Pi Coin Recovers as 10 Million Tokens Exit Exchanges and KYC Rollout Boosts Confidence

Pi Coin shows early signs of recovery as investors withdraw millions of tokens from exchanges following Pi Network’s major KYC breakthrough. The update strengthened user confidence, but looming token unlocks could test the sustainability of this rebound.

Pi Coin (PI) has recorded a modest price increase over the past 24 hours as selling pressure continues to subside. Recent data indicates that nearly 10 million PI were withdrawn from exchanges in October.

The shift comes amid Pi Network’s latest authentication update, a key milestone aimed at enhancing user verification and ecosystem security. The rollout appears to have strengthened community confidence, driving a notable outflow of tokens from exchanges.

What’s Behind Pi Coin’s Price Recovery?

BeInCrypto Markets data showed that over the past 24 hours, the mobile-mined cryptocurrency has seen a 0.91% uptick in value. At press time, it was trading at $0.20.

Pi Coin Price Performance. Source:

BeInCrypto Markets

Pi Coin Price Performance. Source:

BeInCrypto Markets

While the broader trend for PI still remains bearish, the latest uptick highlights that the altcoin is gaining modest momentum. But what’s behind this rise?

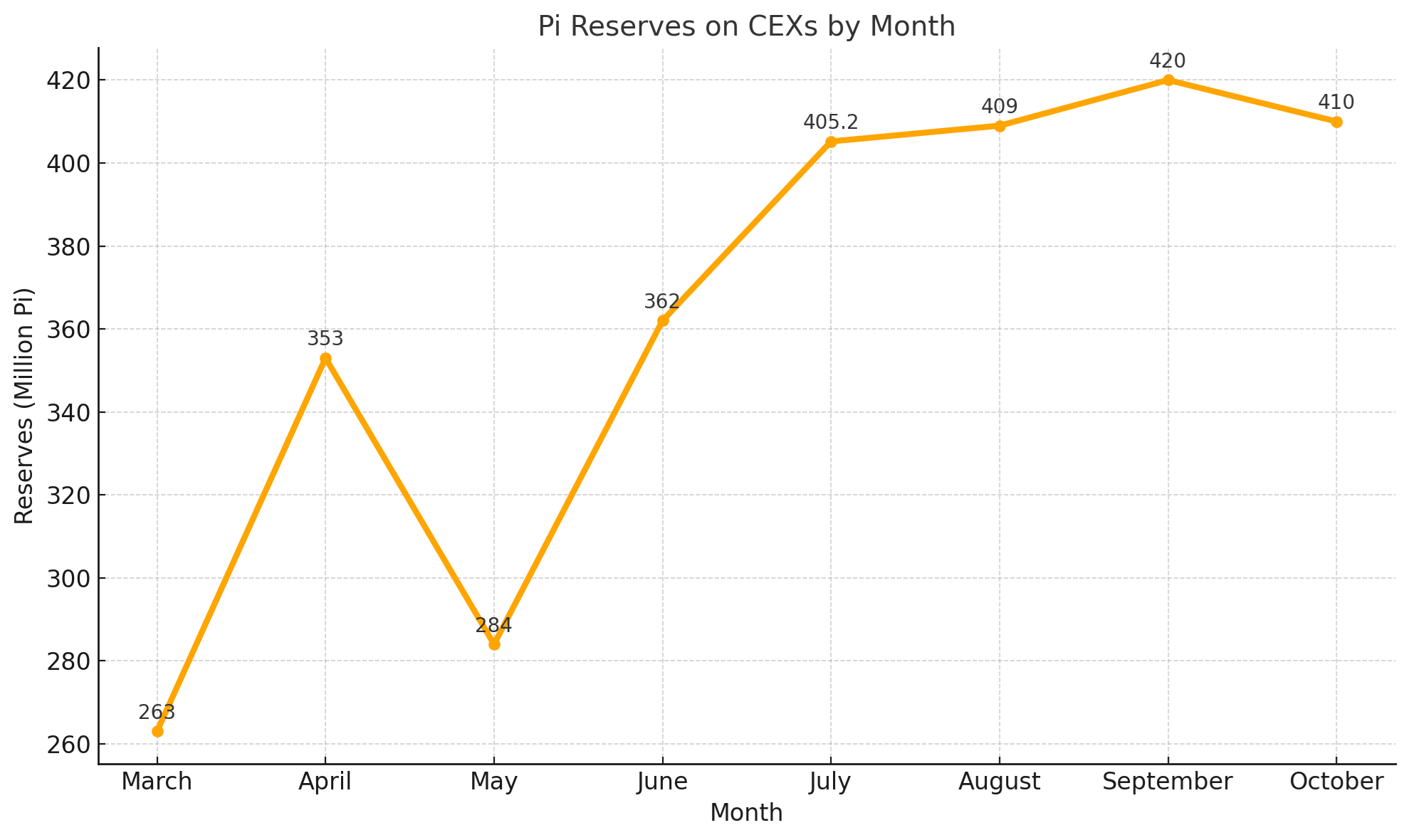

Well, PiScan data showed that over 2.6 million Pi Coins have left exchanges over the past 24 hours. Overall, in October, users withdrew nearly 10 million tokens from exchanges. As a result, centralized exchange supply dropped to 410 million, down from 420 million in September, according to BeInCrypto’s September analysis.

PI Exchange Reserves. Source: Data Curated by BeInCrypto

PI Exchange Reserves. Source: Data Curated by BeInCrypto

When coins move off exchanges, it generally means holders don’t intend to sell soon. Traders and investors usually withdraw to hold long-term, indicating rising confidence in the asset’s future price.

The change in sentiment is not without reason. It comes amid a resolution of verification challenges, leading to renewed optimism.

KYC Breakthrough Boosts Confidence In The Pi Network

After repeated complaints from users, Pi Network took a major step forward in its compliance infrastructure. The project launched a new automated system process designed to review and finalize tentative Know Your Customer (KYC) cases.

In its latest blog post, the team announced that the rollout led to the full verification of over 3.36 million additional Pioneers. Out of the newly verified accounts, around 2.69 million Pioneers have already migrated to the Pi Mainnet blockchain. Furthermore, the new process made 4.76 million Tentative KYC’d Pioneers eligible for full verification.

“This large-scale system process includes complex mechanisms using advanced AI models and analyzing large datasets from liveness checks and KYC application data. It is designed to analyze Tentative KYC cases to verify both that each applicant is a real, living person and that their application passes the additional checks required to fully pass KYC,” the blog reads.

This improved approach strengthens digital compliance and energizes the Pi Network for wider engagement. While confidence in network integrity rises, risks for PI remain.

Over 121 million tokens will be unlocked in the next 30 days, increasing the chance of supply shocks. Thus, the coming weeks will reveal whether Pi Network’s compliance and accumulation sustain positive momentum or if broader headwinds will challenge price stability again.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation