HYPE Rises 8% as Hyperliquid Strategies Seeks $1 Billion to Grow Token Treasury

Hyperliquid Strategies’ $1 billion plan marks a major step in corporate crypto adoption. As HYPE gains momentum through buybacks and institutional demand, the upcoming token unlocks will test the project’s resilience and investor confidence.

Hyperliquid Strategies has filed a Form S-1 registration statement with the US Securities and Exchange Commission (SEC) seeking to raise up to $1 billion. The firm is looking to expand its Hyperliquid (HYPE) token treasury amid growing institutional demand.

The move highlights a shift among public companies, which now increasingly prioritize crypto treasury assets and protocol participation in their strategies.

Public Companies and the HYPE Treasury Play

For context, Hyperliquid Strategies was established as part of a proposed merger between Nasdaq-listed Sonnet BioTherapeutics Holdings Inc. and Rorschach I LLC, a special purpose acquisition company (SPAC). The combined entity aims to build a digital-asset treasury focused on the HYPE token.

The merger remains pending but is anticipated to be finalized before the end of the year. Moreover, the company has applied to list its shares on the Nasdaq under a new ticker.

“There is presently no public market for our Common Stock. We have applied to have our Common Stock listed on the Nasdaq Capital Market under the symbol ‘PURR.’ No assurance can be given that our application will be approved,” the S-1 reads

Under its newly filed registration statement, the firm intends to offer up to 160 million shares of common stock, potentially raising up to $1 billion through a committed equity facility with Chardan Capital Markets LLC.

Hyperliquid Strategies plans to use potential proceeds for general corporate purposes, including possible purchases of the HYPE token. The firm already holds approximately 12.6 million HYPE.

“We intend to use any net proceeds from any sales of shares of our Common Stock to Chardan under the Facility for general corporate purposes, including potential purchases of HYPE Tokens, following the consummation of the Business Combination,” thefirm noted.

Now, Hyperliquid Strategies joins firms like Eyenovia and Lion Group Holding, which have also integrated HYPE into their balance sheets.

HYPE Token Buybacks, Unlocks, and Market Sentiment

Meanwhile, the announcement boosted HYPE’s momentum. BeInCrypto Markets data showed that the altcoin has outperformed all top 20 coins over the past 24 hours. Its value has risen more than 8%. At press time, HYPE traded at $38.26.

Hyperliquid (HYPE) Price Performance. Source:

Hyperliquid (HYPE) Price Performance. Source:

Besides institutional interest, the protocol’s own initiatives have also supported the price. BeInCrypto recently reported that Hyperliquid has been dominating the 2025 protocol buyback trend.

These buyback programs reduce selling pressure and signal a long-term commitment to the ecosystem. So far, the project has spent more than $644.64 million in revenue and bought back 21.36 million HYPE tokens.

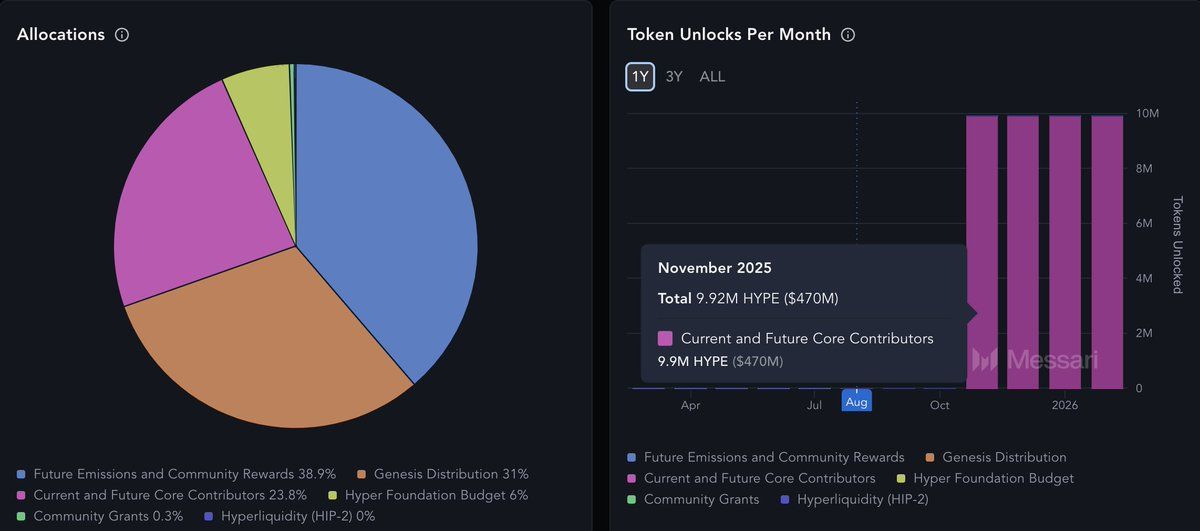

Nonetheless, while buybacks can boost user trust and price, the market now watches the impact of new token unlocks. Starting in November, approximately 10 million HYPE will unlock each month, ending in October 2027.

Typically, an increase in supply triggers market volatility and could lead to potential downward pressure.

HYPE Unlock Schedule. Source:

HYPE Unlock Schedule. Source:

Still, analysts remain optimistic about HYPE’s prospects, highlighting confidence in the protocol.

“The team unlock in November is the most bullish event of Q4 for HYPE. Jeff is based, there’s no chance he’ll start dumping his HYPE on the market. relock? staking? Whatever the decision, it will be beneficial in the short/long term,” an analyst wrote.

Another analyst corroborated this sentiment, noting that the Hyperliquid team is focused on long-term growth.

“Unlocks will pass, and people will realize the HL team are in fact playing long term games,” the analyst added.

Thus, while upcoming token unlocks could test short-term sentiment, the project’s strong buyback activity and institutional momentum suggest continued confidence in HYPE’s long-term potential.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?