Solo Bitcoin miner scores $347K — 'pure self-soverignty in action'

A solo Bitcoin miner has become the latest lucky person to win the “Bitcoin mining lottery,” pocketing a $347,455 block reward.

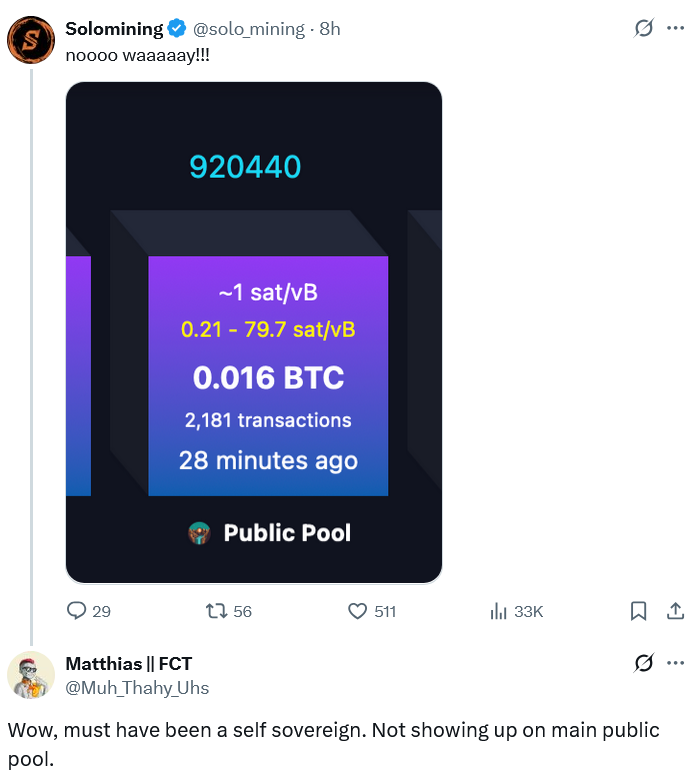

Bitcoin node infrastructure company Umbrel said the solo miner won the block via the Public Pool Bitcoin mining pool — earning the 3.125 Bitcoin (BTC) block reward and a 0.016 BTC transaction fee on top.

It took place at block height 920,440, on Thursday at 7:32pm UTC, Mempool.space data shows.

While solo Bitcoin miners winning blocks isn’t uncommon, this one was more impressive as the miner secured the block entirely on their own by running a solo mining pool as opposed to the more common practice of pooling hash power with others.

“No middlemen. No third-parties. Just pure self-sovereignty in action,” Umbrel said, while the Bitcoin Bazaar X account added:

“A solo block has been mined by a solominer, mining on his own mining pool, hosted on an Umbrel Server. Total sovereignty. We need more of this.”

Source: Matthias

Solo Bitcoin mining is a win for decentralization

The increase in solo Bitcoin miners solving blocks is a good thing for Bitcoin’s decentralization as it gives smaller miners a better chance to compete against the large industrial-scale miners, many of which are publicly traded.

Pocket-sized Bitcoin miners are still cheaper than iPhones

It comes amid a rise in smaller-sized Bitcoin miners, such as Bitaxes in recent years, which sell from $155 to over $600, depending on the machine’s terahash-per-second capacity.

Related: Trump on CZ pardon: I’m told ‘what he did is not even a crime’

While the pocket-sized machines combined only contribute a small boost to Bitcoin’s hash rate, many of these machines have been open-sourced to fight the “secrecy and exclusivity” of larger Bitcoin miners, which typically use the closed-sourced Bitcoin ASICs, a BitMaker spokesperson told Cointelegraph in 2023.

Magazine: Mysterious Mr Nakamoto author: Finding Satoshi would hurt Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Netflix’s co-CEO talked about the Warner Bros. agreement with Trump

Short the Prediction Market

Mean Reversion of the Super Cycle of Speculation

Timeless Insights on Investing from 1927: How Human Behavior Continues to Shape Market Outcomes

- McNeel’s 1927 treatise and Buffett’s strategies emphasize intrinsic value and emotional discipline, countering market volatility through long-term focus. - Behavioral finance validates their approach, showing emotional biases like panic selling distort valuations during crises, while disciplined investors capitalize on dislocations. - Compounding through retained earnings, exemplified by Berkshire Hathaway’s Apple investments, highlights patience’s role in outperforming reactive market timing. - Modern v

Vitalik Buterin's Promotion of ZK Technology and the Prospects for DeFi: An In-Depth Strategic Investment Review

- Vitalik Buterin is driving blockchain's ZK-DeFi convergence, prioritizing scalability and privacy as Ethereum's core upgrades. - His GKR protocol accelerates ZK verification tenfold, while hybrid ZK-FHE/TEE solutions enhance security for voting and governance. - ZK rollups now process 15,000-43,000 TPS, with institutions like Deutsche Bank adopting them for compliance and supply chain transparency. - The $7.59B ZKP market (22.1% CAGR) and $237B DeFi TVL highlight ZK's role in enabling institutional-grade