- PepeCoin is a meme-born token showing strong community power and potential for another explosive rally.

- Cardano is a research-driven blockchain offering scalability and growth potential with ADA’s expanding ecosystem.

- Toncoin is a Telegram-linked project gaining massive exposure through fast, user-friendly blockchain integration.

The crypto market is full of surprises, and a few hidden gems may deliver life-changing returns. Some tokens rise quietly before exploding in value when momentum builds. As 2026 approaches, PEPE, ADA, and TON stand out for their strong communities, growing ecosystems, and rising demand. Each of these promising tokens offers unique potential to turn small investments into serious profits when the next major crypto rally hits.

PepeCoin (PEPE)

Source: Trading View

Source: Trading View

PepeCoin started as a meme but turned into a powerful symbol of community strength. What began as internet humor has transformed into a major digital asset backed by loyal supporters. The 2025 rebound showed how quickly enthusiasm can lift meme tokens when the crowd unites. Influencers and traders continue to spotlight PepeCoin, fueling growing interest. Many investors believe another hype cycle could push the token to new highs. If market trends repeat the meme coin craze of 2021, PepeCoin could deliver huge short-term gains. The token carries high risk, but the reward potential remains impressive. For investors willing to embrace volatility, PepeCoin represents a bold yet exciting bet heading into 2026.

Cardano (ADA)

Source: Trading View

Source: Trading View

Cardano continues to be one of the most esteemed blockchain initiatives in the sector.Years of scientific study have established a framework that prioritizes speed, safety, and sustainability. In 2025, the introduction of the Hydra upgrade significantly enhanced Cardano’s functionality by boosting transaction capacity and reducing fees. Developers are persistently creating decentralized applications and DeFi platforms on the Cardano network, maintaining consistent demand for ADA tokens. Analysts see the existing trading range around $0.63 as a solid entry opportunity for long-term investors. When market sentiment turns positive, Cardano could readily surpass the $1 threshold and target new peaks. For investors looking for a harmonious blend of stability and growth, Cardano presents strong promise for 2026.

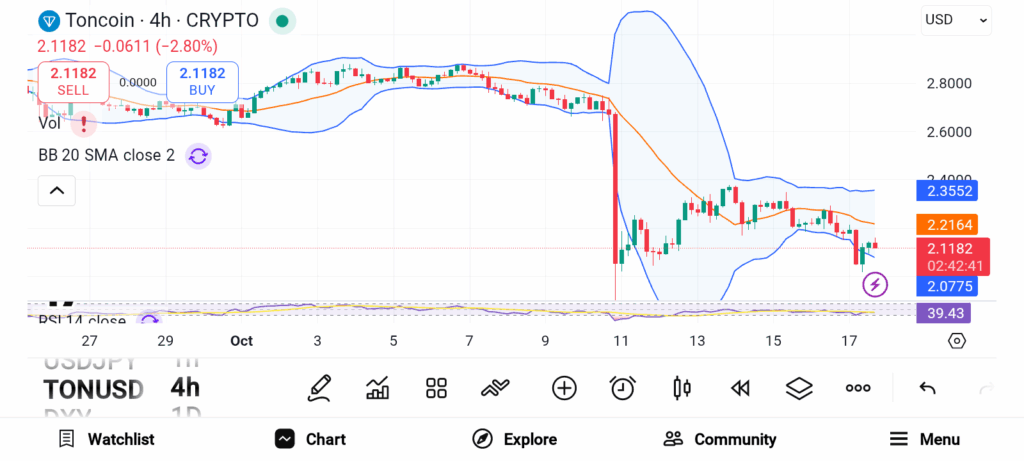

Toncoin (TON)

Source: Trading View

Source: Trading View

Toncoin is distinctive for one primary reason—its connection with Telegram, a service utilized by more than 900 million users. This connection provides Toncoin with unparalleled visibility and availability. Telegram users have the ability to discover games, applications, and Web3 services powered by Toncoin directly within the platform. The blockchain operates on an exclusive multi-tier sharding framework that handles numerous transactions simultaneously, enhancing speed and efficiency. Despite encountering regulatory challenges years back, the community sustained its vitality and success. Currently, Toncoin takes advantage of Telegram’s extensive global presence, providing it with a significant advantage in adoption.

PepeCoin, Cardano, and Toncoin showcase the variety of possibilities within the crypto space. Every project targets a distinct audience while exhibiting significant potential for growth. PepeCoin leverages community enthusiasm, Cardano develops via innovation, and Toncoin flourishes through social connectivity.