Oracle Network Chainlink Declared Top Project on Santiment’s Real-World Asset Development Rankings

The decentralized oracle network Chainlink ( LINK ) is continuing its streak at the top of crypto’s real-world asset (RWA) sector in terms of recent development activity, per new research from the analytics firm Santiment.

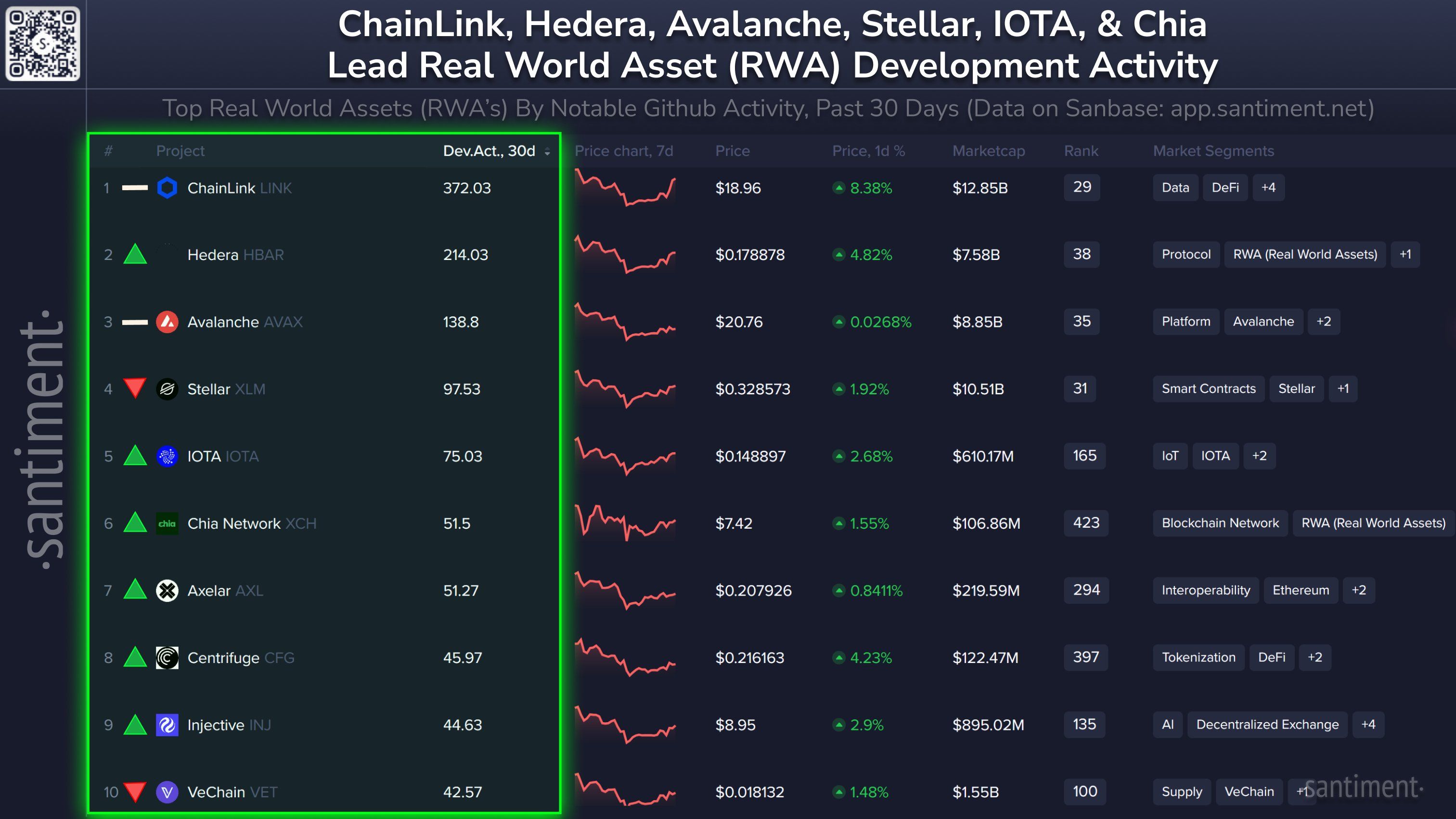

Santiment notes in a new post on the social media platform X that Chainlink registered 372 notable GitHub events in the past 30 days.

The figure far exceeds the second-ranked RWA project, the layer-1 blockchain Hedera ( HBAR ), which clocked 214 GitHub events in the past month.

The Ethereum ( ETH ) rival layer 1 blockchain Avalanche ( AVAX ) was third, with 138, and peer-to-peer payments project Stellar ( XLM ) was fourth with 97.

Source: Santiment/X

Source: Santiment/X

Chainlink has occupied the top spot on Santiment’s list all year, often clocking multiple times the number of GitHub events as the second-ranked project.

The analytics firm notes that it doesn’t count routine updates and relies on a “better methodology” to collect data for GitHub events based on a backtested process.

Santiment has previously explained that crypto projects with lots of development could soon be shipping new features and are less likely to be exit scams.

LINK is trading at $18.80 at time of writing. The top-ranked crypto oracle and 16th-ranked crypto asset by market cap is up nearly 3% in the past 24 hours.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Russia's Decision on Stablecoins May Transform Digital Asset Legislation

- Russia's Constitutional Court will decide if stablecoins like USDT qualify as property under 2021 DFA laws, following a 2023 civil dispute over a $1,000 loan. - Lower courts dismissed the case, excluding foreign-issued stablecoins from DFA scope, but plaintiffs argue this creates unconstitutional property restrictions. - Experts disagree: Guznov calls USDT a "monetary surrogate," while Rosfinmonitoring emphasizes voluntary reporting over blockchain monitoring for ownership verification. - A new law now t

Bitcoin News Update: Top Executives Accumulate ETH and BTC During $1.1B Sell-Off, Highlight 100x Growth Opportunity

- Bitcoin fell below $90,000 amid $1.1B liquidations, with BitMine/Bitwise executives predicting long-term "supercycles" for BTC/ETH despite short-term volatility. - BitMine added 54,156 ETH ($170M) to holdings, while Hyperscale Data bought 59.76 BTC via dollar-cost-averaging, signaling institutional confidence in crypto's value. - ETF outflows ($870M in one day) and LTH selling (815,000 BTC in 30 days) highlight bearish fundamentals, with $102,000 as critical support for Bitcoin. - Fed officials' cautious

Bitcoin Updates: MicroStrategy's Bold Bitcoin Investment Stands Strong Despite 57% Drop in Stock Value

- MicroStrategy's CEO reaffirms Bitcoin buying strategy amid market volatility, adding 8,178 BTC for $835.6M. - Despite 57% stock decline, MSTR's Bitcoin holdings reach $61.7B, funded by preferred shares and convertible notes. - Critics question debt-driven model's sustainability, but analysts praise its Bitcoin-per-share growth and $535 price target. - Saylor envisions $1T Bitcoin balance sheet, leveraging appreciation for credit products and reshaping global finance.

Ethereum Updates Today: Buddy Goes All-In on ETH with $13 Million Leveraged Wager Amid Market Slump

- Buddy Huang’s ETH long position was liquidated, prompting a $9.5M reentry amid market turmoil. - Market selloff attributed to macroeconomic pressures, with BTC dropping 28.7% below $90K. - A $1.24B ETH whale added 13,117 ETH despite $1.59M unrealized losses, signaling bullish conviction. - Institutional caution grew as SoftBank exited $5.8B NVIDIA stake, while Coinbase hinted at December 17th product launch. - Buddy’s $13M leveraged bet faces liquidation risk if ETH fails to stabilize above $3,000, highl