Keycard, an AI-powered identity and access management platform, secures $38 million in funding, led by a16z and others.

On October 22nd, according to an official announcement, Keycard announced the early access of its AI-driven Identity and Access Management (IAM) platform, and completed a $38 million Series A funding round. The round was led by Andreessen Horowitz, Acrew Capital, Boldstart Ventures, with participation from Mantis VC, Tapestry Ventures, Essence Ventures, Exceptional Capital, Modern Technical Fund, Vermillion Cliffs Ventures, and several angel investors.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

LUNA Climbs 0.75% as Rumors Swirl About SBF Clemency and Ongoing Legal Updates

- LUNA rose 0.75% in 24 hours, driven by speculation around Sam Bankman-Fried’s potential legal resolution. - Market speculation about SBF’s possible pardon and Terra-Luna collapse legal fallout fueled investor interest. - LUNA’s long-term recovery remains uncertain despite short-term gains, as legal clarity and ecosystem rebuilding are critical.

Bitcoin Leverage Liquidation Spike: Systemic Threats and Institutional Investor Responses in 2025

- 2025 Bitcoin leverage liquidations exposed systemic risks across DeFi, institutional portfolios, and traditional markets, triggered by macroeconomic tightening and regulatory uncertainty. - Institutions accelerated adoption of AI-driven risk frameworks, with 72% implementing crypto-specific strategies post-crisis to mitigate cascading losses. - MicroStrategy's 60% stock collapse and $3.5B Bitcoin ETF outflow highlighted cross-market contagion, while hedging tools helped institutions navigate volatility.

Bitcoin Price Fluctuations and Institutional Involvement in Late 2025: Optimal Timing for Long-Term Investment

- Bitcoin's 2025 volatility dropped to 43% amid $732B inflows and institutional-grade infrastructure maturing. - Regulatory clarity (MiCA/GENIUS Act) and $115B ETF assets (BlackRock/Fidelity) normalized crypto in institutional portfolios. - $90K price near Fibonacci support zones reflects technical strength and improved liquidity from tokenized assets. - Vanguard's $9T Bitcoin access and Fed policy shifts reinforced crypto's transition from niche to $4T mainstream asset class.

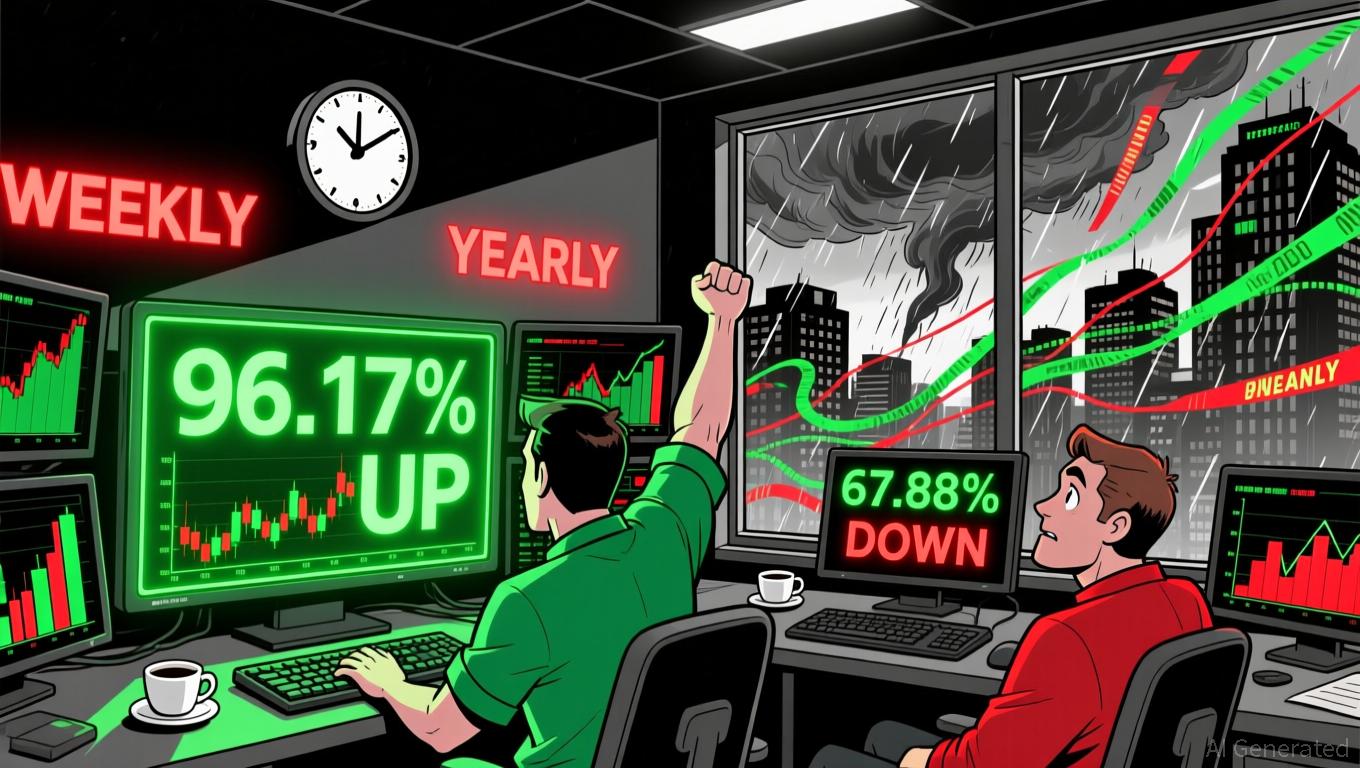

LUNA +96.17% 7D: Surge Attributed to Rumors of SBF Receiving a Pardon

- LUNA surged 96.17% in 7 days amid speculation about Sam Bankman-Fried's potential legal resolution. - The Terra 2.0 token (LUNA) trades at $0.1353, contrasting with LUNC's 70.3% 24-hour gain and $342M market cap. - Market optimism remains cautious as LUNA still faces a 67.88% annual decline and regulatory uncertainties. - SBF's legal developments could influence broader crypto sentiment, though Terra's recovery depends on technical performance.