BlockDAG Leads Chainlink, Hyperliquid & Cardano as the Top Altcoin to Watch in 2025

Every crypto cycle delivers a few clear winners that capture the market’s energy, and 2025 is no different. This year is about real products, transparent teams, and technology that delivers. With attention shifting away from hype and speculation, the market is focusing on coins that have proven traction and lasting use cases.

Points Cover In This Article:

ToggleThis lineup highlights the top altcoin to watch in 2025 based on credibility, technology, and adoption. From hybrid consensus mechanisms to real-time oracle networks and advanced DeFi infrastructure, BlockDAG (BDAG) , Chainlink, Hyperliquid, and Cardano all represent distinct innovations. Yet, one project clearly stands ahead of the pack.

BlockDAG (BDAG): Where High Speed Meets Real Security

What makes BlockDAG stand out is its hybrid framework that combines Proof-of-Work security with a Directed Acyclic Graph (DAG) architecture. This structure allows up to 15,000 transactions per second while maintaining the reliability and decentralization of Bitcoin. The live Awakening Testnet, compatible with the Ethereum Virtual Machine, lets developers deploy decentralized apps at high speed and low cost.

Moreover, BlockDAG goes LIVE on Binance this Friday, October 24, at 3 PM UTC for an exclusive AMA unveiling updates ahead of Keynote 4: The Launch Note and GENESIS DAY. The event marks a milestone for its $430M+ ecosystem. Buyers can still grab BDAG at $0.0015 in Batch 31 using code “TGE” to boost rewards before the dashboard upgrade and price rise. Secure your spot before this global showcase ignites the next wave of momentum.

Outside the code, BlockDAG is earning credibility through verified audits from CertiK and Halborn, a visible leadership team led by CEO Antony Turner, and a global partnership with the BWT Alpine F1® Team . With transparency, working technology, and brand strength, BlockDAG isn’t just promising progress; it’s proving it, making it the top altcoin to watch in 2025.

2. Hyperliquid: Reinventing DeFi Through Derivatives

Hyperliquid is rewriting how decentralized finance operates with its new HIP-3 upgrade, allowing builders to create perpetual futures markets by staking 500,000 HYPE coins, valued at around $20 million. This change makes Hyperliquid a truly permissionless platform where users can customize trading systems, fees, and leverage models.

The project is also supported by a $645 million token buyback program, reflecting strong confidence in its future. Daily trading volume has crossed $836 million, showing high user engagement, while 21Shares has filed for a 2× leveraged HYPE ETF, signaling institutional interest. With these developments, Hyperliquid continues to secure its place among the top altcoins to watch in 2025 for anyone tracking DeFi’s next evolution.

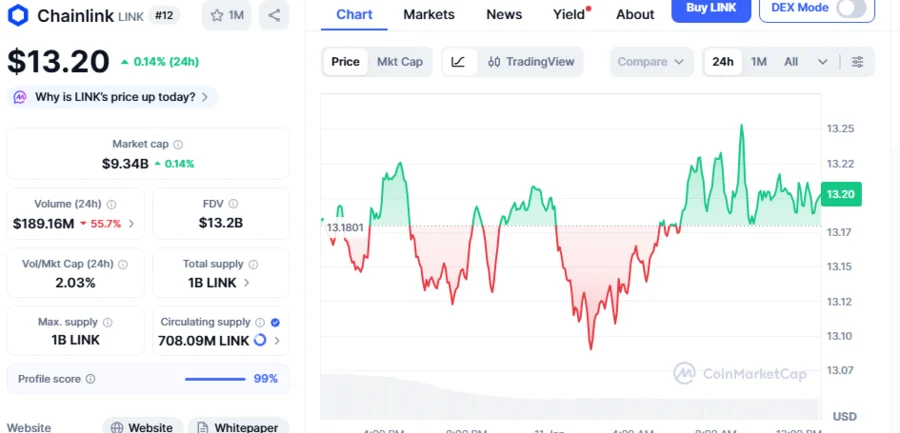

3. Chainlink: Powering Data for the Decentralized Future

Chainlink continues to set the pace in connecting real-world data to blockchain networks. Its latest integration on MegaETH enables sub-millisecond oracle feeds, a breakthrough that boosts DeFi performance and reliability. This update moves Chainlink closer to bridging traditional finance with blockchain applications.

Chainlink’s collaboration list includes major players such as the U.S. government and GLEIF for on-chain identity verification, highlighting its growing relevance in regulated environments. Despite a 9% dip, LINK is trading near $16.87 and still maintains strong fundamentals. Its expansion into real-world asset feeds, compliance protocols, and institutional partnerships ensures Chainlink remains one of the top altcoins to watch in 2025, driven by technology and trust.

4. Cardano: Building a Scalable & Sustainable Network

Cardano’s growth strategy remains deliberate but effective. Its Hydra layer-2 solution is steadily improving scalability, and reports confirm enhanced performance throughout 2025. Although ADA’s price sits between $0.50 and $0.60, on-chain data shows increased retail accumulation despite large holders selling roughly 180 million ADA.

Capital inflows are at a three-month high, indicating revived confidence. Analysts forecast a potential 60% rebound if broader market conditions stabilize. With its focus on sustainability, governance, and scaling, Cardano’s ongoing developments and community engagement ensure its continued inclusion among the top altcoin to watch in 2025.

Identifying the Top Altcoin to Watch in 2025

The 2025 crypto scene is proving that the strongest projects are those that deliver. Each of these names, BlockDAG, Chainlink, Hyperliquid, and Cardano, stands for a unique strength: scalability, interoperability, DeFi innovation, and governance. Together, they illustrate how blockchain is maturing beyond speculation into lasting use.

Still, BlockDAG is in a class of its own. With $430M+ raised, verified audits, and a live hybrid network, it’s showing what true execution looks like. For anyone searching for the top altcoin to watch in 2025 , BlockDAG represents measurable progress, real-world relevance, and sustainable growth.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Iran’s Covert Cryptocurrency Transfers Bypass Sanctions

Is Chainlink Heading To $18? Analyst Points Out A Range-Bound Pattern Suggesting 36.3% LINK Rally Amid Growing Buying Pressure

Dan Ives: Massive AI Investments Mark Only the Beginning of the ‘Fourth Industrial Revolution’

Borderlands Mexico: Flexport cautions importers that tariff concerns will remain prominent in 2026