Key Market Information Gap on October 22, Must Read! | Alpha Morning News

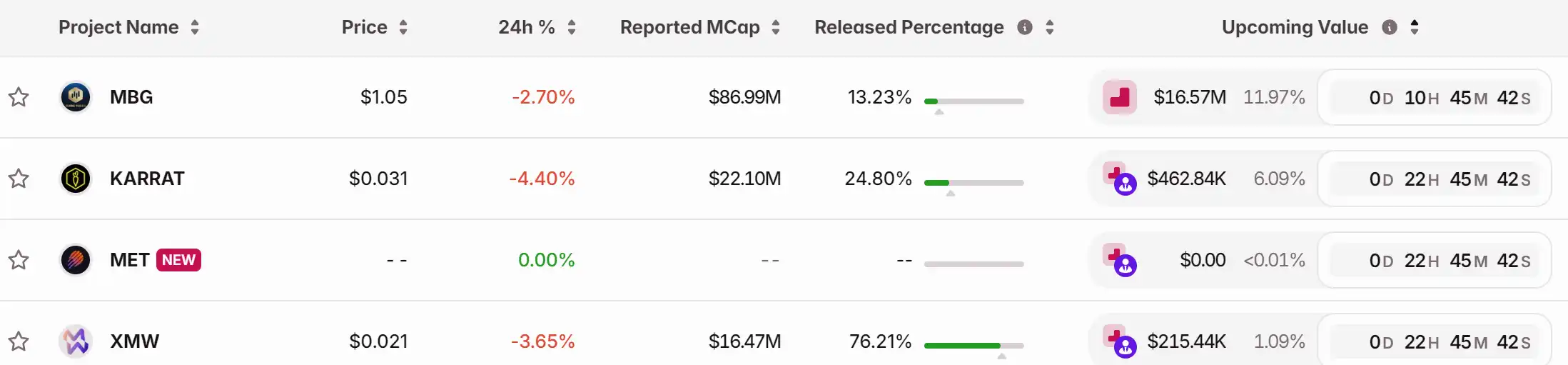

1. Top News: The meme coin "索拉拉" saw its market capitalization briefly surpass $20 million, reaching a new all-time high. 2. Token Unlocks: $MBG, $KARRAT, $MET, $XMW.

Selected News

1.Meme coin "索拉拉" market cap briefly surpassed 20 million USD, reaching an all-time high

2.Spot gold plummeted 6%, marking the largest drop in over 12 years; analysts warn of bubble risks

3.Public chain Kadena announces cessation of operations, KDA drops over 60% in 24 hours

4.US department store chain Bealls announces acceptance of cryptocurrency payments

Articles & Threads

2." Behind the explosive popularity of "索拉拉", meme creators earn from the protocol for the first time "

A few days ago, the social protocol platform Trends launched an event to "collect Chinese names for Solana", with a prize pool of 100 SOL. Users could participate by quoting and retweeting the official post and suggesting a Chinese name for Solana. After the event started, Solana's official account, Solana founder Toly, and Solana Foundation Chair Lily Liu all retweeted Trends' event post and continued to interact with the community throughout the event. A large number of players actively participated, including users from the English-speaking community.

Market Data

Daily overall market capital heat (reflected by funding rates) and token unlocks

Data sources: Coinglass, TokenUnlocks

Funding Rate

Token Unlocks

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto, TradFi sentiment improves: Will Bitcoin traders clear shorts above $93K?

Bitcoin catches a bid, but data shows pro traders skeptical of rally above $92K

Trending news

MoreBitget Daily Digest (Dec. 9)|Michael Saylor is promoting a Bitcoin-backed banking system to governments; the CFTC has launched a digital asset pilot program allowing BTC, ETH, and USDC to be used as collateral

[English Thread] Wake-up Call and Review for the Crypto Industry in 2025: Where Is the Direction of the Next Cycle?