Bloomberg Analyst Eric Balchunas Shares a Key List of Altcoin ETFs! Here Are the Details…

The government has been shut down in the US since the beginning of October, so official institutions are operating on a limited basis.

The government shutdown has affected all sectors, and cryptocurrency is one of them. The wave of ETF approvals for altcoins like XRP and Solana (SOL) expected in October has also been delayed.

At this point, it seems that the number of altcoin ETFs, whose final approval decisions have not been announced by the SEC due to the government shutdown in the US, will increase in the coming period.

Bloomberg senior ETF analyst Eric Balchunas predicted in his post that more than 200 crypto ETPs could be launched within a year.

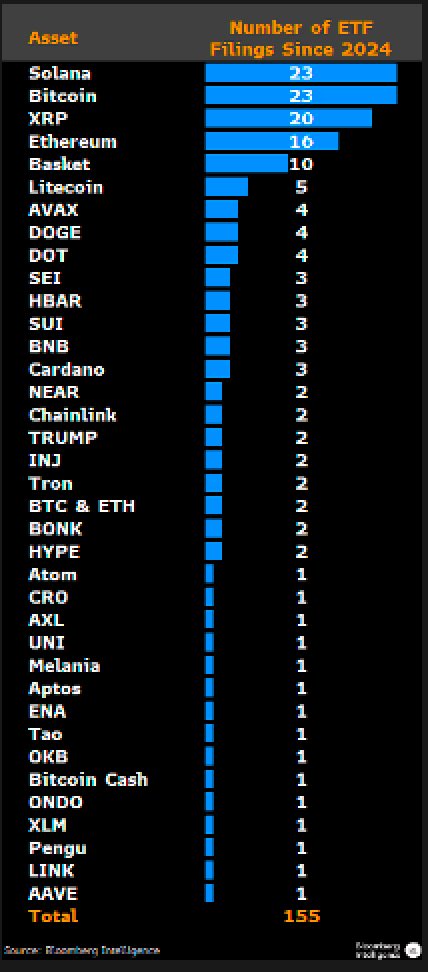

According to Eric Balchunas, there are currently 155 ETFs on the market that track 35 different cryptocurrencies.

Balchunas predicted that more than 200 ETFs are likely to launch in the next 12 months.

The cryptocurrencies with the most ETFs are Solana (SOL) and Bitcoin (BTC), followed by XRP and Ethereum (ETH).

Popular altcoins such as Litecoin (LTC), Avalanche (AVAX), and Dogecoin (DOGE) also top the list.

Analysts expect more institutional investors to enter the market with the SEC's approval of crypto ETFs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The Growing Significance of Financial Well-being in Investment Strategies

- Investors increasingly prioritize financial wellness, integrating emotional intelligence (EI), ESG principles, and fintech to align wealth strategies with holistic well-being and ethical values. - Research shows higher EI improves investment resilience, prompting advisors to address emotional biases like loss aversion through AI-driven tools and personalized guidance. - ESG-linked assets surpassed $50 trillion by 2025, with fintech platforms enabling tailored sustainable portfolios and AI-powered debt ma

COAI Experiences Significant Price Decline in Late November 2025: Is the Market Overreacting or Does This Present a Contrarian Investment Chance?

- ChainOpera AI (COAI) plummeted 90% in late 2025 due to CEO resignation, $116M losses, and regulatory ambiguity from the CLARITY Act. - Market panic and 88% supply concentration in top wallets amplified the selloff, while stablecoin collapses worsened liquidity risks. - Contrarians highlight C3 AI's 26% YoY revenue growth and potential 2026 regulatory clarity as signs of mispriced long-term AI/crypto opportunities. - Technical indicators suggest $22.44 as a critical resistance level, with analysts warning

Hyperliquid (HYPE) Price Rally: An In-Depth Look at Protocol Advancements and Liquidity Trends

- Hyperliquid's HYPE token surged 3.03% amid HIP-3 upgrades enabling permissionless perpetual markets and USDH stablecoin launch. - Protocol innovations boosted liquidity by 15% but failed to halt market share erosion to under 20% against competitors like Aster. - Structural challenges persist through token unstaking, unlocks, and OTC sales, yet HyENA's $50M 48-hour volume signaled renewed engagement. - Whale accumulation of $19.38M near $45-46 and HYPE buybacks aim to stabilize price, though long-term suc