Bitcoin Price Faces Rising Weakness, Struggling Around $108,000

Bitcoin weakens near $108,000 as bearish sentiment deepens. With key cost-basis levels lost, BTC risks falling toward $105,000 unless it reclaims $110,000 soon.

Bitcoin (BTC) continues to struggle with recovery after failing to maintain momentum above key support levels. The crypto king’s inability to reclaim lost ground highlights growing structural weakness across the market.

Recent data suggest that bearish sentiment is intensifying, as multiple on-chain and volatility metrics reveal deteriorating investor confidence.

Bitcoin May See Some Resistance

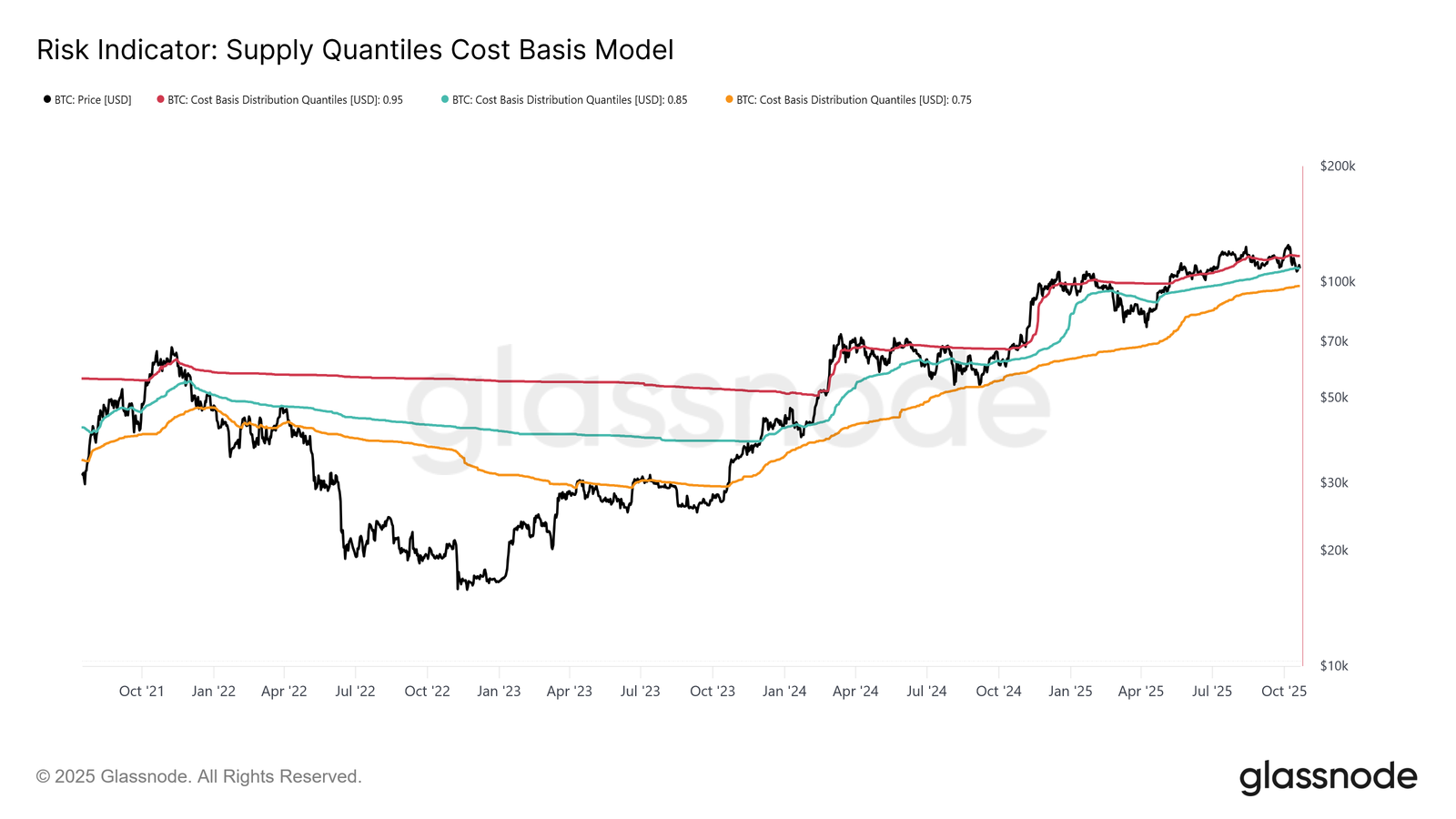

The Supply Quantiles model indicates increasing bearishness in Bitcoin’s short-term outlook. This framework tracks cost-basis levels across quantiles—specifically the 0.95, 0.85, and 0.75 thresholds—representing portions of supply held at a loss. Bitcoin currently trades below the short-term holder cost basis of $113,100, which shows that the stress faced by recent buyers amid persistent market headwinds.

More concerning, BTC remains under the 0.85 quantile at $108,600. Historically, losing this level has hinted at structural weakness and eventual broader corrections. Going forward, if the pattern holds, Bitcoin could retest the 0.75 quantile near $97,500. This alignment suggests that sellers may dominate the near term as market resilience continues to fade.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Bitcoin Supply Quantiles. Source;

Glassnode

Bitcoin Supply Quantiles. Source;

Glassnode

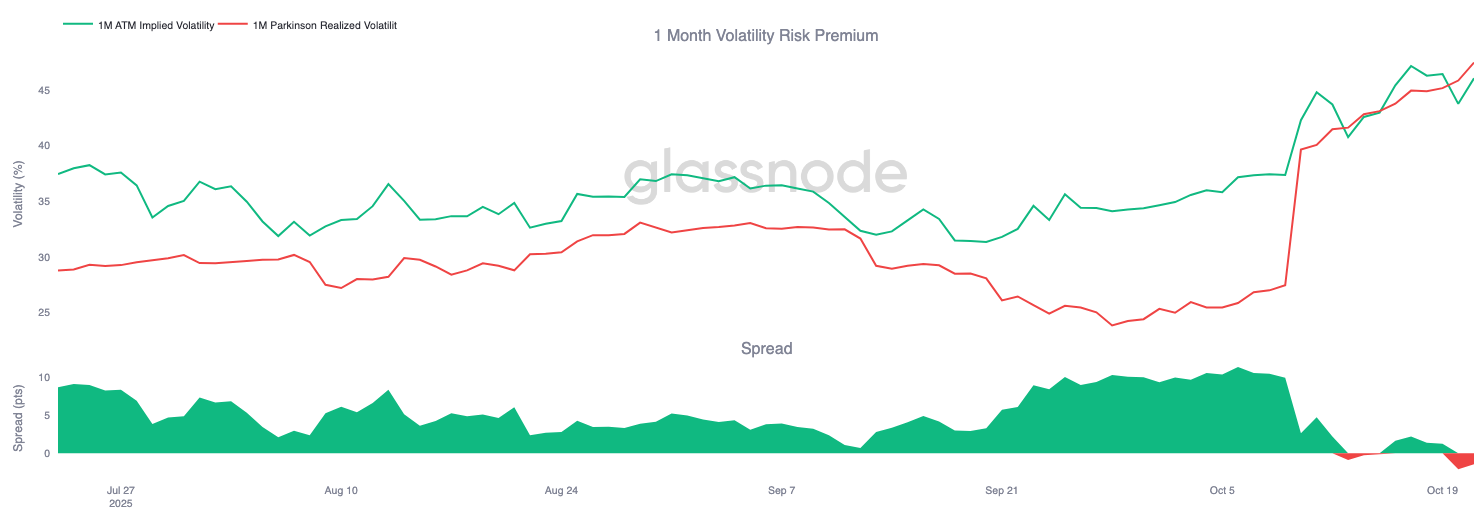

Bitcoin’s macro momentum is showing cracks as volatility conditions shift. The 1-Month Volatility Risk Premium—the difference between implied and realized volatility—has turned negative for the first time in four months. This signals the end of a stable, low-volatility phase that previously favored passive income strategies for options sellers.

As volatility returns, short-gamma positions face increased pressure. This transition from complacency to reactivity suggests that larger swings may be ahead, potentially amplifying Bitcoin’s ongoing struggle to regain stability above key technical levels.

Bitcoin Volatility Risk Premium. Source;

Glassnode

Bitcoin Volatility Risk Premium. Source;

Glassnode

BTC Price Could Note a Dip

Bitcoin trades at $108,772 at press time, holding marginally above the $108,000 support. However, repeated failures to recover beyond this threshold highlight fragile market sentiment and persistent hesitation among institutional and retail participants alike. Moreover, the lack of strong buying activity suggests that confidence in a short-term rebound remains limited.

At the same time, if bearish momentum continues, Bitcoin’s price could break below $108,000 and test $105,585 or even $105,000. Consequently, such a decline would deepen investor losses and confirm near-term downside risks, thereby reinforcing the current corrective phase.

Bitcoin Price Analysis. Source:

TradingView

Bitcoin Price Analysis. Source:

TradingView

However, if Bitcoin maintains support at $108,000 and bounces, a relief rally toward $110,000 could follow. A sustained move above this resistance would pave the way for a climb toward $112,500, potentially invalidating the bearish outlook.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?