AI-blockchain industry sidesteps courtroom battle through $120M token settlement

- Fetch.ai and Ocean Protocol agree to return 286M FET tokens ($120M) to resolve a 2024 merger dispute, avoiding legal action and restoring trust in AI-blockchain governance. - The feud arose after Ocean Protocol allegedly converted 661M OCEAN tokens into FET and transferred 160M to Binance and 109M to GSR Markets, which Fetch.ai accused of misappropriation. - Ocean Protocol denied wrongdoing, blaming FET's 93% price drop on market volatility and other alliance members' sales, while criticizing Fetch.ai fo

The prolonged disagreement between Fetch.ai and Ocean Protocol seems close to being settled, as both sides have agreed to return

The conflict, which became one of the most widely discussed disputes in the AI and blockchain world, began after the 2024 formation of the

Ocean Protocol has repeatedly

This resolution carries weight for the AI-blockchain field, which has faced doubts over transparency and governance. Since the ASI merger, Fetch.ai’s FET token has dropped more than 93% in value, while Ocean’s OCEAN token has also declined, recently trading at $0.30 after a 4% daily fall. Experts suggest the agreement could help restore investor trust, especially as the crypto sector faces broader instability. GeoStaking, a validator node that helped mediate the negotiations, confirmed Ocean Protocol’s readiness to return the tokens once a formal request is made, with news sources indicating the two sides are

This episode underscores the difficulties of running decentralized organizations, where differing governance approaches and liquidity plans can spark public disputes. Although the ASI Alliance set out to lead decentralized AI development, its breakup—after Ocean Protocol’s exit in October—highlighted the fragility of such partnerships. Should the token return go through, it may represent a fresh start for both projects, allowing them to concentrate on technological progress instead of legal strife; observers have cautioned that the dispute

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Dogecoin News Today: Institutional Altcoin ETFs Resist Crypto Market Downturn

- Grayscale and VanEck launch Dogecoin/Solana ETFs as crypto markets decline, defying broader outflows. - U.S. spot Bitcoin ETFs see $870M outflows; Ethereum ETFs lose $259.7M amid third-week withdrawal streak. - Institutional altcoin ETFs gain traction with $550M+ assets, signaling growing crypto legitimacy in portfolios. - Ethereum's 3.6M token treasury and Fusaka upgrade optimism contrast with 4% ETF outflows of AUM. - Persistent retail caution contrasts with institutional adoption, as crypto's traditio

Bitcoin News Update: Blockchain.com’s Co-CEOs Steer Through Crypto Market Fluctuations as Company Relocates Headquarters to Texas

- Blockchain.com appoints Lane Kasselman as co-CEO alongside Peter Smith, adopting a dual leadership model to enhance operational efficiency during transition. - The firm relocates its U.S. headquarters to Dallas, Texas, leveraging the state's tax incentives, regulatory flexibility, and proximity to the Texas Stock Exchange. - This move aligns with broader corporate trends in Texas, as companies like Coinbase and McKesson shift operations to capitalize on business-friendly policies and innovation hubs. - T

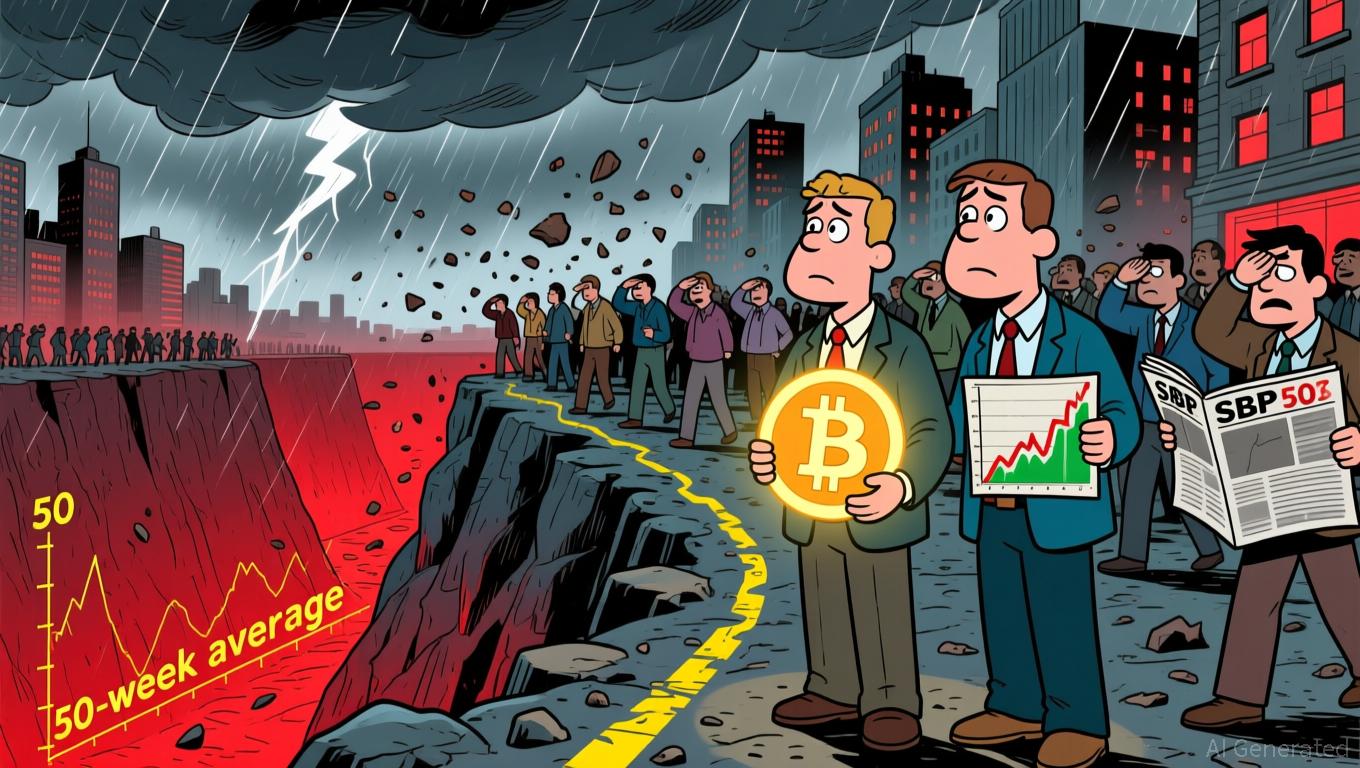

Bitcoin Updates Today: Is Bitcoin’s Drop Indicating a Bear Market or Revealing Foundational Strength?

- Bitcoin's drop below $95,000 triggered a 2.8% S&P 500 decline, raising fears of synchronized market downturns. - American Bitcoin (ABTC) reported $3.47M profit but shares fell 13% as BTC price erosion offset mining gains. - 43-day U.S. government shutdown created information vacuum, while $869M Bitcoin ETF outflows highlighted investor panic. - Fed rate cut odds dropped to 45% amid inflation concerns, with analysts warning of cascading price drops below $90,000. - Institutional ETF adoption and $835M Mic

Hyperliquid News Today: Goldman: AI's $19 Trillion Buzz Surpasses Actual Progress, Bubble Concerns Rise

- Goldman Sachs warns U.S. stock markets have overvalued AI's economic potential, pricing $19T gains ahead of actual productivity impacts. - The bank identifies "aggregation" and "extrapolation" fallacies as key risks, mirroring historical tech bubbles from 1920s/1990s over-optimism. - AI expansion extends beyond tech sectors, with blockchain compliance tools and energy management markets projected to grow via AI integration. - Regulatory challenges persist as DeFi collapses expose gaps in AI token definit