Will Rising Inflation Spark a WLFI Comeback or Sink It Further?

The upcoming CPI data showing inflation rising to a 17-month high could shake the crypto market — and WLFI (World Liberty Financial) is sitting right on the edge of a potential trend reversal. Let’s break down what this means for WLFI’s price and where the chart might be heading next.

Inflation Pressure Returns: What Does It Mean for WLFI Price Prediction?

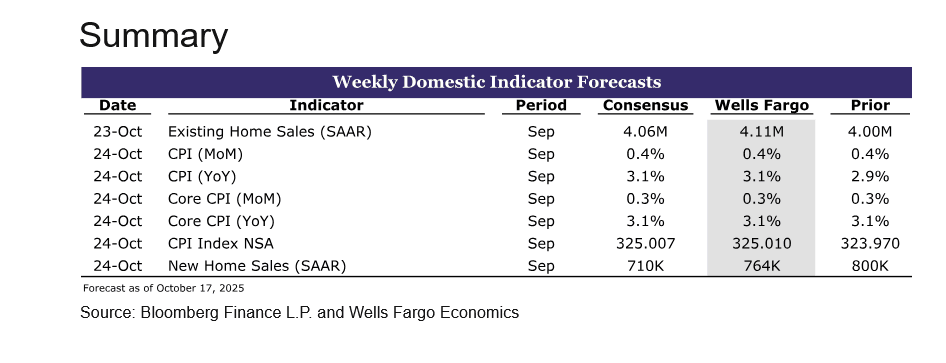

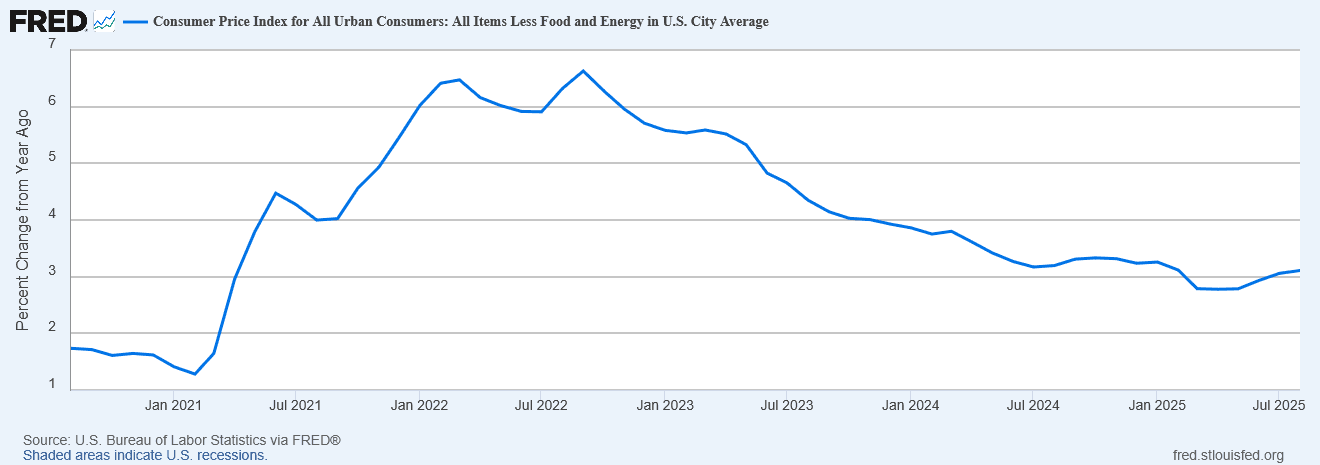

Forecasts suggest that the Consumer Price Index jumped 3.1% year-over-year, its highest level since May 2024. Tariffs introduced by President Trump have pushed prices higher, reversing months of cooling inflation. Normally, higher inflation tightens financial conditions — but this time, the Fed looks set to cut interest rates again, prioritizing job stability over price control.

That paradox — higher inflation with easier policy — could become a short-term catalyst for risk assets like WLFI. Investors often move toward digital assets when real yields fall or the dollar weakens, and early rate cuts tend to trigger liquidity rotations into speculative markets. WLFI price action suggests it’s already positioning for that possibility.

WLFI’s Technical Setup: Bottoming Out or False Hope?

WLFI/USD Daily Chart- TradingView

WLFI/USD Daily Chart- TradingView

Looking at the daily chart, WLFI price trades near $0.14, up roughly 4.8% on the day, but still far below its September levels near $0.30–$0.35. The Bollinger Bands have narrowed sharply, indicating volatility compression — a setup that often precedes large directional moves.

Price candles have flattened just above the lower Bollinger Band ($0.09–$0.10), signaling that selling pressure has likely exhausted. The latest green Heikin Ashi candle crossing above the 20-SMA mid-band around $0.15 shows early attempts to reclaim momentum. If WLFI can hold above this level, we may see a slow transition from a bearish drift to an accumulation phase.

Support lies near $0.098, with a stronger demand zone between $0.08–$0.10 — where previous panic selling stabilized. Resistance stands at $0.19–$0.20, aligning with the upper Bollinger Band. A daily close above this range could flip sentiment toward bullish continuation.

Market Psychology: Fear May Be Peaking

The broader crypto market has been cautious ahead of the CPI release. Traders fear that higher inflation could delay liquidity easing. But the narrative could flip instantly if the Fed proceeds with its expected October rate cut despite the inflation print.

In that case, World Liberty Financial chart suggests a volatility spike to the upside. The low volume drift since early October reflects indecision, not conviction. Once direction returns, the move could be sharp — and traders positioned early near current levels might capture that breakout.

Short-Term WLFI Price Prediction: Sideways to Bullish Bias

Given the macro setup and chart structure, WLFI price appears poised for a technical rebound toward $0.18–$0.20 if inflation data doesn’t shock markets beyond expectations. Any dovish tone from the Fed could extend that move toward $0.25, reclaiming lost ground from late September.

Conversely, if inflation overshoots and markets fear a delayed rate cut, WLFI price could revisit $0.10 support, but a breakdown below that seems unlikely without fresh selling triggers.

WLFI Price Prediction: Macro Repricing May Work in WLFI’s Favor

The inflation spike may not be all bad news. The Fed’s pivot toward growth support could mark the start of a new liquidity cycle that benefits high-beta assets. World Liberty Financial, being a relatively low-cap token, tends to respond dramatically to liquidity inflows.

The technical pattern looks similar to early accumulation structures seen before previous crypto rallies — prolonged compression, flat candles, and narrowing volatility bands. If global yields soften through Q4, WLFI price could stage a late-2025 recovery toward the $0.30 zone, potentially doubling from current prices.

WLFI Price at a Turning Point

WLFI’s chart is quietly setting up for a breakout while macro forces swirl. Inflation data might jolt markets temporarily, but policy easing remains the stronger force beneath the surface. If WLFI holds above $0.13 and volume picks up, the odds favor an upward breakout by early November.

For now, the key is patience — watch how the next CPI print and Fed decision align. Together, they’ll decide whether $WLFI begins its next leg higher or slips back into another consolidation trap

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Crypto cards have no future

Having neither the life of a bank card nor the problems of one.

MiCA regulation poorly applied within the EU, ESMA ready to take back control

$674M Into Solana ETF Despite Market Downturn