uniBTC Is Now Live on Rootstock: Unlock New BTC Yield and DeFi Opportunities

Bedrock’s Bitcoin liquid restaking token, uniBTC, is now live on Rootstock — a Bitcoin Layer 2 built for DeFi, combining Bitcoin security with EVM compatibility. With its native token RBTC pegged 1:1 to BTC and its thriving DeFi ecosystem, Rootstock allows Bitcoin to move beyond being just digital gold — and start working for you.

Now, with Bedrock, you can earn rewards and restake your BTC directly on Rootstock by minting uniBTC, unlocking yield across multiple DeFi integrations while keeping your Bitcoin liquid and secure.

Why Rootstock?

Rootstock (RSK) is the most battle-tested and secure Bitcoin Layer 2, built to extend Bitcoin's utility while preserving its integrity.

-

Merge-Mined with BitcoinSecured by over 50% of Bitcoin’s hashrate through merge mining, Rootstock inherits the security of Bitcoin itself.

-

EVM CompatibleDeploy Ethereum smart contracts, use MetaMask, and interact with dApps just like on Ethereum — but with BTC.

-

Low Gas FeesRootstock brings low transaction costs with faster confirmation times, making it efficient for restaking and DeFi.

With Bedrock now live on Rootstock, uniBTC holders can tap into new yield opportunities across the Rootstock DeFi ecosystem — from lending and LPing to upcoming protocols launching with Bedrock integrations. Users will also be able to participate in exclusive campaigns and incentive programs on Rootstock.

Follow this step-by-step guide to get started:

1. To start liquid staking your Bitcoin, visit the uniBTC page on Bedrock dApp .

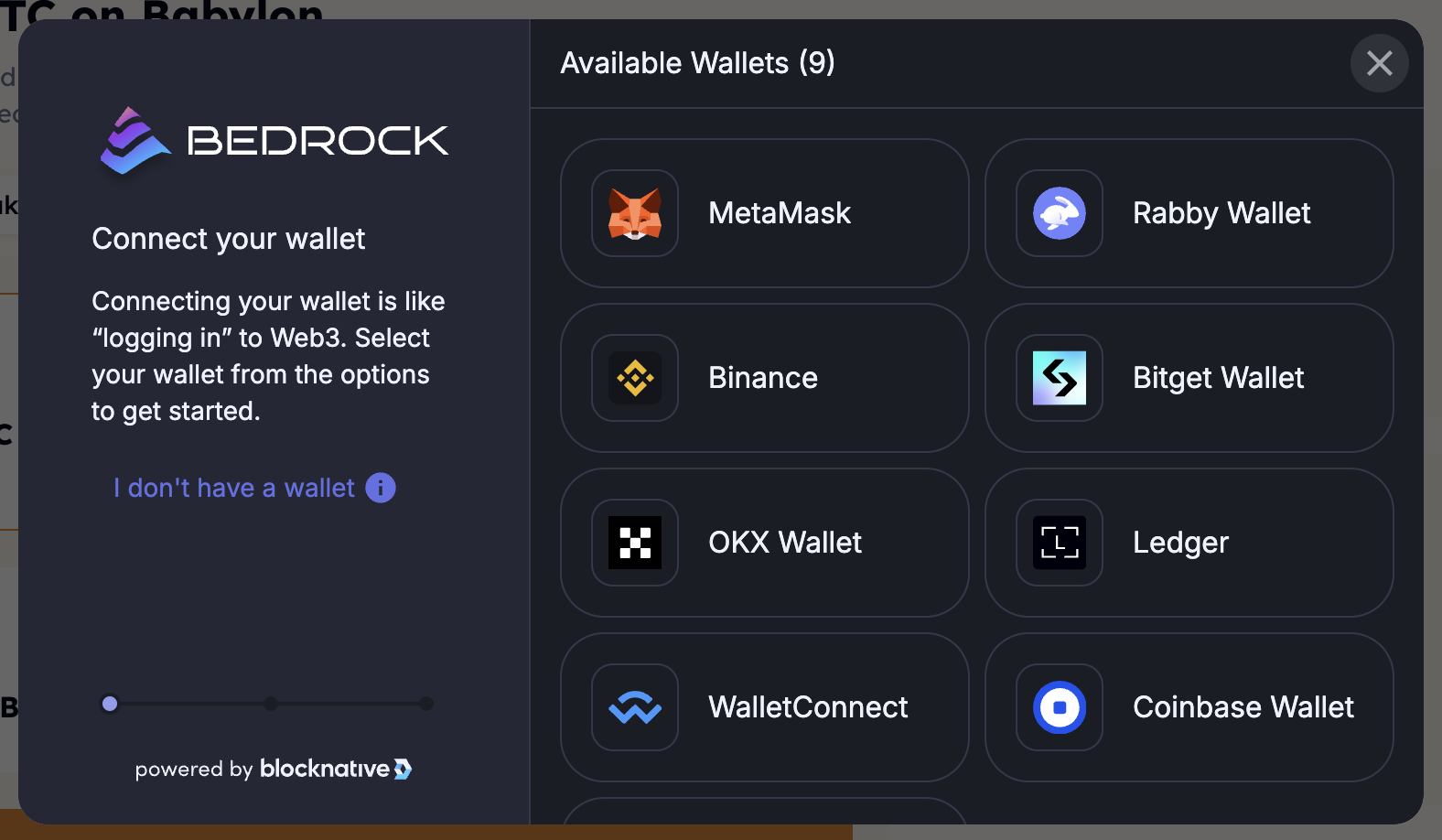

2. Click 'Connect Wallet' at the top of the page to link your preferred wallet (MetaMask in this tutorial) to the dApp.

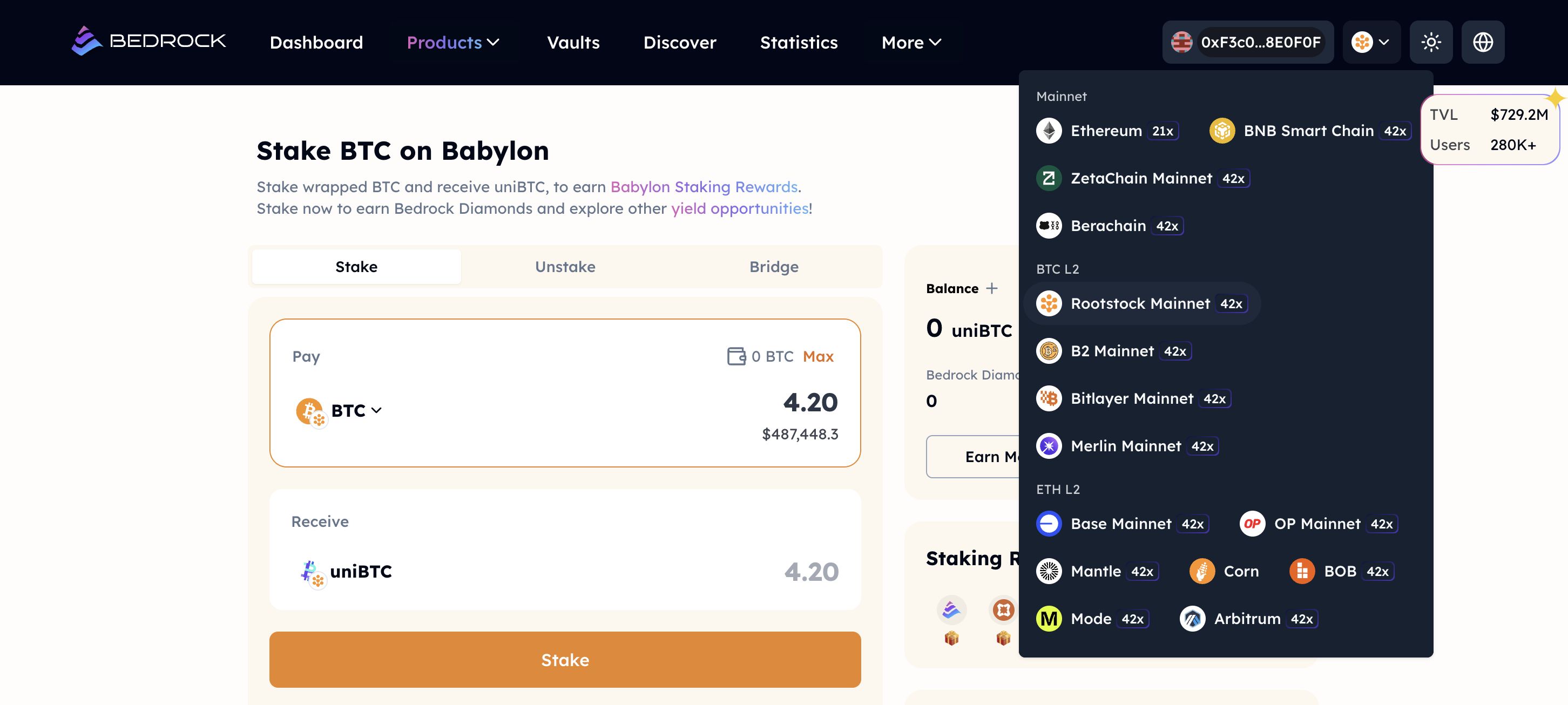

3. Select the Rootstock Mainnet using the dropdown menu on the top right of the page.

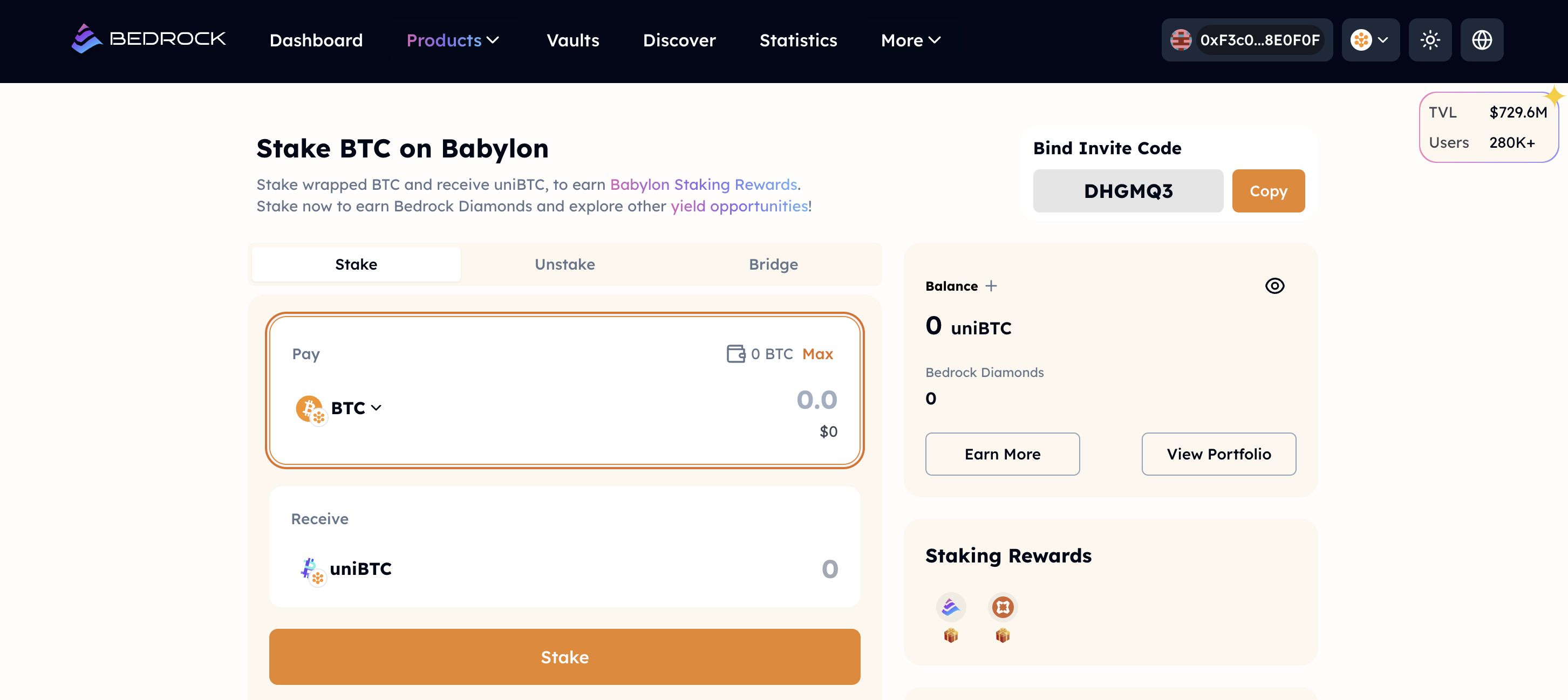

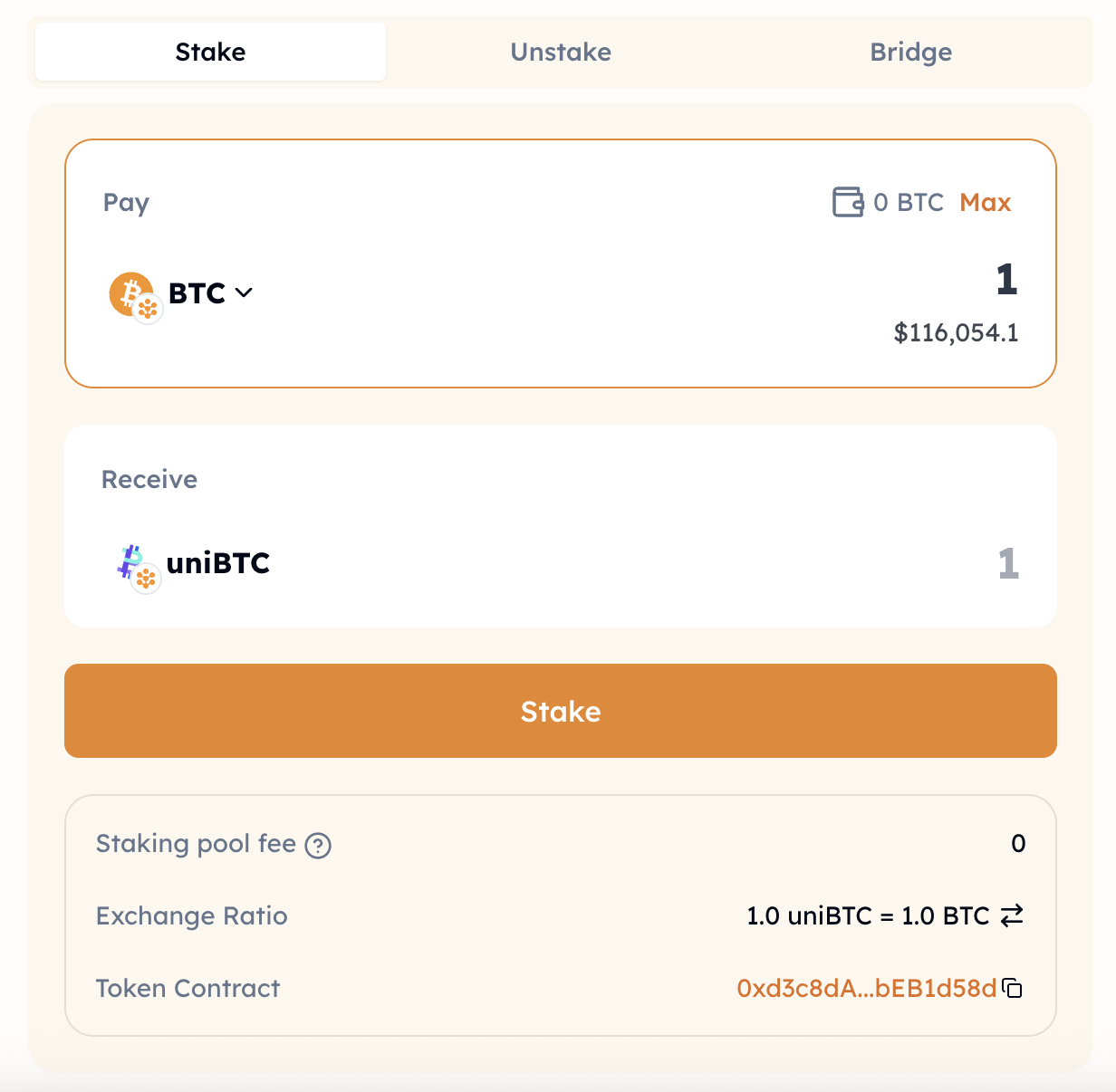

4. Enter the amount of BTC on Rootstock you would like to Liquid Restake in the input box and click on Stake.

5. Click on the stake button once confirming that all amounts input are correct. Additionally, the uniBTC contract on Rootstock can be viewed via the contract address shown.

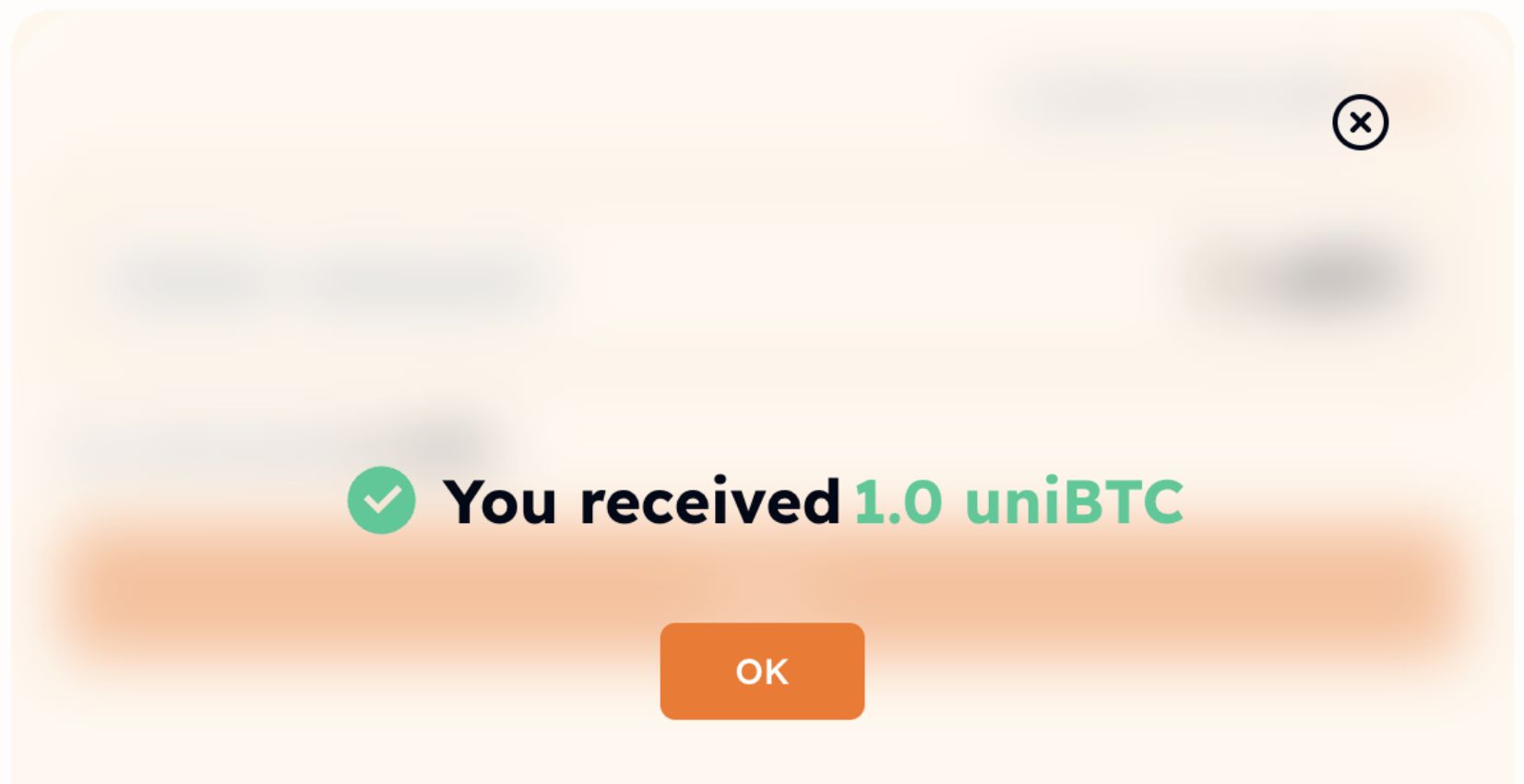

6. Confirm and sign related transactions on your wallet. Once the transaction has been confirmed, you will receive your corresponding amount of uniBTC.

If you already hold uniBTC on another chain, you can bridge it directly to Rootstock via Free.

Token Information

-

RBTC (Rootstock Bitcoin)0xf3981eb22c6583abe769a1cbe15a0ba71f7c67b1 (Rootstock’s 1:1 BTC peg — used for gas and transactions)

-

uniBTC (Bedrock’s Liquid Restaked BTC)0xd3c8dA379d71a33BfEE8875F87Ac2748bEB1d58d (Earn Diamonds, Babylon Points, and cross-chain yield)

About Bedrock

Bedrock is the first multi-asset liquid restaking protocol, pioneering Bitcoin staking with uniBTC. As the leading BTC liquid staking token, uniBTC enables holders to earn rewards while maintaining liquidity, unlocking new yield opportunities in Bitcoin's $1T market. With a cutting-edge approach to BTCFi 2.0, Bedrock is redefining Bitcoin's role in DeFi, while integrating ETH and DePIN assets into a unified PoSL framework.

BR is the native utility and governance token of Bedrock, powering incentives, emissions, and staking across the PoSL ecosystem. It is also listed as one of Binance Alpha tokens.

Official Links

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Five charts to help you understand: Where does the market go after each policy storm?

After this regulatory crackdown, is it a harbinger of an impending downturn, or the beginning of a new cycle where all negative news has been fully priced in? Let’s examine the trajectory after the storm through five key policy milestones.

Mars Morning News | The crypto market rebounds across the board, Bitcoin rises above $94,500; The "CLARITY Act" draft is expected to be released this week

The crypto market has fully rebounded, with bitcoin surpassing $94,500 and US crypto-related stocks rising across the board. The US Congress is advancing the CLARITY Act to regulate cryptocurrencies. The SEC chairman stated that many ICOs are not securities transactions. Whales are holding a large number of profitable ETH long positions. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model is still being iteratively updated.

Federal Reserve’s Major Shift: From QT to RMP, How Will the Market Transform by 2026?

The article discusses the background, mechanism, and impact on financial markets of the Federal Reserve's introduction of the Reserve Management Purchases (RMP) strategy after ending Quantitative Tightening (QT) in 2025. RMP is regarded as a technical operation aimed at maintaining liquidity in the financial system, but the market interprets it as a covert easing policy. The article analyzes RMP's potential effects on risk assets, the regulatory framework, and fiscal policy, and provides strategic recommendations for institutional investors. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still in the process of iterative improvement.

Rate Hike in Japan: Will Bitcoin Resist Better Than Expected?