling trend. Contrary to profit-taking behavior, data suggest these investors are driven by fear rather than greed. The median return for holders in the three- to six-month range sits between 1.14x and 1.4x, modest gains that imply panic selling rather than strategic exits.

Many investors appear eager to lock in small profits or minimize potential losses as prices waver. This behavior typically surfaces during periods of market uncertainty. If this cautious sentiment persists, it may limit Solana’s upward potential in the short term.

Solana HODL Cave. Source:

Glassnode

Solana HODL Cave. Source:

Glassnode

SOL Price Needs A Bounce

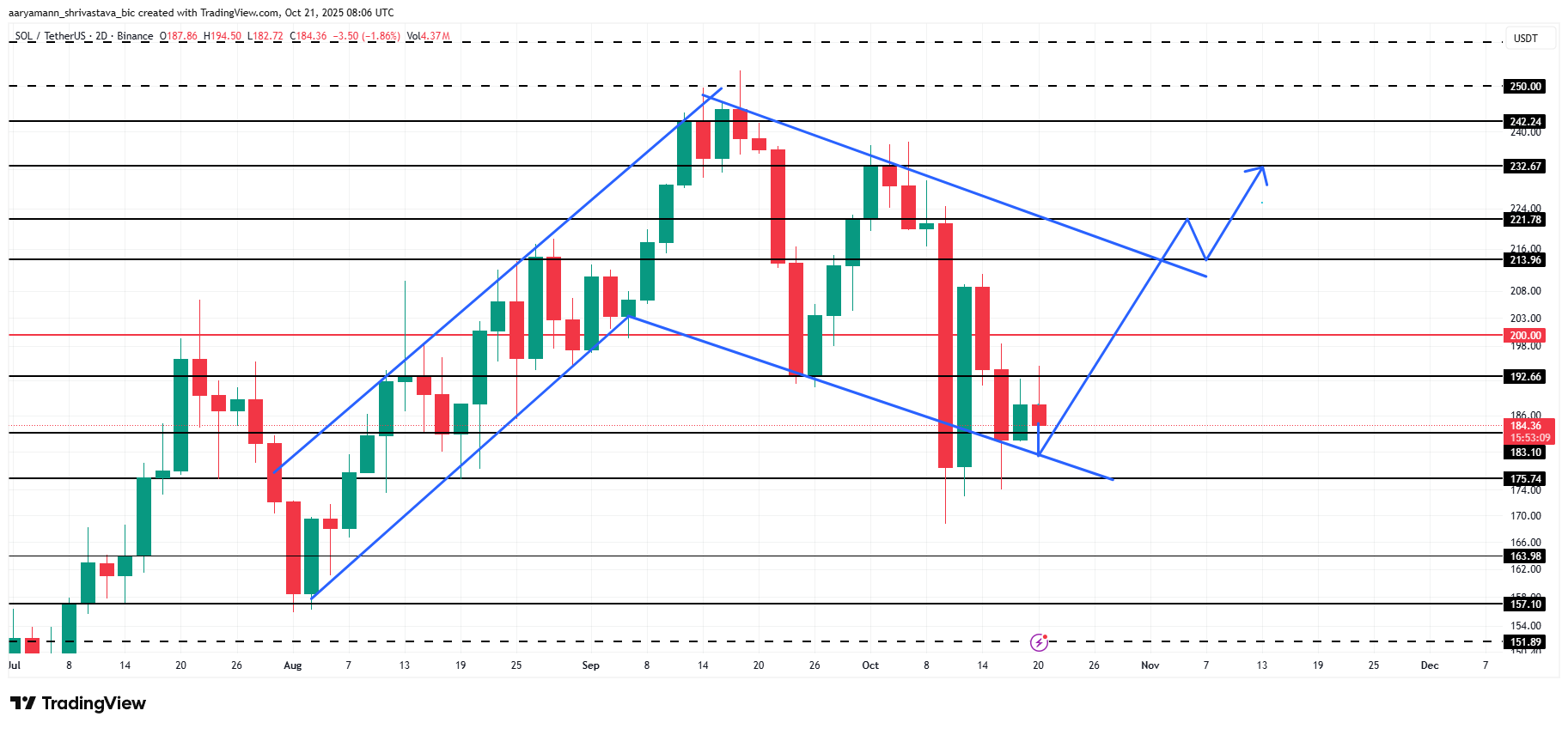

At the time of writing, Solana’s price stands at $184, holding above the crucial $183 support. The altcoin appears to be forming a flag pattern, a technical setup often associated with bullish breakouts. However, confirmation will depend on volume strength and investor conviction.

Following the recent crash, SOL briefly dropped out of this pattern before testing and validating it again. For a clear breakout, Solana needs to bounce off the lower trendline or move past $192. Failure to sustain buying pressure could drive the token below $175, potentially falling to $163, invalidating the bullish pattern.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

Conversely, if Solana breaches $192, it could surpass $200, a key psychological barrier. Breaking out from the pattern could ignite renewed momentum, setting the stage for a potential surge toward $250. Nevertheless, investors and traders should proceed with caution given the current market fragility.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Witness the Dynamic Shifts in Bitcoin and Altcoin ETFs

In Brief Bitcoin and altcoin ETFs witness dynamic shifts in inflows and outflows. XRP and Solana ETFs attract notable investor attention and activity. Institutions explore diversified crypto ETFs for strategic risk management.

Peter Schiff Clashes With President Trump as Economic and Crypto Debates Intensify

Bitcoin Cash Jumps 40% and Establishes Itself as the Best-Performing L1 Blockchain of the Year

Bitcoin Price Plummets: Key Reasons Behind the Sudden Drop Below $88,000